(Bloomberg) — Emerging-market currencies jumped to their highest since May after US consumer prices unexpectedly fell in June, cementing bets that the Federal Reserve will cut interest rates soon.

Most Read from Bloomberg

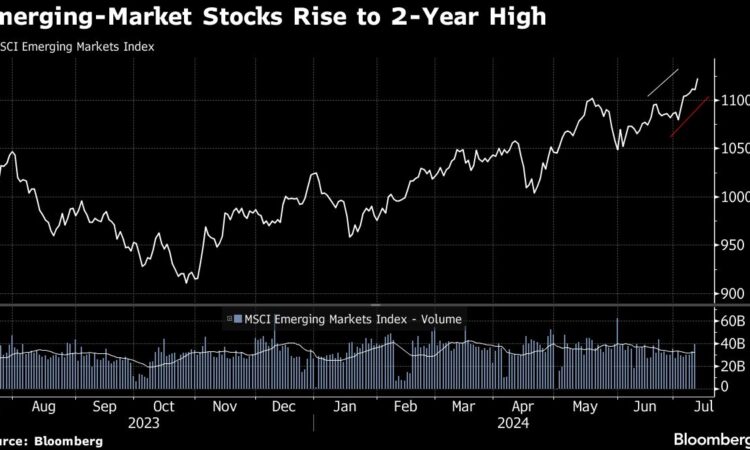

The South African rand, the Korean won and the Czech koruna led the developing-world currency index 0.3% higher as the greenback weakened. The broad equity index rose to the highest level in two years on an intraday level, with the two largest US-listed exchange-traded funds that track it up for the session.

US consumer prices slid 0.1% in June, while the core measure that excludes food and energy rose at its lowest monthly pace since August 2021. The figures spurred higher odds of a third cut by the Fed this year, according to swaps market pricing.

“It’s a very good number for emerging markets,” said Marco Oviedo, a strategist at XP Investimentos in Sao Paulo. “It gives the Fed a reason to cut rates sooner than forecast.”

That scenario outweighed the importance of easier monetary policy elsewhere, after inflation prints in Hungary, Czech Republic and Romania this week bolstered the case for rate cuts.

Carry Unwound

Latin American currencies, which should favor from the increased appetite for risk, underperformed, paring gains as the Japanese yen soared as much as 2.6% against the dollar with traders unwinding so-called carry trades.

The region’s high interest rates have made the currencies Wall Street favorites for these types of wagers, in which investors borrow in a low-yielding currency, like the yen, to buy another one with high interest rates, such as Colombia’s peso or Brazil’s real. The yen’s strength sparked speculation over authorities intervening in the foreign-exchange market.

For now, traders will keep an eye out in Mexico for President-elect Claudia Sheinbaum, who’s likely to name cabinet members in a press conference Thursday. Minutes from the latest central bank meeting showed members forecast lower economic growth.

Emerging Europe

Inflation in Romania eased to the slowest pace since 2021, data showed Thursday, boosting scope for the central bank to press ahead with monetary easing after the first rate cut in three years.

While the country has kept the closely managed leu steady, the Czech koruna and the Hungarian forint each took hits earlier this week after their respective inflation readings. Serbia delivered its second interest-rate cut in as many months Thursday as inflation in the Balkan nation continues to ebb.

In Asia, China took some of its most extreme steps yet to restrict short selling and quantitative trading strategies, seeking to support the nation’s sliding stock market. At the same time, the financial regulator asked some rural lenders to shorten the average duration of their bond holdings, according to people familiar with the matter, as authorities seek to safeguard the banking sector.

Elsewhere, Malaysia’s central bank kept its benchmark interest rate unchanged on Thursday, giving itself room to weigh the impact of potential price hikes as the government unwinds blanket fuel subsidies. Economists expect Peru’s central bank to keep rates unchanged at 5.75% on Thursday.

–With assistance from Leda Alvim.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.