BULAWAYO, Zimbabwe — Zimbabwean businesses have not transitioned to the nation’s new currency as they continue to adjust their systems, six days after the central bank introduced the sixth medium of exchange in 16 years.

The southern African nation, which has been grappling with currency crises over the past 24 years, on April 5 introduced the Zimbabwe Gold (ZiG), which is backed by 2.5 tonnes of gold and some foreign currency reserves worth about $285 million.

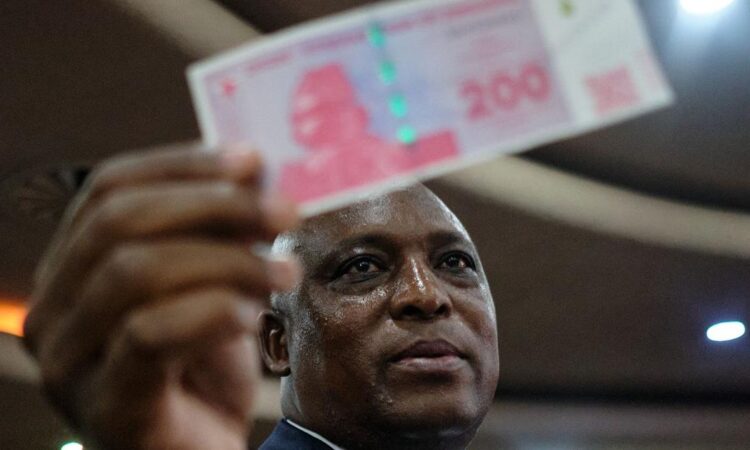

The government made the change following a drastic depreciation of the Zimbabwe dollar (ZWL) since its reintroduction in 2019. Banks, mobile money companies and retailers, among other businesses, put local currency transactions on hold a day after Reserve Bank of Zimbabwe Governor John Mushayavanhu announced his first monetary policy statement.

Though electronic ZiG transactions began on April 8, physical notes and coins will begin to circulate on April 30. Those holding the ZWL have been left stranded as the changeover progresses.

Street currency traders in Bulawayo, the second largest city, and other major cities, remain idle. Zimpricecheck.com, a popular platform which tracks the exchange rate and prices in the economy, did not feature a parallel market rate on April 9.

“The issuance of a currency is one thing, managing and supporting it is another,” said Eddie Cross, a business leader and former member of the RBZ monetary policy committee (MPC), when Semafor Africa asked him about the future of the ZiG.