Rupee takes cues from Asian peers as bond market eyes US Treasury movement- Republic World

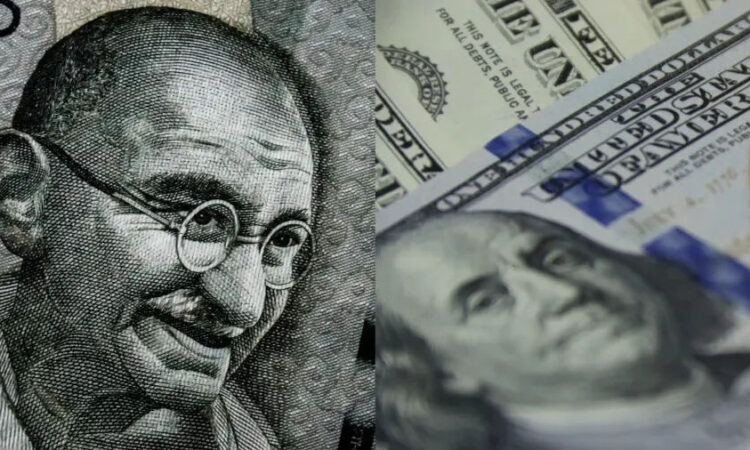

Rupee versus Dollar | Image:Unsplash

Rupee Vs Dollar: The Indian Rupee is poised to track the movements of other major Asian currencies in the upcoming week, while investors in the government bond market keep a close watch on developments in US Treasury yields. All eyes are on the release of the February US non-farm payroll data, which will offer insights into the Federal Reserve’s stance on interest rates.

Closing at 82.90 per US Dollar on Friday, the Rupee showed minimal change and managed a slight weekly gain of 0.04 per cent. This marks its third consecutive weekly rise, bolstered by inflows into both equity and debt markets.

Although most Asian currencies saw gains on Friday, the week’s performance was mixed, with the Dollar index ending slightly lower. Traders anticipate the Rupee to fluctuate between 82.75 and 83.10 throughout the week.

Arnob Biswas, head of foreign exchange research at SMC Global Securities, anticipates a slight bias towards depreciation for the Rupee. This sentiment stems from uncertainty surrounding the timing of the first rate cut by the Federal Reserve. Biswas also highlights the potential pressure on Asian currencies, including the Rupee, in the event of an uptick in the Dollar index supported by robust US economic data.

Although expectations for a rate cut in March have diminished, with odds for May and June at 18 per cent and slightly above 63 per cent, respectively, according to CME’s FedWatch tool, the market remains watchful for any shifts in the Fed’s stance.

Meanwhile, the 10-year Indian government bond yield ended marginally lower for the week at 7.0572 per cent, with expectations of a range between 7.04 per cent and 7.12 per cent in the coming week. Traders continue to monitor Treasury yields and liquidity dynamics within the banking system.

ICICI Securities Primary Dealership forecasts growth at 6.5 per cent in the next fiscal year, lower than the central bank’s estimate of 7 per cent. It suggests that any adjustments to real rates might lead to rate cuts, albeit in a shallow cutting cycle, possibly delayed until August or the second half of fiscal year 2024-2025.

Looking ahead, key events include the release of HSBC India’s February services PMI on Monday, US S&P Global services and composite PMI, as well as Jan factory orders and ISM non-manufacturing PMI on Tuesday. Thursday brings updates on US international trade GDP and initial weekly jobless claims, followed by the highly anticipated US non-farm payrolls and unemployment rate data on Friday.

(With Reuters inputs.)