-

Next week, the GBP/USD faces a major test with key data releases and interest rate decisions from the Federal Reserve and Bank of England.

-

Meanwhile, the US Dollar Index is fluctuating, with this week’s indicators suggesting a potentially stronger dollar.

-

For now, the focus has shifted to the labor market with jobless claims and nonfarm payrolls data taking center stage.

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

The will be facing a big test, starting on the final day of this week and pretty much the whole of next. We have several key data releases from both sides of the pond to look forward to, including the US report on Friday and data next.

In addition, both the Federal Reserve and Bank of England will be making their respective interest rate decisions next week. While everything could hinge on the outcome of these macro events, it is worth noting that the GBP/USD has been tracking the stock markets closely, rising in November along with the big rally in major indexes.

Although the start of this month has seen the US indexes pause for a breather, the has continued to ascend to new all-time highs. So, the underlying long-term trend in stocks is still arguably bullish and once the phase of profit-taking abates, the bullish trend may well resume for cable, irrespective of the short-term volatility as a result of the upcoming macro events.

Dollar turns lower as investors eye key US data

After a positive start to the week, the was down in the early European session on Thursday, falling back below the 104.00 handle. Much of the DXY’s losses were attributed to the Japanese yen. The yen rallied across the board after the BoJ Governor Ueda met PM Kishida, which gave rise to speculation that the BoJ might be ending its negative interest rates policy.

But leaving the pair aside, the dollar’s losses were mild against other currencies. Overall, the greenback remained inside a holding pattern, and its general direction may very well hinge on the upcoming US jobs report and the following week’s CPI data and FOMC meeting.

This week’s indications from FX and bond markets suggest that investors are factoring in a subdued NFP figure, hinting at the possibility of a stronger dollar if the data doesn’t prove too weak. However, with risk appetite having improved drastically in recent months, any notable rally in the dollar could be sold in favour of the more risk-sensitive commodity dollars and the pound. Regarding today’s upcoming data, I don’t anticipate jobless claims to play a significant role. So, the GBP/USD should remain in a holding pattern ahead of bigger events starting Friday with the release of the US non-farm payrolls report.

The was left largely unscathed following Tuesday’s conflicting US data releases. October’s unexpected drop in further fuelled speculation of future Fed rate cuts, but the more up-to-date PMI data in November, which was stronger-than-expected, provided a counter move. Wednesday’s release of weaker data didn’t lead to an immediate dollar sell-off, until Thursday’s yen-inspired drop.

Focus turns to US labor market for the remainder of this week

The dollar’s resurgence earlier this week was attributed in part to comments by Federal Reserve chair Jerome Powell on Friday when he pushed back on rate-cut bets. However, he did say that interest rates were sufficiently restrictive, suggesting that peak rates have been reached, as per market expectations. As there will be no further updates from Federal Reserve officials until the conclusion of the next FOMC meeting on December 13, incoming data releases will provide the main source of direction for the dollar in the interim.

First up is the weekly jobless claims data today, which is expected to rise to around 220K from 218K last week. But attention will quickly turn to the nonfarm payrolls data on Friday. In the last 5 months, we have seen 3 misses in the headline jobs growth, a sharp contrast to the previous 14 occasions when we saw repeated beats.

The recent weakness in jobs growth, although not alarming by any means, suggests that the jobs market is cooling. This has also been highlighted in other measures of the labour market, with jobless claims rising more than expected and the unemployment rate edging higher. If we get a rather weak number this time, then expectations over a sooner-than-expected rate cut could send the dollar lower again. A headline print of 185K is expected this time, compared to 150K the previous month. Watch out for revisions.

GBP/USD set for a big test next week

GBP/USD faces a big week next week, with several data releases from both sides of the pond to come while the Federal Reserve and Bank of England will be making their respective interest rate decisions. Here’s the full economic calendar, relevant to the GBP/USD pair:

|

Date |

Time (GMT) |

Currency |

Data |

Previous |

|

Mon Dec 11 |

6:01pm |

USD |

10-y Bond Auction |

4.52|2.5 |

|

Tue Dec 12 |

7:00am |

GBP |

Claimant Count Change |

17.8K |

|

GBP |

Average Earnings Index 3m/y |

7.9% |

||

|

1:30pm |

USD |

Core CPI m/m |

0.2% |

|

|

USD |

CPI m/m |

0.0% |

||

|

USD |

CPI y/y |

3.2% |

||

|

6:01pm |

USD |

30-y Bond Auction |

4.77|2.2 |

|

|

Wed Dec 13 |

7:00am |

GBP |

GDP m/m |

0.2% |

|

1:30pm |

USD |

Core PPI m/m |

0.0% |

|

|

USD |

PPI m/m |

-0.5% |

||

|

7:00pm |

USD |

Federal Funds Rate |

5.50% |

|

|

USD |

FOMC Economic Projections |

|||

|

USD |

FOMC Statement |

|||

|

7:30pm |

USD |

FOMC Press Conference |

||

|

Thu Dec 14 |

12:00pm |

GBP |

Monetary Policy Summary |

|

|

GBP |

MPC Official Bank Rate Votes |

3-0-6 |

||

|

GBP |

Official Bank Rate |

5.25% |

||

|

1:30pm |

USD |

Core Retail Sales m/m |

0.1% |

|

|

USD |

Retail Sales m/m |

-0.1% |

||

|

USD |

Unemployment Claims |

|||

|

Fri Dec 15 |

9:30am |

GBP |

Flash Manufacturing PMI |

47.2 |

|

GBP |

Flash Services PMI |

50.9 |

||

|

1:30pm |

USD |

Empire State Manufacturing Index |

9.1 |

|

|

2:15pm |

USD |

Industrial Production m/m |

-0.6% |

|

|

2:45pm |

USD |

Flash Manufacturing PMI |

49.4 |

|

|

USD |

Flash Services PMI |

50.8 |

GBP/USD technical analysis

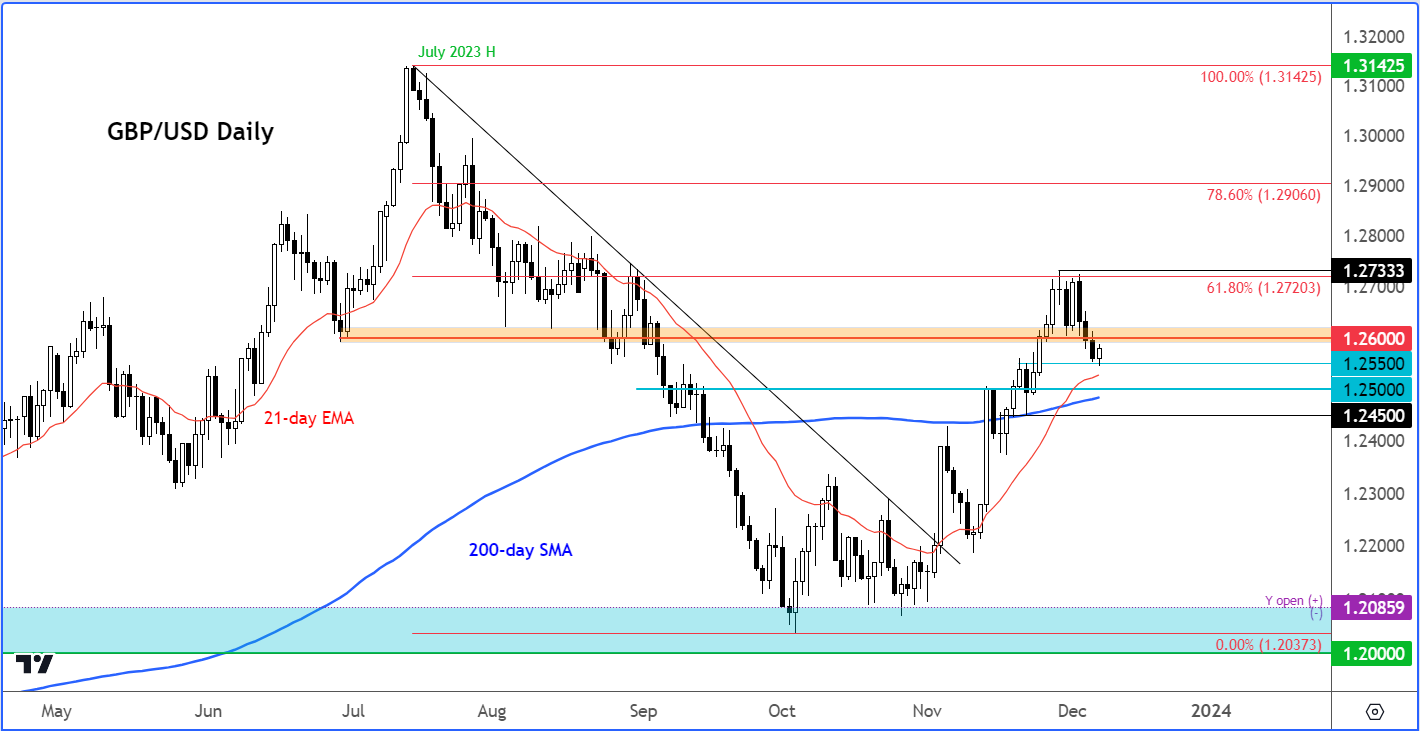

The higher highs and higher lows ever since the GBP/US bottomed out in October means the path of least resistance is still to the upside for the cable. In the middle of November, the pair moved above the 200-day average to provide us with an objective indication that the trend had turned positive.

So, I would be inclined to look for bullish setups to emerge around key support levels such as 1.2550 and 1.2500. These levels were previously resistance.

The line in the sand for me is around 1.2450, which was the last low prior to the latest rally.

A move below 1.2450 would create a lower low and thus a bearish reversal signal. We will cross that bridge if and when we get there. For now, a rebound towards 1.2600 area looks the more likely outcome.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.