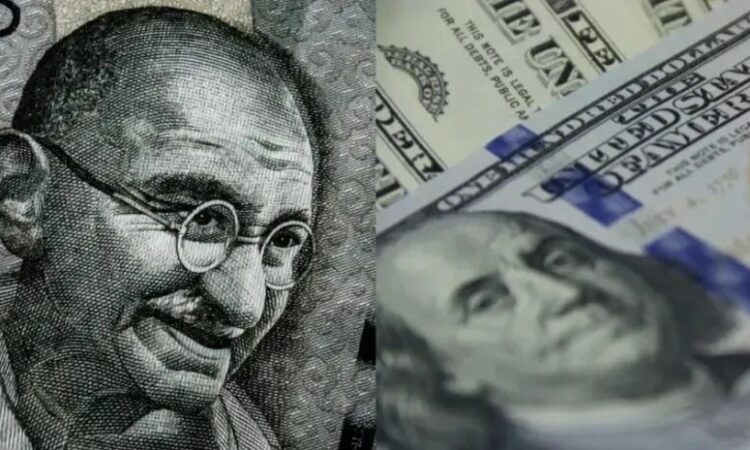

Rupee slips as dollar demand surges, Asian currencies weigh

| Image: Unsplash

Rupee slips as dollar demand surges: In a significant intraday downturn, the Indian rupee witnessed its most substantial decline in over two weeks on Monday, driven by heightened dollar demand from importers as the month-end approached. Concurrently, weakness across major Asian currencies exerted additional pressure on the domestic unit.

Closing at 83.47 against the US dollar, the rupee depreciated by 0.16 per cent from its previous session’s close of 83.34.

The broader Asian currency market experienced a downturn ranging between 0.1 per cent and 0.3 per cent, while the dollar index edged down by 0.3 per cent to 105.6. This drop followed the Japanese yen’s rebound from a 34-year low earlier in the day, attributed to reported yen-buying interventions by Japanese authorities to bolster the currency.

An FX trader at a private bank noted, “Strong dollar demand has been there since the morning,” although the rupee found some respite as the yen strengthened, prompting a moderation in losses across most Asian currencies.

Initial pressure on the rupee stemmed from dollar bids by foreign banks, further exacerbating its decline.

Mandar Pitale, head of treasury at SBM Bank India, projected a near-term trading range of 83.25-83.75 for the rupee, highlighting the significance of debt and equity inflows as pivotal drivers of currency movements.

Concerns regarding the timing of Federal Reserve’s policy rate adjustments have weighed on emerging market assets, with investors presently factoring in only one rate cut for 2024, according to CME’s FedWatch tool.

As the Federal Reserve convenes for its April 30-May 1 meeting, market participants eagerly await Chair Powell’s remarks for insights into policymakers’ perspectives on the future interest rate trajectory.

(with Reuters inputs)