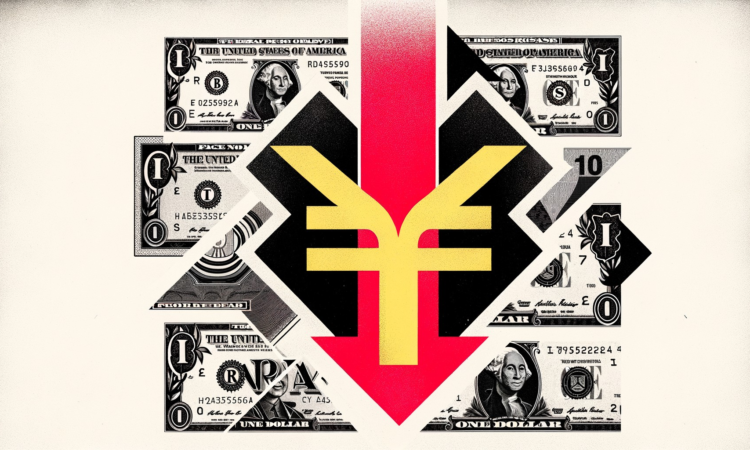

What’s going on here?

Asian currencies have been struggling against the US dollar, with the Indonesian rupiah hitting a four-year low. This comes as the US Federal Reserve holds steady on interest rates, causing widened yield differentials and more regional central bank interventions.

What does this mean?

The Indonesian rupiah has depreciated over 6% this year, making it one of the region’s worst-performing currencies. On June 20, it slipped 0.3% to 16,475.00, the lowest since April 2020. To stabilize the currency, Bank Indonesia plans to use various monetary tools, despite keeping its interest rate unchanged. Analysts at Mirae Asset Securities expect active intervention in the foreign exchange market and strong yield maintenance to attract capital inflows. Meanwhile, broad Asian currency weakness is attributed to the diverging monetary policies between the US and regional economies, which is also impacting currencies like the Philippine peso, Thai baht, and South Korean won.

Why should I care?

For markets: Navigating the stormy seas of currency markets.

The divergence in monetary policies has widened yield differentials, making Asian currencies more vulnerable. Investors should keep an eye on central bank moves and regional economic policies. Recent interventions, like South Korea’s expanded currency swap line and potential monetary easing measures in Thailand, aim to defend against currency depreciation. However, ongoing pressure suggests further volatility ahead.

The bigger picture: Global economic ripples.

The struggle of Asian currencies against the US dollar highlights significant global economic shifts. Countries like Indonesia and the Philippines dealing with weakened currencies may have to employ more aggressive monetary interventions. Meanwhile, differing inflation trends and policy stances across Asia, such as Japan’s slowing demand-led inflation, will shape future economic strategies and impact global trade dynamics.