Semiconductor equipment giant ASML Holding (NASDAQ: ASML) has stitched together impressive gains on the stock market so far this year, appreciating by nearly 28% as of this writing, and the company’s fourth-quarter 2023 results played a key role in driving that surge.

ASML released its Q4 results on Jan. 24. Investors liked what they saw, and the stock hit a new high. The Dutch semiconductor bellwether has maintained its momentum since then, but its rally will be put to the test when it releases its first-quarter 2024 results on April 17. Will ASML be able to deliver another strong set of results and guidance later this month?

Why ASML could deliver a positive surprise

ASML ended 2023 with a total revenue of 27.6 billion euros, an increase of 30% from the previous year. However, the company offered conservative guidance for 2024, saying it expects its revenue to be identical to 2023.

Management pointed out in the fourth-quarter earnings release that the semiconductor industry is currently working through a bottom, and said demand for its lithography equipment is showing signs of improvement. Still, management adopted a cautious approach, forecasting that Q1 revenue would land between 5 billion euros and 5.5 billion euros.

That would be a 22% decline from the prior-year period’s 6.75 billion euros. Additionally, ASML’s gross margin guidance range of 48% to 49% for Q1 would be a contraction from the 50.6% gross margin it delivered in the same period last year.

In short, ASML has predicted that its top and bottom lines will contract significantly in Q1.

However, there is a good chance that the company may surprise Wall Street with better numbers. After all, the guidance for its full-year revenue to be flat suggests that it expects a nice jump in revenue in subsequent quarters as customers start purchasing more of its semiconductor manufacturing equipment. And it won’t be surprising if we hear that the turnaround actually began in the first quarter, for a few simple reasons.

ASML saw a significant surge in orders in Q4. The company received bookings worth almost 9.2 billion euros, which was more than three times the 2.6 billion euros in bookings it received in Q3. This sharp surge can be attributed to the booming demand for artificial intelligence (AI) chips.

This is evident from the fact that 5.6 billion euros worth of ASML’s orders last quarter were for its extreme ultraviolet (EUV) lithography machines. These EUV lithography machines are used for making advanced chips using process nodes that are 7-nanometer or smaller in size. Foundries, chipmakers, and cloud computing companies are aggressively looking to boost their AI chip production capacities to meet demand.

Foundry giant Taiwan Semiconductor Manufacturing Company, for instance, could increase its 2024 capital expenditure budget by more than 7% to a range of $30 billion to $34 billion from the earlier forecast of $28 billion to $32 billion, according to Taiwan-based newspaper Commercial Times. Meanwhile, Samsung plans to increase its production of high-bandwidth memory chips by 2.5 times in 2024 to satisfy AI-driven demand.

All this explains why sales of wafer fabrication equipment are expected to return to growth in 2024 with a projected gain of 3% following their 3.7% decline in 2023. Even better, equipment spending is forecast to jump by 18% in 2025. As foundries and chipmakers start opening their wallets for semiconductor manufacturing equipment, ASML should ideally be able to convert more of its 39 billion euros worth of backlog into revenue.

If that happens, there is a good chance that its revenue, earnings, and guidance could turn out to be better than what Wall Street is forecasting, and that could help the stock sustain its impressive rally.

But should you buy the stock before earnings?

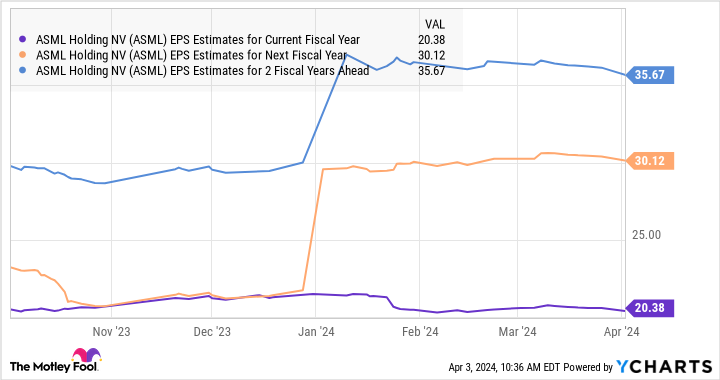

ASML stock’s rally in 2024 has brought its price-to-earnings (P/E) ratio to 46. That’s higher than its five-year average P/E ratio of 41. Meanwhile, its forward earnings multiple of 50 suggests that analysts on average are expecting a contraction in its earnings for the full year to $20.38 per share. But we have already seen that ASML is capable of springing surprises on the market, and the good part is that analysts are forecasting a sharp acceleration in its bottom-line growth starting in 2025.

So, ASML seems to be on solid ground as far as its near-term and longer-term prospects are concerned, and the stock seems capable of heading higher after the company delivers its Q1 results on April 17. That’s why investors who are looking to buy semiconductor stocks to capitalize on the AI boom could consider buying ASML before that report arrives.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Should You Buy ASML Holding Stock Before April 17? was originally published by The Motley Fool