The strength of the US dollar against Asian currencies is surprising to many and a worry to several central banks stuck between expectations of limited movement against the almighty dollar and the negative impact on their economies of raising interest rates to keep a firm currency. Indonesia is struggling to keep the rupiah under 16,000 to the US dollar and the Thai baht is back to 36.5 to the dollar, 5 percent down on its end 2023 level.

But for the longer term, one currency in particular stands out not for an immediate threat to weakening but whether it is compatible with other economic developments: the Hong Kong dollar, for decades since its crisis in 1983 pegged to the US dollar. Between March 29 and April 4, Hong Kong had five days of holiday – a long Easter weekend followed after just two days by the Ching Ming festival on April 4. Add in the following weekend there was a long stretch giving opportunity to travel. Huge numbers did so, particularly to the mainland which is so close – only a few minutes on the train.

The losers were the Hong Kong businesses, restaurants in particular, which otherwise would have enjoyed spending by the local population. As it was, there was scant counterflow into Hong Kong. There was no equivalent Easter holiday on the mainland and anyway, although mainland visits to the SAR have picked up, the city’s attraction still lags well behind pre-Covid times. Meanwhile, two other things have been happening.

First is the ongoing improvement in the rail and bus networks which means that it has become quicker to cross the border. For the increasing number of people living in the northern New Territories towns such as Fanling, the city on the other side, Shenzhen, is only a few minutes plus a border crossing away. Meanwhile, the high-speed rail offers quick access to places further inland. The bridge to Macau and Zhuhai offers yet another alternative.

Hong Kong’s whole cost structure is high relative to the mainland, with property prices the main culprit, flowing through to wages and all rents. The exchange rate has been an added burden. None of that mattered so much in the past. It does now.

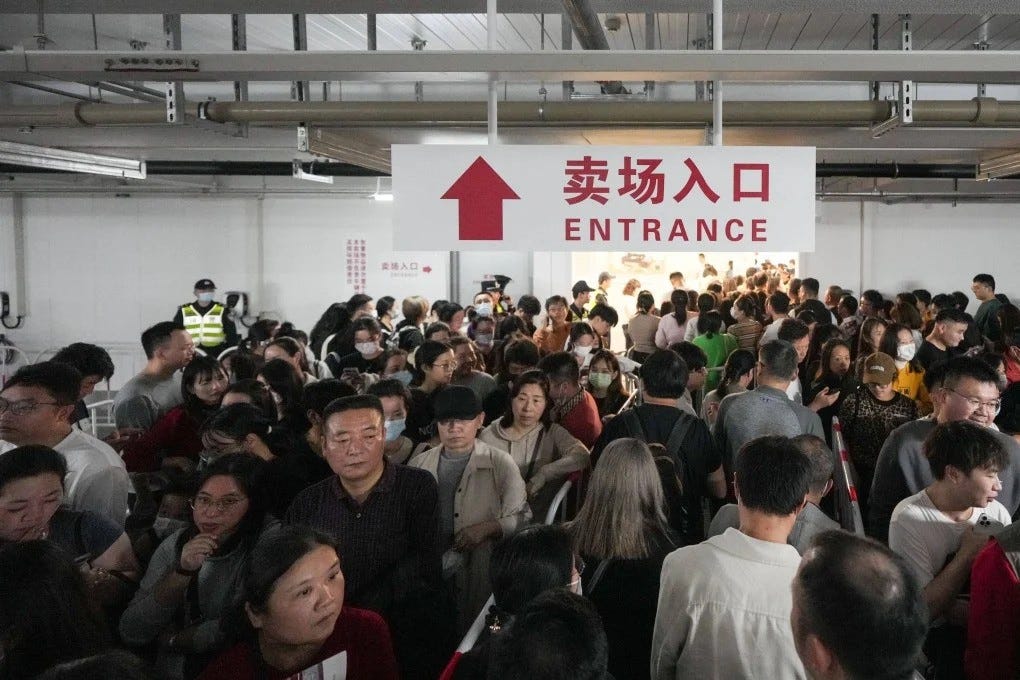

Hong Kong people may well be fed up with listening to government officials proclaiming the importance of the city integrating into the so-called Greater Bay Area, a recent creation which combines it with several cities, including Guangzhou, in and around the Pearl River Delta. But when it comes to spending hard-earned money, why not spend a little crossing the border and getting a meal, massage, or almost any other service and many goods for 30 to 50 percent less than in Hong Kong?

The price gap has always been there but standards in Shenzhen are said to have improved relatively, and the price gap has even been widened by the strength of the HK dollar, up 6 percent against the RMB compared with a year ago and 10 percent compared with April 2022.

While the mainland has fairly strict exchange controls, there is no way that Hong Kong can adopt it without ending one of its principle financial attractions. However, a peg to a close proximity to the RMB would make closer economic integration easier with the mainland, which is anyway inevitable. Europe has examples of currencies which are independent of the euro but generally move in line with it.

Change other than in a crisis is not something which comes easily to government, especially in Hong Kong. Anyway, the drawbacks of being pegged to a strong US dollar may not be around for long. The US dollar attracts inflows only on account of relatively high interest rates. Its fundamentals are rather less obvious. At about ¥152 to the dollar, the yen is at a 34-year low. Yet confidence in the dollar contrasts with a record gold price – in the past strong gold has reflected a weak US dollar. It may now reflect general unease about the state of the world, so the dollar is seen as the next best option. But given the prospect of a Trump presidency and also the likelihood of a recession in the US within a year or so. there are doubters, at least among those with longer views than the average 30-year-old currency trader.

As for fundamentals, the US now has a current account deficit running at nearly 3 percent of GDP or US$750 billion a year which needs financing at a time when most of the Asian economies in addition to Japan with currently weak currencies have current account surpluses of 2+ percent of GDP. In the US itself, voices are increasing for the need of the Federal government to rein in its own deficit, which is running at about 7 percent of GDP and total debt nearing 130 percent. These are big numbers by any standard and probably cannot be sustained without a significant fall in the currency, regardless of interest rates. In any event, the HK dollar peg to it is a product of a period of history nearing its end.