Kenya’s Riots Send Shilling on Its Longest Slide Since January – BNN Bloomberg

(Bloomberg) — Anti-government riots that disrupted Kenya’s economy for the past month and spooked investors are hurting its currency, which has suffered its longest decline since January.

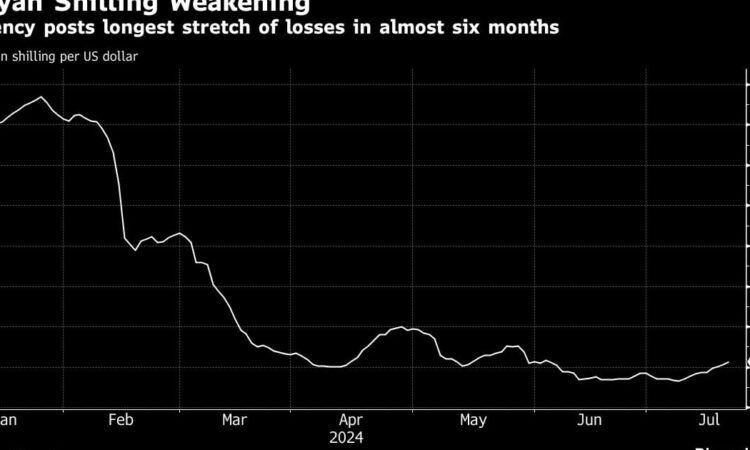

The shilling weakened for nine straight days to 130.68 per dollar at close of Friday trading in Nairobi, paring its year-to-date gains to 17%, according to data compiled by Bloomberg. On Monday it was up less than 0.1% in early trading. While it’s still Africa’s best-performing currency this year, last week’s drop was the largest since April.

Protests erupted in Kenya in mid-June urging the government to halt tax increases and address corruption. At least 53 people have died and more than 400 have been injured. While President William Ruto has rescinded the proposed measures and sacked almost his entire cabinet, the demonstrations have continued, with calls for him to step down.

High import costs and stubborn inflation have contributed to weakening the shilling, but the protests have clearly unsettled investors, said Timothy Kiarie, a Nairobi-based financial analyst at foreign-exchange broker Scope Markets.

“Demonstrations by Kenya’s Gen Zs demanding proper governance have aggravated the situation by creating uncertainties in the economy and causing disruption in business activities,” Kiarie said.

The shilling had been strengthening since mid February after Kenyan authorities bought back part of a Eurobond, which matured last month. The currency reached its strongest point this year at 128.30 per dollar on July 8, before the slide started.

–With assistance from David Herbling.

©2024 Bloomberg L.P.