Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US retail, shares help greenback higher

The US dollar extended this week’s recovery, with the USD index rising from three-month lows, after a hotter-than-expected result from US retail sales overnight.

While US retail sales were flat – at 0.0% in June versus the 0.3% fall expected – markets looked through the headline number to other indicators including “core sales” up 0.4% and “sales ex autos and gas” up 0.8%. “Control group sales” were up 0.9% versus the 0.2% expected.

Additionally, US shares continued to surge overnight, with hopes for US rate cuts and the so-called “Trump trade” driving a shift in gains from technology stocks to more traditional industrial and smaller stocks.

The Dow Jones index surged 1.9%, the S&P500 climbed 0.6% while the tech-focused Nasdaq underperformed with a 0.1% gain.

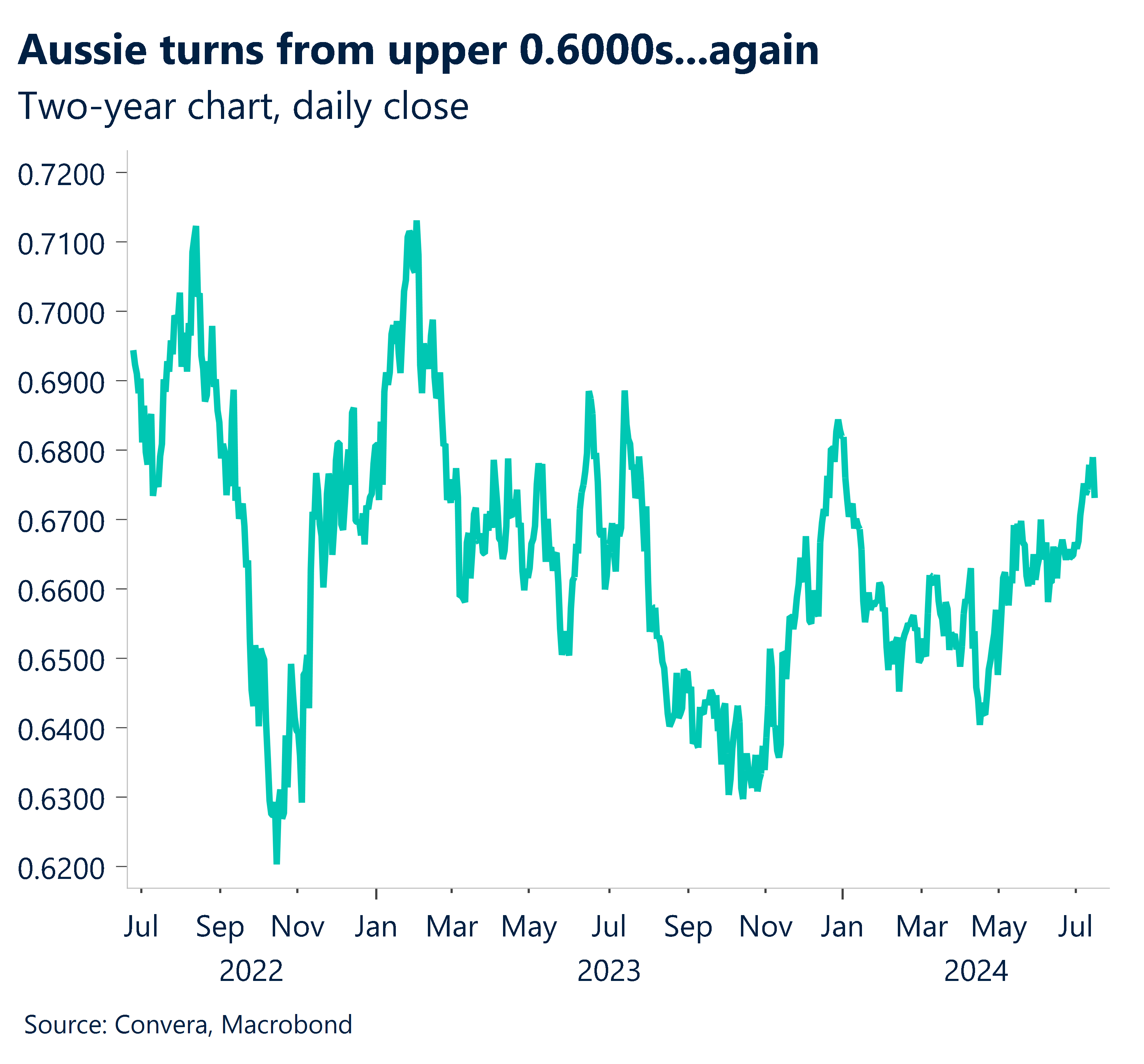

The stronger US dollar saw most currencies weaken. The AUD/USD fell 0.4% as it extended its reversal from levels in the high 0.6000s.

In Asia, USD/CNH, USD/SGD and USD/JPY all gained 0.1%.

In Europe, markets performed better, with both EUR/USD and GBP/USD flat.

Kiwi at two-month lows as CPI data looms

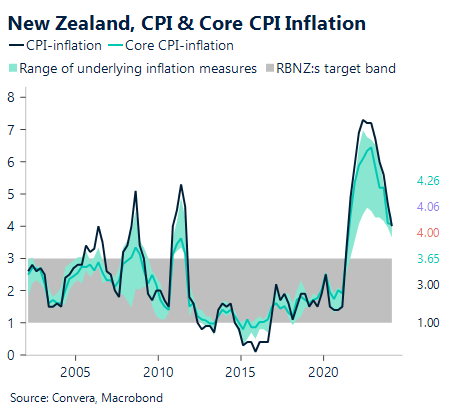

The NZD/USD fell to two-month lows, down 0.4% overnight, ahead of today’s inflation reading at 10.45am NZST (8.45am AEST).

We calculate headline inflation increased 3.3% y-o-y and 0.3% q-o-q in Q2. This would be much less than the RBNZ prediction from May (3.6% y-o-y) and a significant drop from Q1 (4.0% y-o-y).

Data from the June NZ Select Price Index, which represents over 45% of the total CPI basket, point to relatively slight pressures on food prices as well as decreased travel and lodging expenses for passengers in Q2.

A lower inflation rate gives the RBNZ the opportunity to cut rates and this has been the main driver of the kiwi’s recent weakness. As the removal of unduly restrictive interest rate policies weighs on rate differentials, NZD/USD might remain in a narrow range in the low 0.6000s.

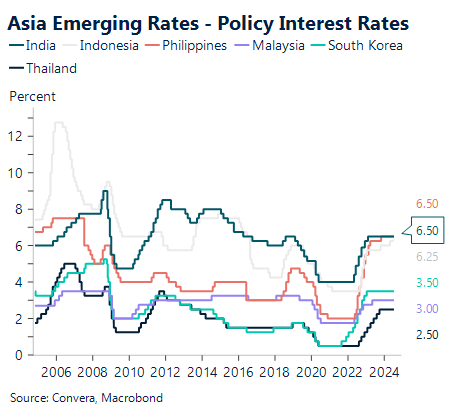

Indonesia BI expected to hold rates

Since FX pressures seem to have subsided since the last meeting, we expect Bank Indonesia (BI) to maintain its policy rate at 6.25%.

However, we would like to stress that this decision is in line with BI’s “pro-stability” monetary policy position. We anticipate that the policy statement will have a similar tone to prior statements, with BI continuing to exercise caution while facing still-high levels of external risk.

Nevertheless, there is a chance that the governor, Governor Warjiyo, would give less aggressive signals in his answers to press inquiries. He has previously stated in parliament that he sees room for a rate decrease before year-end if the currency stays steady.

The USD/IDR has recently fallen to six-week lows but remains in a clear uptrend in line with ongoing USD strength across Asia.

Euro, GBP hold fast versus rebounding USD

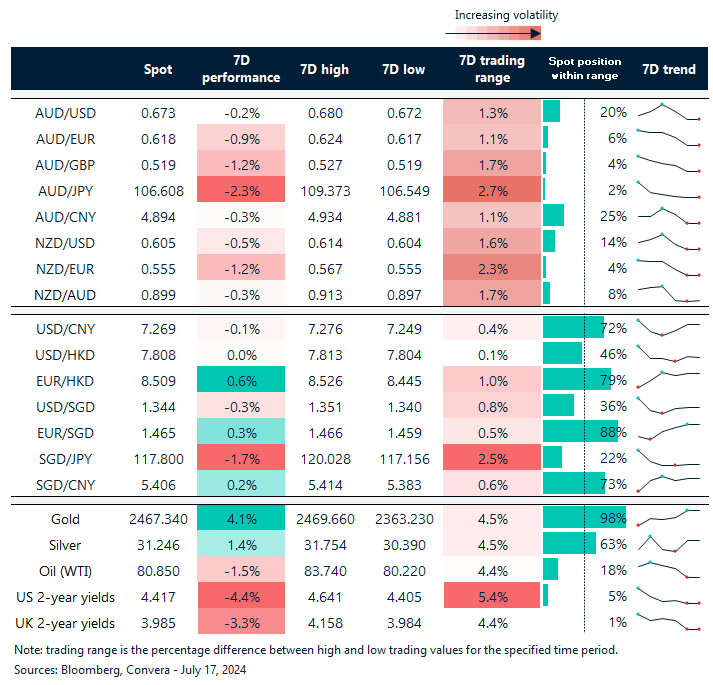

Table: seven-day rolling currency trends and trading ranges

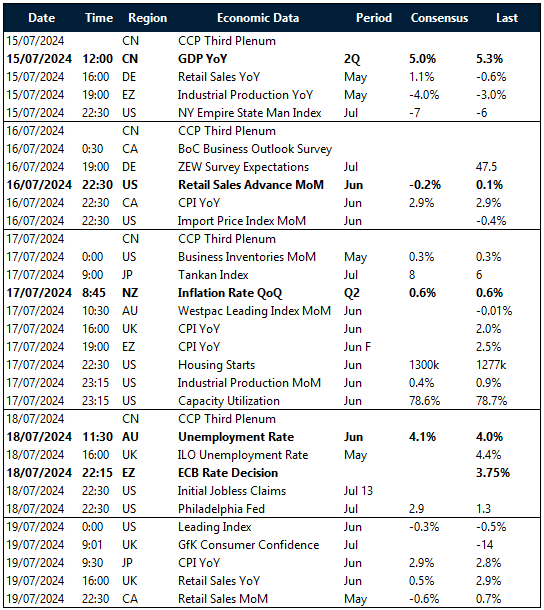

Key global risk events

Calendar: 15 – 19 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]