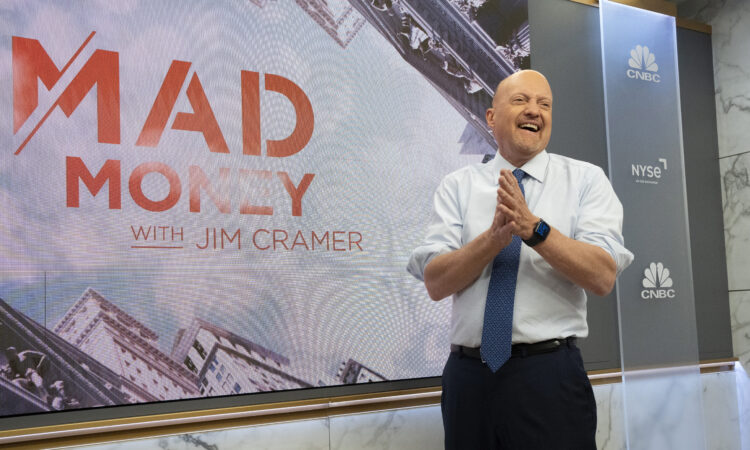

In the wake of a contentious debate between President Joe Biden and former President Donald Trump on Thursday night, CNBC’s Jim Cramer described how the vibe of the market could change if Trump returned to the White House.

“If you think that Trump’s more likely to be president, the overall tone of the stock market will improve if only because the man can’t bear to see it go down, as the major averages are the barometer he uses to measure his own job approval,” Cramer said. “You may think that’s insane, but it’s the reality, and if nothing else — hate him or like him – he’s good for your portfolio.”

The Trump administration rarely tried to block mergers, Cramer said. So companies like Kroger, which has been trying to buy Albertsons, might do well, along with Tapestry, which wants to acquire Capri. Capital One could also be poised for success, as it’s hoping to buy Discover.

Cramer noted that Trump is broadly amiable to gas and oil, pointing to companies like New Fortress Energy and Cheniere. He also predicted that if elected, the Republican would impose tougher trade regulations, especially with China, which might not bode well for companies like Nike and Starbucks.

Cramer said as long as he’s known Trump, the GOP candidate has had a keen interest in the market.

“He loved bantering about the stock market, appeared on this show many times, because even though he was in real estate, he enjoyed stocks,” Cramer said.

Former President Trump’s campaign did not immediately respond to a request for comment.