UK house prices have been on something of a journey over the past two years.

After hitting a record high in August 2022, they plummeted in the wake of Liz Truss’s disastrous mini-Budget. Prospective buyers abandoned the housing market as interest rates on mortgages shot up, competition between lenders temporarily collapsed, and the value of cash deposits was eroded by record inflation.

Mortgage rates soared again in mid-2023 and recently crept up once more as markets have continued to question the UK’s ability to bring inflation down. There was also uncertainty about when the Bank of England would halt its cycle of Base Rate hikes – a key factor in setting mortgage rates.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now, after nine months of rates being frozen at a 16-year high, this uncertainty has moved to when the UK’s central bank will announce interest rate cuts, while concerns about inflation persist. Thanks to the general election, reductions look set to be delayed once again.

So, what’s happening to UK house prices now – and what are the indicators we use to determine how they are changing?

Are sold house prices falling in the UK?

Sold house prices are the ultimate indication of what’s been happening in the UK property market. We will explore how each house price index (HPI) measures them further down in this article.

The major drawback of these house price yardsticks is that the transactions they measure may have been agreed several months in the past. So, the figures may not be a true indication of current market conditions. Given HPIs showing sold prices often rely on large, varied datasets, they also tend to take about a month to publish.

According to the latest Halifax HPI, covering May, house prices were relatively flat month-on-month and up slightly compared to the same month in 2023. The lender said this stability may serve to help buyers enter the market, and sellers to move.

It also registered that there was a regional disparity in prices, with properties in the cheaper north growing at a faster pace than those in the more expensive south – a fact that’s been seen in other HPIs, such as Zoopla’s (more below).

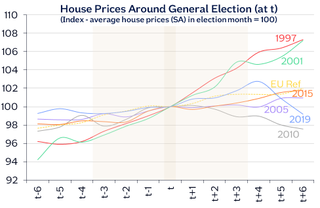

Nationwide Building Society painted a slightly different picture in its most recent analysis, which came out on 31 May. Its HPI showed monthly and annual growth had bounced back after two consecutive months of decline. It also predicted the general election would not impact the market.

(Image credit: Nationwide)

An HPI is also produced each month by property listing website Zoopla. But its main focus is on market conditions. In its latest report, it found housing stock was at an eight-year high, suggesting it’s currently a buyer’s market out there.

Arguably the most comprehensive HPI is produced by the UK’s official statisticians at the Office for National Statistics (ONS). Using data from HM Land Registry – the public body that records all property sale completions in England and Wales – plus equivalent data from Scotland and Northern Ireland, the ONS is able to show exactly how much properties sold for in a given month.

As the datasets the ONS uses are so large, we usually get statistics around two months after the month they were gathered from. These are also initial figures that are revised at least once more as more figures are fed into the data. The most recent month for which we have ONS data was March, when house prices rose 1.8% to an average of £283,000. You can see how prices are changing in your area with the ONS’s house prices tool.

Are property asking prices going up?

Asking prices are a useful barometer for market sentiment as it currently stands. These snapshots tend to be published only a matter of weeks after the data was recorded, and refer to prices as they were then rather than months in the past. Of course, the problem with these snapshots is that asking prices don’t necessarily translate into sold prices.

The latest Rightmove HPI, which was published on 20 May and covered the period between mid-April and mid-May, showed average asking prices rose 0.8% (£3,000) month-on-month to a record £375,131.

In a sign that more positive house price data could be on the way, the property listing website also reported a 17% annual rise in the number of agreed sales over the first four months of the year. However, it also warned that sellers currently face a buyer’s market.

Other surveys give us an indication of market sentiment without asking prices. For example, the Royal Institution of Chartered Surveyors (RICS) uses data gathered from its members to track market activity each month.

Its most recent set of findings, published on 9 May and covering April, showed the number of property listings had risen to its highest level since September 2020 at 43 per estate agent branch. However, it also found that the number of new buyers was down for the first time in three months, in a sign that mortgage rate hikes were impacting demand.

Will house prices fall in 2024?

After two years of big ups and downs, reading the future direction of house prices has been extremely difficult for analysts. The kremlinology of analysing what the Bank of England will do next, and uncertainty over what will happen to inflation – particularly against a backdrop of global instability – have meant things can quickly change, soon leaving predictions looking out of date.

Despite the unexpected dip in house prices we’ve seen this spring – a result of the slight increase in mortgage rates – several experts are predicting that the housing market will grow over the course of 2024. However, much depends on what happens to mortgage rates.

Major estate agency and property services firm Savills is among those looking positively at the remainder of the year. In its latest five-year outlook for house prices, it said it expects the average home to see a 2.5% increase in value over the course of the year. This outlook marked an improvement on its previous forecast (published in November 2023), which expected a 3% fall in value this year.

Lucian Cook, head of residential research at Savills, says of the figures: “The outlook for 2024 has improved since our last forecast as mortgage costs have nudged down slightly and are much less volatile. The outlook for economic growth has also slightly improved, pointing to relatively modest house price growth this year, with greater potential over the following few years.”

But Cook also warns that the picture could still change due to the impact on swap rates (which set mortgage pricing) of “continued uncertainty in the Middle East and higher than expected US inflation”.

Commenting on the findings of Halifax’s latest HPI in early May, the bank’s head of mortgages, Amanda Bryden, said she also expects things to improve as the year progresses. “If, as is still expected, downward moves in Bank Rate come into play later this year, fixed mortgage rates should fall. Combined with the resilience displayed by the housing market over recent months, we now expect property prices to rise modestly over the course of 2024,” she says.

She adds that the HPI showed “homebuyers are gaining confidence” as the number of mortgage approvals has been on the rise. This indicates that greater activity will be seen in the housing market later on in the year.

Bryden’s comments have been echoed by Simon Rubinsohn, RICS’s chief economist, who also suggests that price growth could be on the way later in the year. “There is still a strong perception that activity in the market will pick up in the latter part of the year and into 2025, irrespective of any political uncertainty around the general election,” he says.

But not everyone is sharing in the optimism about the housing market later this year. Sarah Coles, head of personal finance at Hargreaves Lansdown, says that if Bank of England base rate cuts don’t come until the autumn “we may not get dramatic changes” to mortgage rates – a stumbling block that could mean affordability challenges in the housing market continue.

She says: “Variable rates will fall, but with only two or three cuts expected by the end of the year, they’re unlikely to move far. Fixed rates, meanwhile, may remain unmoved until we have signs that inflation has worked its way out of the system and rates are set to go significantly lower in the foreseeable future. It’s only if we get hints at potential earlier cuts that we could see some better deals emerge.”

How are house prices measured?

All of the different house price indices (HPIs) measure the property market in different ways. Here’s an outline of how each of them work.

Nationwide House Price Index

The Nationwide HPI has been in operation since 1952. It is based on the lender’s valuations of properties at the mortgage approval stage – a sales price figure that can change as the transaction moves through the system, but is likely to be close to the final sold price.

The building society’s index is ‘mix-adjusted’. What this term means is that it tracks a representative UK home by applying a relative weight to each type of property characteristic. For example, a three-bed semi-detached.

A statistical process called ‘hedonic regression’ is then applied to “relate observed combinations of these characteristics to the house purchase price”, Nationwide says. This stops the HPI from displaying any price disparities caused by different types of property being sold each month. This HPI gets published at the start of every month.

Halifax HPI

Halifax’s HPI uses a dataset that goes back to 1983. Similarly to the Nationwide index, it’s based on the bank’s valuation of a home at the mortgage approval stage. A standardised house price is calculated using this data.

Property price movements are then analysed over time on a like-for-like basis. The lender’s HPI is usually published in the first week of every calendar month.

Zoopla HPI

The Zoopla HPI claims to be the most comprehensive index available. It uses sold house prices, mortgage valuations, and data for agreed sales to provide as holistic a picture of the market as possible. This price data normally comes out on a slightly longer time lag than other HPIs.

The property listing website also gathers information on the number of days it takes to sell a home, from the initial listing to when the property goes under offer. It also gives figures on how many listings and buyers there are. This set of information is slightly more up-to-date, coming out only about 10 days after the four-week data period has ended.

Office for National Statistics/Land Registry HPI

The UK’s official HPI uses property sales data that’s been gathered by HM Land Registry, the Registers of Scotland and the Land and Property Services Northern Ireland. As with the Nationwide HPI, it uses hedonic regression. But, unlike that HPI – and those of all the other organisations in this article – it captures all of the transactions that have taken place in the UK.

While this means it provides a broader view of the UK housing market, the ONS HPI has a time lag of at least two months due to how long it takes to process submissions from conveyancers to the Land Registry after the completion stage. The sheer size of the dataset means it also goes through at least one revision after it’s published, for example, to take account of seasonal effects.

Rightmove HPI

Rightmove’s HPI differs from the others in that it is based solely on asking prices. It uses 95% of the properties it lists for sale on its website (excluding those in inner London) to measure seller sentiment at the very first stage of the sales process.

These statistics are then released about 10 days after the end of the four-week data period they have come from. It means the figures show seller trends almost as they happen. Handily, Rightmove also measures discounting and the speed at which properties sell.

But given the HPI only includes asking prices, it is highly exposed to the week-by-week volatility of the property market. There is also the fact that not all listed homes sell, with some being withdrawn and relisted at a later date. So, the HPI cannot be seen as a reliable indicator of overall market conditions.

UK Residential Market Survey by RICS

The UK Residential Market Survey by the Royal Institution of Chartered Surveyors (RICS) is very different to all of the HPIs on this list. Rather than measuring house prices, it’s a monthly poll of chartered surveyors operating in the residential sales and lettings markets. As such, it is an indicator of property market sentiment.

RICS measures the percentage of surveyors reporting house price increases versus declines, and how many of them report more buyer instructions (a sign that a transaction is taking place) versus fewer. It therefore serves as an indicator of current and future market conditions in the UK.

The surveyors who take part are asked 18 questions on various metrics, such as sales, enquiries and listings, and are required to report whether these have increased, remained the same or decreased. A positive net balance indicates that there is more activity taking place, while a negative net balance suggests that the housing market is weakening.