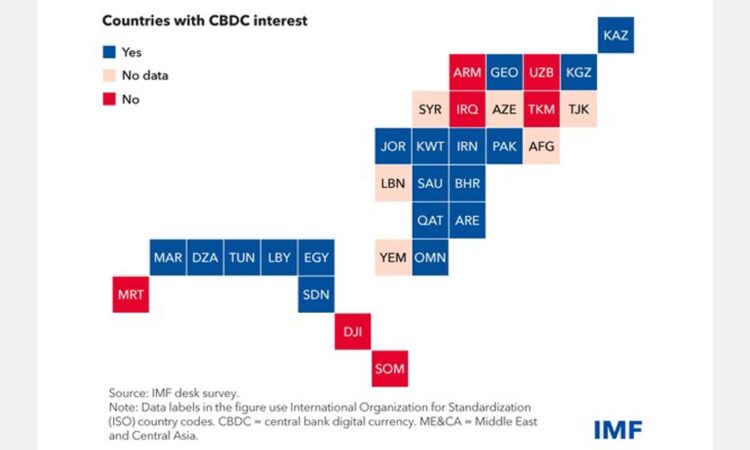

Almost two-thirds of countries in the Middle East and Central Asia are exploring adopting a central bank digital currency (CBDC) to promote financial inclusion and improve the efficiency of cross-border payments.

Adopting a CBDC requires careful consideration. Countries from Morocco and Egypt to Pakistan and Kazakhstan must weigh their unique circumstances. Many of the 19 countries currently exploring a CBDC are at the research stage. Bahrain, Georgia, Saudi Arabia, and the United Arab Emirates have moved to the more advanced “proof-of-concept” stage. Kazakhstan is the most advanced after two pilot programs for the digital tenge.

CBDCs can potentially improve the efficiency of cross-border payment services. This is important for exporters and Gulf Cooperation Council countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Cross-border payments have frictions like varying data formats and operating rules and complex compliance checks. CBDCs could cut transaction costs.

Some countries have introduced cross-border technology platforms to address these issues, such as the Buna cross-border payment system created by the Arab Monetary Fund in 2020.

For monetary policy, CBDCs could strengthen the pass-through into deposit rates by increasing competition among banks. A CBDC could also strengthen the bank lending channel of monetary policy. However, the impact would likely be country-specific and is difficult to estimate because CBDC uptake is limited so far.

Source: imf.org