FLEXIBLE HEDGING APPROACH THAT ADAPTS TO CHANGING MARKET ENVIRONMENTS

All investors are exposed to currency risk when investing internationally. Investors who allocate to global equity portfolios may be exposed to currency risk as a result of fluctuations in exchange rates. Those wishing to minimize currency impacts often hedge their foreign currency risk without altering their underlying equity exposure. Fully-hedged indexes may be used by those seeking to remove the direct impact of currency from their equity asset allocations.

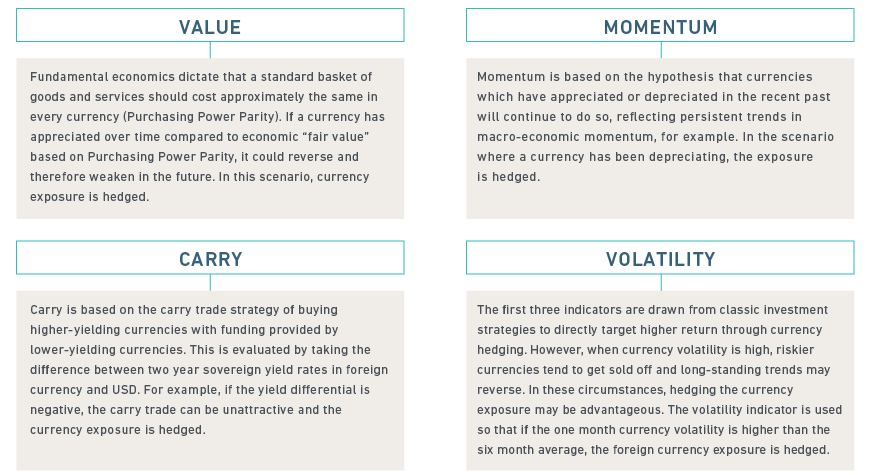

However, currency fluctuations can also sometimes increase the returns from investments in a foreign currency. Investors may wish to benefit from these currency movements, which can often be sharp. The MSCI Adaptive Hedge Indexes use versions of four well-known currency indicators – Value, Momentum, Carry and Volatility to determine systematically the level of hedging to be applied to each foreign currency in the index.

A RULE-BASED DECISION TO HEDGE, NOT TO HEDGE, OR PARTIALLY HEDGE