(Co-Authored with Colin Suvak)

One of the most heavily discussed topics in the financial media today is the observation that most of the gains in the stock market are being driven by just a handful of names, and this, as in past episodes of market melt-ups and melt-downs, may be a precursory signal for an impending crash. These mega-cap stocks have become both retail favorites and forced holdings for many professional investors who simply cannot afford to not own them. The phenomenon has resulted in descriptors that remind us of the parable of the blind men and the elephant (see here). The elephant is the massive bull market rally in the S&P 500, and the subjective experiences explaining them are labels such as “concentration”, “momentum”, “dispersion”, “low volatility”, “buybacks”, etc. Other explanatory metrics are “revenues”, “earnings”, “book value”, and many others that are used by analysts for judging value in the stock market. Depending on who you speak with, they will label and perhaps even identify the stock market today as exhibiting one or more of these causes and utilize one or more of the metrics to justify their point of view. This leads to an extremely complex discussion, and while some investors think that the stock market is in a bubble, others differ, and think that the current market euphoria is justified. For our own part, we simply don’t know, but we believe that the labels and metrics above are inter-related; more importantly, since similar episodes have occurred in the past, with a rigorous analysis they provide us with a blueprint for what we can act on, even without being able to forecast what happens next . Our goal is to combine and weigh all the variables and use a coherent approach to finding historical parallels which might help shed light on what might be a good course of action even without an ability to forecast perfectly.

To set the stage, let us focus on concentration in the stock market. It started as the FANG companies – Facebook, Amazon, Netflix, and Google. It then expanded to FAANG, with the inclusion of Apple, and later to FANMAG, as Microsoft joined the consortium. More recently, many perhaps know these companies as the Magnificent 7, with Nvidia now part of the group. Finally, we have arrived at the Fab 4, or Nvidia, Amazon, Meta (previously known as Facebook), and Microsoft. The capitalization of the market is heavily concentrated in these large mega-cap tech firms, as are many people’s 401(k)s of late.

Next, let us look at performance. After briefly pausing their ascent in 2022, during which valuations across the market declined precipitously as the Federal Reserve increased interest rates to combat accelerating inflation, these companies are again on top of the market, and the rate of gain has been simply breathtaking. Year-to-date so far in 2024, all except one of these companies are outperforming the S&P 500 Index; three, including Netflix, Meta, and Nvidia, are up over 30%, nearly triple that of the benchmark. Nvidia, for its part, is up over 140% and has driven close to half of the gains for the S&P 500 this year; over the last year and a half, it has gone up by almost a factor of 10! In the wonkish academic literature, the underlying explanation of this stock price outperformance by some companies is called the “momentum” factor, which is simply another word for the Newtonian concept that what has gone up tends to keep going up… until it doesn’t. Both the origin of momentum, and its reversal, are almost impossible to time. But all bubbles and busts are accompanied by a surge and inevitable reversal in momentum.

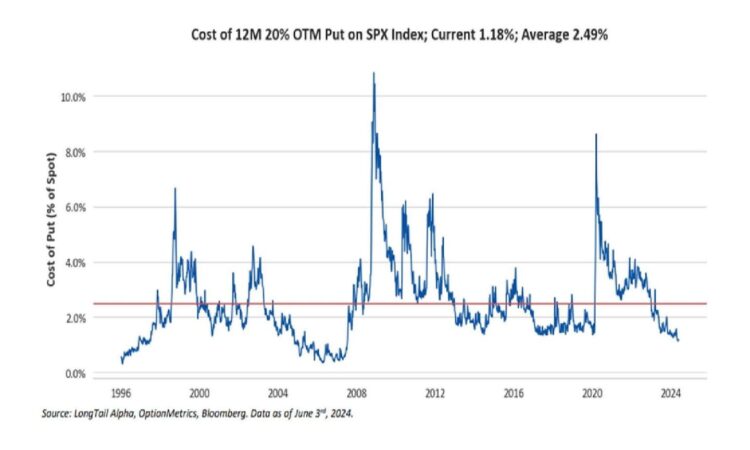

Finally, let’s discuss dispersion and its impact on volatility. The more correlated the performance of a basket of stocks, the less disperse it is. But today, both realized measures and market-implied correlations are at extremely low levels. We can neatly bucket the full S&P 500 into the Fab 4 and everyone else. The Fab 4 rule their own domains as being the best in class, have massive free cash flow, untouchable products (“moats” in analyst lingo), and huge cash reserves on which they are earning plenty of yield thanks to rising short rates. And yes, they can use a lot of the free cash-flow to buy back their own stock, setting a floor to how much market forces can bring them down. The higher the stock price, the more access to capital they have, and the more their stock is worth as currency to acquire other businesses. The rest of the index stocks are in a more precarious position and much more exposed to the economy and rising interest rates. In other words, the S&P 500 is made up of “haves” and “have-nots”. If we think simplistically of the index as made up of these haves and have-nots, then the correlation between these two groups is, and should be low, which should, mathematically, result in the volatility of the index being low. We can think of this dynamic in the following way – when one group tends to do well, the other tends to do worse. And since the index is a combination of both, this results in lower index volatility. Indeed the VIX, which is a measured of S&P implied volatility is at lows last seen before the “volmageddon” episode of 2018. Indeed, as the picture below shows, the cost of hedging has fallen to levels not seen since the Global Financial Crisis.

Cost of Hedging

To get to the impact of these related phenomena, let us assess the fundamental features of stocks in the S&P 500 more rigorously and compare it with history. Based on market capitalization, or the total equity value of each company, the weight of the Fab 4 stocks in the benchmark is close to as high as it has ever been. If we expand our measure of concentration in the index to the top 25 stocks – making room for the likes of other large businesses such as Berkshire Hathaway, J.P. Morgan, Tesla, and Visa – that measure is the highest it has ever been, at least since the early 1970s. Those 25 companies make up over 50% of the market value of the entire set of 500 companies in the blue-chip index. Note that the composition of both the index and the top-25 companies is dynamic and has changed substantially over this period.

Market capitalization is not the only metric we can use to quantify concentration. On real measures of company profitability such as sales, earnings, and free cash flow, these large businesses in the S&P 500 are also behemoths and dominate the index. For example, measured again in terms of the top 25 firms by market cap, these companies’ sales and free cash flow generation per year ranks in the top 15% of observations over the last 50 years.

Does concentration pose significant risks to markets? After all, if the top 25 firms make up over 50% of the weight of the S&P 500 – to say nothing of the fact that the top four firms alone comprise nearly a quarter of the weight alone, or that the top seven make up over a third – then any underperformance from these businesses when it comes to generating revenue and turning that into earnings and free cash flow may materially impact the S&P 500’s returns overall. In 2025, for example, current estimates from sell-side analysts suggest that Nvidia will deliver nearly 100% growth in sales and over 100% growth in both earnings and free cash flow, a year which is expected to be followed up with multiple years of double-digit increases in all measures. No doubt Nvidia may meet and even exceed such lofty expectations, but when mega-cap stocks are already potentially priced to perfection, any misses could spell disaster not only in fundamental returns, but also in a re-valuation lower, and would impact all the other variables we have discussed above. Volatility would spike, dispersion would fall, correlations would rise, and momentum would reverse, all without warning. The exhibit below shows how volatility tends to rise sharply right after concentration peaks.

Investors may indeed have reasons to worry about these projections if this time is not completely different from history. The first concerning fact is the relative level of market cap concentration. But other fundamental metrics are also concentrated, as the top 25 firms in the index are in the most expensive 6-7% of observations going back five decades on measures of both relative market capitalization to fundamental concentration (this is similar to the “Buffett Ratio”, but applied to the largest stocks compared with the rest of the market) and other valuation ratios more broadly; this was only surpassed by the late 1990s tech bubble.

Can we use history as a yardstick to measure where we are today? How similar are we to previous episodes where we had similar dynamics? To perform this analysis, we cannot just take one or other one of our favorite metrics. We must jointly take the metrics, both market capitalization and the fundamental measures, and rigorously measure them with other historical periods. In other words, and using the elephant and the blind men parable once more, what we have to do is to combine all the metrics into one quantitative measure of similarity to the past so that we are not biased by one metric alone.

Measured using the level of concentration in market capitalization, sales, EBITDA, free cash flow, and net shareholder yield, as well as trailing 12-month returns for these firms going back five decades, we find that by far the most relevant historical analog to today is the late 1990s Dot-Com Bubble and Bust, followed closely by the late 2020-early 2022 period. In the exhibit below we display this similarity measure of concentration against trailing volatility of the top 25 stocks in the S&P 500 index. Clearly volatility tends to pick up as the concentration starts to decline.

Similarity Measure and Volatility

Of course, this time could be different, but both of these past periods ended up in tears for returns to the largest growth companies. In the early 2000s, growth stocks declined significantly relative to value stocks, momentum reversed, market liquidity evaporated, correlations rose, and volatility spiked. Market darlings like Amazon.com, Qualcomm, Juniper Networks, and others all lost a significant portion of their market value as the markets recalibrated to new realities. Just prior to the popping of the Dot-Com Bubble in early 2000, the trailing 12-month weighted-average return of the top 25 stocks was over 100% in December 1999. By the end of 2002, the 13 firms that were consistently in the top 25 throughout this time period were down cumulatively as much as 60-75%, and on average had declined in value by nearly a third, to say nothing of those that fell out of the top 25 whose returns were even worse. At the end of this decline, many of these companies became great ones to own at a discounted price for investors who still had liquidity and the stomach to do so, giving proof to Baron Rothschild’s investment dictum to buy when there’s blood in the streets.

A similar theme played out in 2022. Of the 17 firms that likewise stayed consistently in the top 25 largest companies throughout the year, three were down nearly 50% or more, and the average stock in the group had fallen over 11% in value. This average is skewed heavily by one outlier in the group that was up 87%; removing this outlier, which was ExxonMobil, the average loss in equity value falls to nearly a fifth. Again, a terrific opportunity for investors to own great companies at great prices after the correction.

None of these statistics are to suggest that a similar story will play out today in the short run. Many would argue that the current revolution in generative AI and other investment opportunities makes today different from historical analogs — presuming AI isn’t another bubble. Nvidia, for its part, has actually seen its valuation metrics decline despite a meteoric return over the past year, as the company has grown its earnings and other fundamental metrics even faster than what was priced in. And even if a subsequent decline in the value of mega-cap growth stocks is on the horizon, there is no way of telling when it will happen. However, it is clear that at least in the last five decades, when concentration levels across many fundamental metrics, not just prices, have reached similar peaks, the resulting forward returns to growth, momentum, and short volatility have been poor. Those have also been times to be defensive, to be long volatility instruments and market hedges, and to own plenty of liquidity, if for no other purpose than to be ready for the opportunity to buy great companies at great prices when there’s blood in the streets.

To answer the question posed – are we in a bubble? Maybe, maybe not. We could be in for another two or three years of momentum stock outperformance and the big firms getting bigger yet, and concentration rising even further. On the other hand, if we are close to a bust, then it would be silly not to take this opportunity to reduce some risk. Given how easy it is to manage downside risk and create liquidity in the event that it turns out that we were in a bubble, it would be a shame not to use the opportunity to do so.