US dollar soars as Fed quashes rate cut bets, Pound rocked by mixed data

Euro

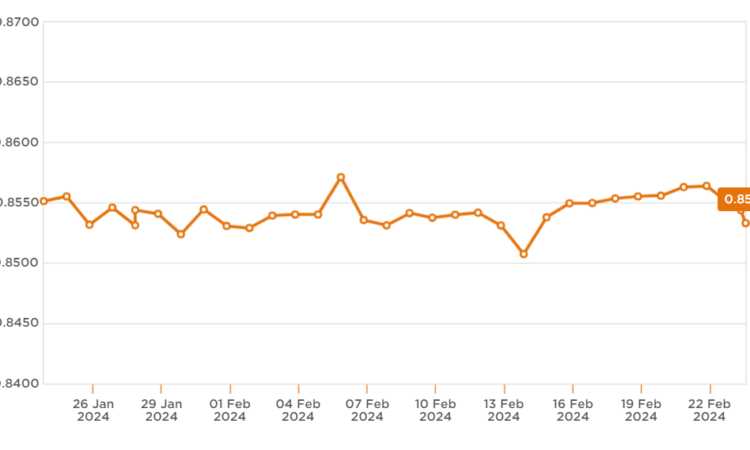

EUR/GBP: Unchanged at £0.85

EUR/USD: Down from $1.08 to $1.07

A dovish shift by the European Central Bank has acted as a key headwind for the euro in recent weeks. With many ECB policymakers offering their thoughts on when the bank should begin cutting interest rates.

The single currency’s strong negative correlation with the US dollar also applied pressure to EUR exchange rates through February, amid strong demand for the greenback.

Conversely a modest improvement in some eurozone data releases lent some support to the euro.

Looking ahead, EUR investors will be laser focused on the ECB’s next interest rate decision. While no policy changes are expected next month, if the bank hints it is getting closer to cutting interest rates, the euro is likely to nosedive.

Pound

GBP/EUR: Unchanged at €1.16

GBP/USD: Down from $1.27 to $1.26

The pound fluctuated through February, as the Bank of England’s latest interest rate decision and some mixed economic data infused volatility into the currency.

The BoE’s first policy meeting saw the bank push back against rate cut speculation, but also drop its pretence that its next move could be a rate hike.

In terms of data, Sterling briefly surged in response to an upbeat jobs report, with GBP/EUR even spiking to an 18-month high. However, these gains were quickly reversed, after a weaker-than-expected inflation print, and confirmation the UK slipped into a recession in the second half of 2023, stoked BoE rate cut speculation.

The coming month will see Chancellor Jeremy Hunt unveil his Spring Budget. GBP investors will be hoping for growth boosting tax cuts, potentially leaving the pound vulnerable to losses if they do not materialise.

US Dollar

USD/GBP: Up from £0.78 to £0.79

USD/EUR: Up from €0.91 to €0.92

The US dollar enjoyed strong support over the past month as the Federal Reserve strongly pushed back against interest rate speculation.

The Fed firmly ruled out a rate cut in March following its first policy meeting of the year. While subsequent comments from Fed Chair Jerome Powell propelled USD exchange rates to new multi-month highs as he further pushed back on rate cut bets.

The US dollar was also supported by upbeat US data. With surprisingly strong payrolls and inflation prints bolstering USD demand.

With a March rate cut no longer on the cards, USD investors will be keeping a close eye on upcoming US data releases as they attempt to gauge when the Fed is likely to start loosening its policy. If US data continues to impress this is likely to price out a May rate cut and underpin the US dollar.

Currencies Direct have helped over 430,000 customers save on their currency transfers since 1996. Just pop into your local Currencies Direct branch or give us a call to find out more about how you can save money on your currency transfers.

Sponsored

Thank you for taking the time to read this article. Do remember to come back and check The Euro Weekly News website for all your up-to-date local and international news stories and remember, you can also follow us on Facebook and Instagram.