12

min of reading ▪ by

At the origin of Bitcoin (BTC), several projects attempted to create a new form of digital, anonymous, and decentralized currency. Although they did not succeed, they laid the ideological, technological, and economic foundations for the functioning of the pioneer cryptocurrency. In this article, we review the ancestors of Satoshi Nakamoto’s currency.

2.

The eCash protocol addresses the problem of double spending

3.

The objectives of eCash

5.

The popularity of e-gold

6.

B-money – 1998

9.

Proof of Work and Reusable Proof of Work

10.

The RPOW server

11.

Liberty Reserve – 2006

12.

In conclusion

eCash (DigiCash) – 1990

In 1983, in his book titled Blind Signatures for Untraceable Payments, American cryptographer David Chaum introduced the idea of an anonymous electronic currency. However, it wasn’t until 1990 that he managed to turn this theory into reality.

Through his company DigiCash, he launched eCash, a payment system designed as a digital replica of cash. This was the first known attempt to create a new currency for use on the Internet.

The eCash protocol addresses the problem of double spending

To avoid double spending, the eCash protocol involves banks as trusted third parties. Its principle is as follows:

- At the request of their clients, banks issue digitally signed monetary units called “cyberbucks.”

- They then transmit them via a dedicated application while deducting the equivalent amount from the client’s bank balance.

- Holders of cyberbucks have the option to use this electronic currency to purchase goods or services.

- When a buyer initiates a digital transaction, the merchant must transfer the received cyberbucks directly to the bank to verify that they have not been used before.

- If so, the transaction is validated, and the bank can exchange the merchant’s cyberbucks for cash or new cyberbucks (according to their needs). Otherwise, the transaction is canceled.

The objectives of eCash

eCash was designed to transfer funds securely and anonymously for online transactions. This was made possible by blind signatures, an encryption mechanism developed by Chaum himself. These allowed banks to generate cyberbucks and verify their validity without knowing the identity of their original owner.

At the time, due to its security guarantee, eCash attracted the interest of many Internet users. So much so that banks like the Mark Twain Bank, Deutsche Bank, and Credit Suisse decided to support it.

Finally, in 1998, DigiCash went bankrupt, taking eCash down with it. This downfall was mainly due to the fact that this solution was far ahead of its time.

E-Gold – 1996

Developed in 1996 by Dr. Douglas Jackson, e-gold was an electronic currency backed by gold reserves. Specifically, for each unit of e-gold, there was an equivalent unit of pure gold held by the Gold & Silver Reserve.

The e-gold.com site offered its users the ability to transfer the ownership of their gold from one account to another. Additionally, they could also use this digital gold to make purchases on the Internet. E-gold transactions were instantaneous and much cheaper than traditional financial operations. Furthermore, they could not be reversed.

The popularity of e-gold

In 2005, this service had more than 3.5 million users in over 165 countries. In reality, it enjoyed a popularity almost equal to that of PayPal for transferring money on the Internet.

Very convenient for anonymity needs, the e-gold system unintentionally became a facilitator for money laundering. For several years, the company operated without a license and without complying with banking secrecy regulations. Eventually, becoming a victim of its own success, it caught the attention of U.S. federal authorities, who did not fail to notice its legal shortcomings.

Finally, to avoid trouble, Jackson began cooperating with law enforcement in 2005. Thus, his company identified and reported fraudulent practices occurring on its platform. However, this did not prevent the U.S. justice system from prosecuting him two years later for money laundering, conspiracy, and illegal money transfer activities.

Ultimately, in 2008, Douglas and his associates pleaded guilty to these charges. Subsequently, e-gold made several unsuccessful attempts to obtain a license. As a result, it had to shut down in 2009.

B-money – 1998

In 1998, Wei Dai published a white paper describing an anonymous and distributed electronic payment and contract execution system. Named b-money, this protocol aimed, among other things, to provide a means to transfer funds peer-to-peer to avoid regulatory constraints.

In this regard, the project promised to guarantee the privacy of its users. The idea was that they could not be associated with any transaction made on the network. Thus, to preserve their identity, b-money holders used public keys as pseudonyms.

In reality, the functioning of this protocol is very similar to that of Bitcoin. In particular, when a transaction is initiated, it is signed by its sender and encrypted for its recipient. Then, it is broadcast to a decentralized network of servers that track the account balances of network users. These servers verify the validity of the transaction before releasing the funds to the recipient and updating the financial states of the participants.

Furthermore, in his white paper, Dai suggested the integration of an incentive mechanism to reward the servers responsible for creating the currency.

In light of these elements, one might think that many of Dai’s ideas were adopted by Satoshi Nakamoto. Especially since Nakamoto cites him as a reference in the Bitcoin white paper. However, in reality, the BTC creator would only have learned of his colleague’s work following an exchange with Adam Back, which took place after he had written the Bitcoin white paper.

Ultimately, b-money never came to fruition. The project remained at the reflection stage after its promoter distanced himself from the Cypherpunk crypto-anarchist movement.

Bit Gold – 1998

In 1998, Nick Szabo invented Bit Gold, a digital currency whose goal was to eliminate reliance on trusted third parties, namely banks and other centralized monetary institutions. It is important to note that Bit Gold should not be confused with Bitcoin Gold, which is a Bitcoin fork that occurred much later, in 2017.

To achieve this, he attempted to transpose some of the characteristics of gold (no intermediaries, high production cost) into his project.

Like Bitcoin, Bit Gold relied on using timestamped blocks placed in a publicly distributed ledger.

Moreover, these were produced using a proof-of-work mechanism that also allowed for the creation of new units of bit gold.

However, this monetary production process did not incorporate a mining difficulty adjustment system, as is the case with BTC.

Ultimately, Szabo was unable to bring this project to fruition. He encountered technical obstacles such as the non-fungibility of bit gold tokens, a centralized timestamping service, and an incomplete consensus mechanism.

RPOW – 2004

When Hal Finney introduced RPOW (Reusable Proofs of Work) in 2004, his goal was to materialize the proposal previously formulated by Nick Szabo (Bit Gold). That said, he was also inspired by HashCash, eCash, and b-money.

To recall, HashCash is a proof-of-work (POW) system designed by cryptographer Adam Back in the early days of the Internet to combat spam.

Like Szabo, Finney wanted to create a reserve currency akin to gold. More precisely, he wanted to launch a system of digital tokens that were as scarce as they were valuable. And to establish this sense of scarcity, he relied on the high cost of production.

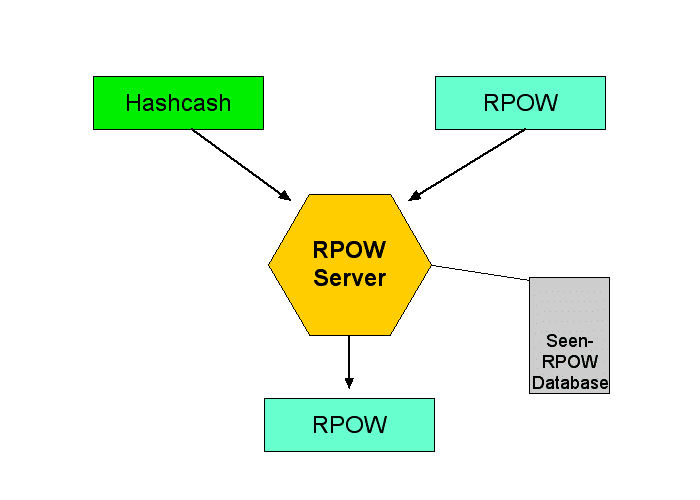

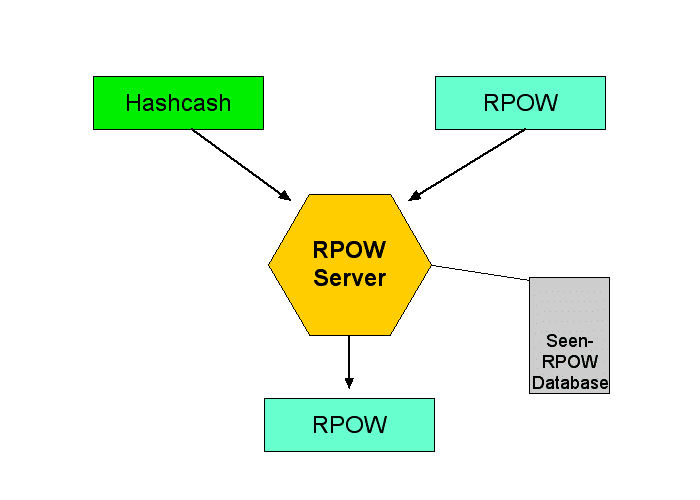

Proof of Work and Reusable Proof of Work

He envisioned a protocol incorporating both proof of work (POW tokens) and reusable proof of work (RPOW tokens). The system operated as follows:

- First, miners had to generate a proof-of-work token to prove their involvement in the network’s proper functioning. This was an arduous process that required many resources. The problem was that these POW tokens had not been designed to be transferred from one place to another.

- Therefore, POW tokens were sent to the RPOW server (not to be confused with mining nodes), which encoded them using an encryption algorithm, thus creating reusable proof-of-work tokens (RPOW).

The RPOW server

To avoid double spending, Finney adopted the method used by eCash. The RPOW server maintained a database listing RPOW and POW tokens that had already been used. Thus, to verify the authenticity of a token, it was enough to consult this archive.

Moreover, unlike bit gold tokens, RPOW assets were designed to be fungible. Thus, they could be split into smaller units. Consequently, during a transaction, the recipient had to transfer the tokens he received to the RPOW server to obtain one or more new RPOW tokens of an equivalent sum.

Although it was used for several months, Hal Finney’s protocol eventually collapsed under the weight of certain operational flaws (inflation, security vulnerabilities).

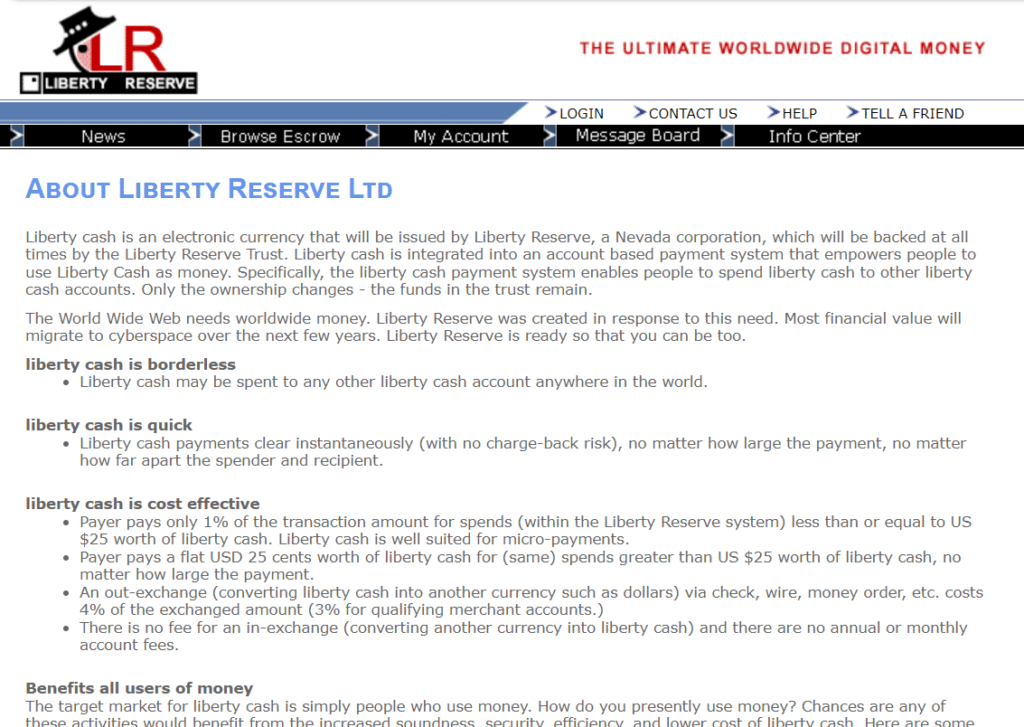

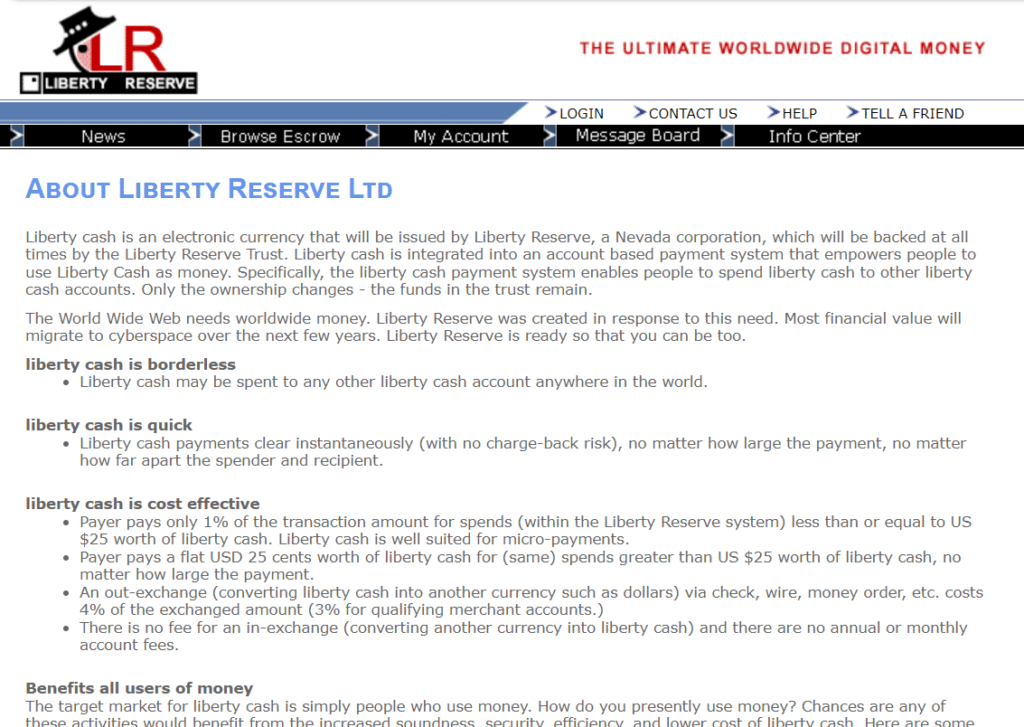

Liberty Reserve – 2006

Liberty Reserve (LR) was an independent monetary system that offered the possibility of transferring money over the Internet without revealing information about the origin of the funds (the identity of the senders, account numbers, etc.). Inspired by the e-gold system, it was launched in 2006 by Arthur Budovsky and Vladimir Kats.

Without being truly innovative, Liberty Reserve had the merit of being operational. It allowed the exchange of LR tokens for fiat currency (dollars, euros, etc.), digital currencies, and gold.

To access this service, the only condition was to have a user account. That said, registration on the platform required very little personal information. Moreover, these were not necessarily subject to verification.

Between anonymity, low costs, and accessibility, this platform managed to acquire a large customer base. At its peak, Liberty Reserve had over five million users worldwide.

Indeed, the system enjoyed great success until May 2013, when authorities began citing its potential involvement in money laundering activities. Finally, after fierce legal battles in the United States and Costa Rica, the company was dissolved.

In conclusion

The genesis of Bitcoin’s history shows us that the need to break away from fiat currencies had already been present in people’s minds for decades. Indeed, whether we’re talking about eCash, e-gold, b-money, bit gold, RPOW or Liberty Reserve, each of these projects has contributed in its own way, consciously or unconsciously, to the rise of cryptocurrencies.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.