jetcityimage

Dow Inc. (NYSE:DOW) is not my favorite stock. And that doesn’t matter one bit to me. Because I’m not about stock-picking in the traditional sense. I don’t fall in love with businesses, because the way modern markets work, with algorithms and index funds dominating the landscape, individual stocks have never been more relegated to “inanimate objects” to use as tools than they are now.

In other words, I don’t need to fall in love with these stocks and their underlying businesses. I just need them to make money for me while I own them, especially when I own a lot of shares of them. And, I need them to not contribute to blowing up my portfolio. That’s it. Nothing fancy, just risk management, portfolio construction, quantitative and technical analysis, and a little technique I created and am pursuing a trademark in called YARP: Yield at a Reasonable Price.

In the case of Dow, I find a business that is a leader in a sector that has largely been ignored by mainstream Wall Street, basic materials. At 2.15% of the S&P 500 as of Friday, that sector is the smallest of the 11 sectors that make up the most popular index. That means that with all the money piling into index funds, DOW, its chemical industry peers, and other basic materials stocks merely get a few crumbs, while tech, financials, and healthcare get the big money. That alone means that identifying high reward/lower risk stocks in this sector is tougher. They do not have that automatic cash inflow from the index funds to boost their stock prices.

So while I have added DOW to my 40-stock YARP portfolio I am currently building out (I have 19 in there so far, mostly at below-average weightings given my broader stock market concerns), I place a hold rating on it here. One reason is because I am not “bullish” on stock ratings, as I feel they are often misleading to investors. Though in this case, I like DOW, but like the rating says, I am holding it. And I am doing so at a low weighting. But my process is more about owning the 40 stocks I want to own, hopefully for a long time, but adjusting the weightings much more frequently than many investors are likely to. That’s the key to YARP: the names in the portfolio are important, but the tactical adjustments along the way are what boost my dividend yield and protect capital when good companies go bad for a while.

I do not want to go forward with a 40 stock, dividend-oriented portfolio without having at least two stocks from each of the 11 S&P 500 sectors. So in determining which two or more I wanted from the basic materials sector, my preference for blue chips and the stocks in the Dow Jones Industrial Average led me to DOW. It is currently the fourth highest yielding stock in that index, at over 4.8%.

DOW: background

Simply Safe Dividends, a source I have relied on alongside Seeking Alpha and others for some time, summarizes the Dow Chemical story quite well, so I’ll paraphrase, using the key parts of their review as I see them.

Dow has grown from a one-product start-up founded by H.H. Dow, an industry pioneer, way back in 1897. From that simple beginning, DOW now boasts more than 6,000 products that reach thousands of customers around the world. DOW’s cash flow is about equal parts plastics and chemical building blocks. These are used in food packaging, consumer, health, and hygiene businesses, and also in artificial turf, pipe, and power transmission. The essential nature of many of its chemicals as inputs in other products is what makes DOW a sustainable business, and long-term member of the Dow Jones Industrial Average.

YARP dividend analysis

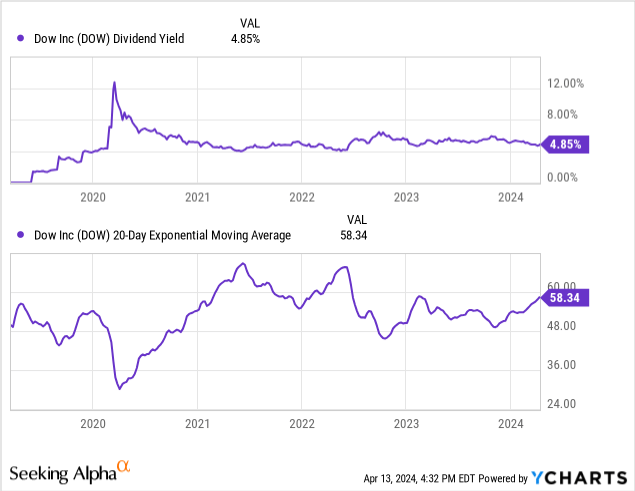

Normally, my YARP approach involves reviewing the current dividend yield versus where it has been over the past seven years. DOW was created by a merger back in 2019, and so I am a couple of years short of an ideal YARP review. But there’s enough to go on with this blue chip name that I can interpolate a bit. The bottom line is that at 4.85%, the yield is toward the top end of its recent historical range. Again, this is one stock out of 40, and so to me, it is better to give it a “pass” on the limited trading history under the DOW ticker than pass on it entirely.

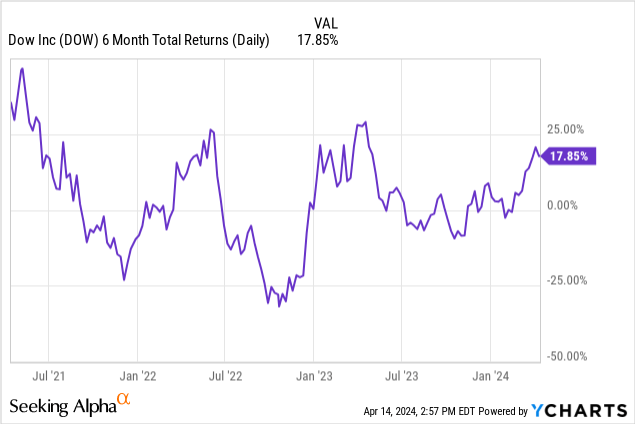

DOW also has a bit of upside momentum, or at least it did back on April 5 when I first stepped into it. However, the current market is getting more dangerous by the day, and so that price momentum could vanish quickly. Again, this is another reason why my lower position size is a key here.

Profitable and potentially undervalued

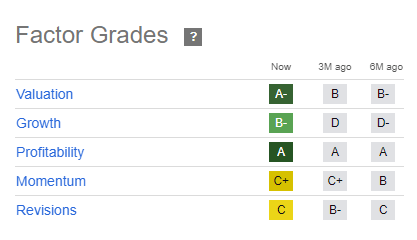

The Seeking Alpha profitability grade of A means a lot to me. And while I realize it is relative to the materials sector, not a raw measure of DOW’s ability to sustainably produce profits and cash flow, since I am looking for at least a couple of stocks in each sector, I’m fine with that tradeoff.

The Valuation grade of A- also checks a box, though I am looking primarily for stocks that are of high quality and are “cheap” on a long-term dividend yield basis. So current valuation is important but not a deal-breaker. I want 40 stocks I can manage actively, and valuations will ebb and flow.

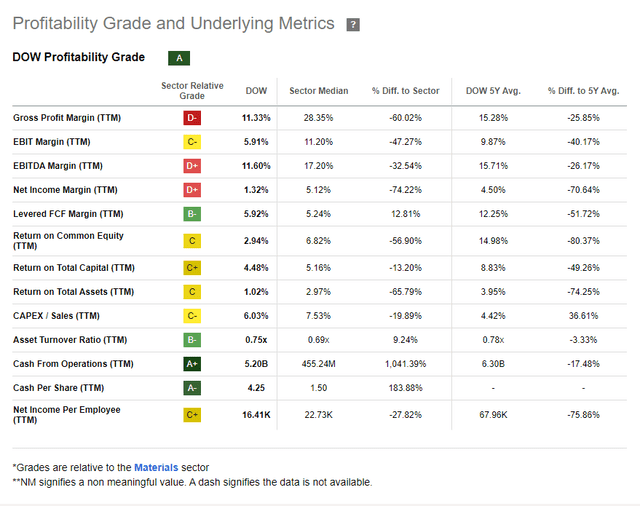

Seeking Alpha

Cash flow is the strongest aspect I see in the table below, and while the margins are below sector median, this is a very diverse sector. Basic materials is a mix of stocks in the fields of chemicals, metals, mining, paper and forest products, containers, packaging and construction materials. That’s a diverse set of stocks, and so I am more concerned about the cash flow positives than margins which are positive but on the low side. Again, I’m not “falling in love” with the business, just trying to find a basket of 40 I can use to different degrees to get dividend income and, when conditions are ripe, price appreciation.

Seeking Alpha

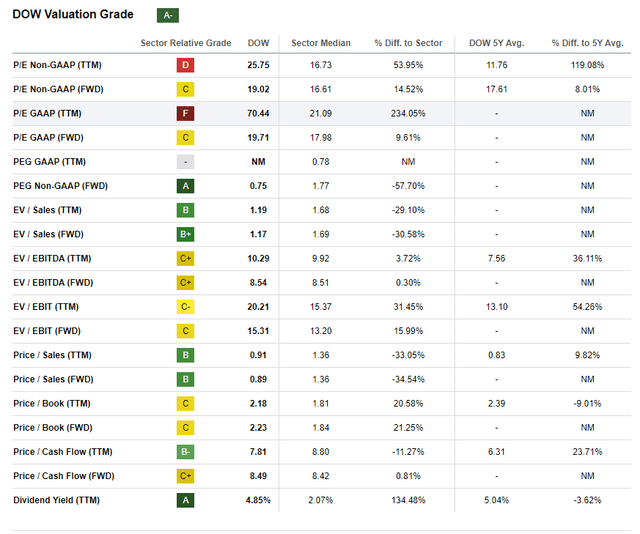

As shown below, DOW sells for less than 1x sales on both a trailing and forward basis, and at a PEG (price/earnings to growth rate) which is also less than 1.0, at 0.75. While, as I always remind readers, I am not a deep-dive fundamental analyst, these are figures that resonate with me for my specific purpose in identifying the type of blue chips that I want to include in my 40-stock basket.

Seeking Alpha

Dividend: solid enough for now, you get what you pay for

As noted earlier, DOW is one of the highest yielding stocks in the Dow Jones Industrial Average. That index used to be a happy place to hunt for dividend stocks. However, with the inclusion of Salesforce (CRM), Amazon (AMZN) and the suspension or cutting of dividend yield from some long time Dow components, it is relatively slim pickings. That will likely persist until a significant market selloff occurs. As much of a fan of the Dow index as I am, I see some pretty strong headwinds, technically speaking. It currently looks like it might lead the S&P 500 and Nasdaq 100 lower. The bad news is that I have several Dow index stocks on my watchlist. The good news is that my positions are light and I’d run to the front of the line to buy some of them at distressed prices.

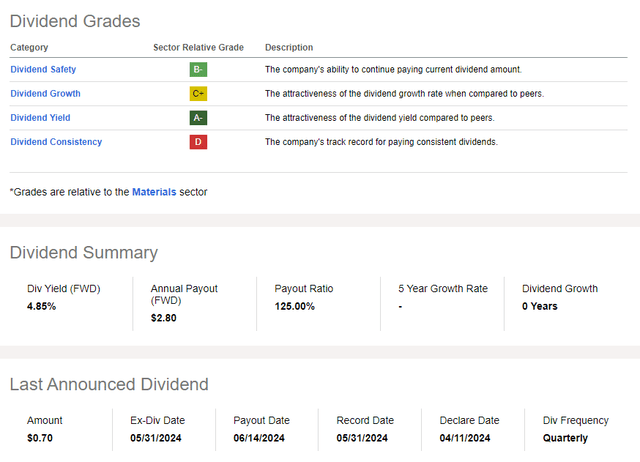

As for DOW’s stock and its dividend yield, a high and relatively safe yield as judged by the Seeking Alpha quant factor grades provides me with an above average yielder, at a time when a small portion of the large cap stock market yields anywhere near the 5%+ that T-bills currently pay. And, that D grade for dividend consistency is tainted by the aforementioned merger that gives Dow, whose corporate history dates back to 1897, a limited dividend-paying history in its current form.

Seeking Alpha

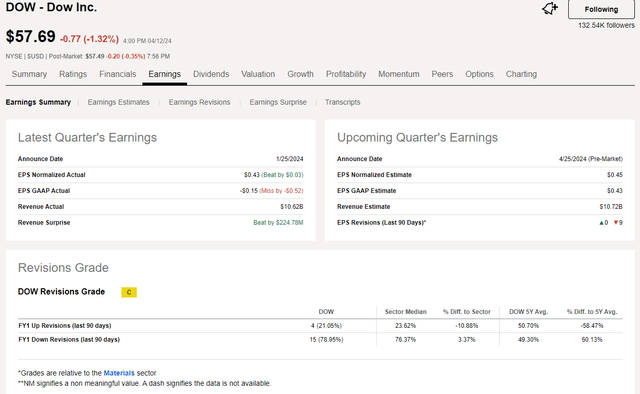

Earnings: expectations low, which is OK by me

Seeking Alpha

Key risks

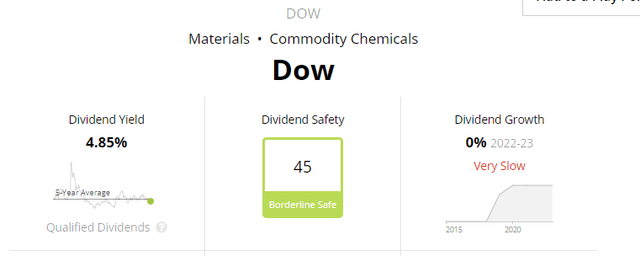

SimplySafeDividends.com

The dividend is “borderline safe” according to Simply Safe Dividends, and the Seeking Alpha quantitative assessment (B-) concerns me. That payout ratio is an eyesore, though the cash dividend percentage payout is below 100%.

DOW: top 40 stocks for me, just not top 10

This is a low margin, low pricing power business. But that’s no different for most chemical companies. DOW’s product line is also sensitive to oil prices, which are trending upward and can potentially go parabolic, given the turmoil in at least two parts of the globe right now. That could be a positive, at least up to a point. Dow’s BBB credit rating is a signal that the market is well aware of the risks and tradeoffs.

This is why I include it in my top 40, but not at the top of list. It would be there if the price falls to such a point where I conclude that it has been sold off beyond reason. That could easily occur in the near future, as it has twice in just the last three years, where a 25% total return drop in only six months allowed investors to get in and see strong returns from a sector leader shortly after.

My bottom line on DOW: it helps my stock basket at times, and so is a good fit for that basket, since I will weight it between 1% and 5% at any point in time. It goes in toward the lower end of that range, and thus I own it, but in Seeking Alpha rating terms, consider it a Hold.