Emerging Currencies Drop, Stocks Gain Ahead of Data-Heavy Week – BNN Bloomberg

(Bloomberg) — Developing currencies fell Monday as the dollar strengthened, with Latin America underperforming peers, as investors wait for major central bank decisions and economic data this week.

MSCI’s index for emerging-market currencies dropped 0.1%, with the Mexican peso slumping to the weakest level in over a month, leading the group of exchange rates as the worst performer. Colombia’s peso and South Africa’s rand also declined.

“Latam FX may be under pressure at the moment due to the weakness in commodity prices and softer US equity prices,” said Benito Berber, chief Latin America economist at Natixis.

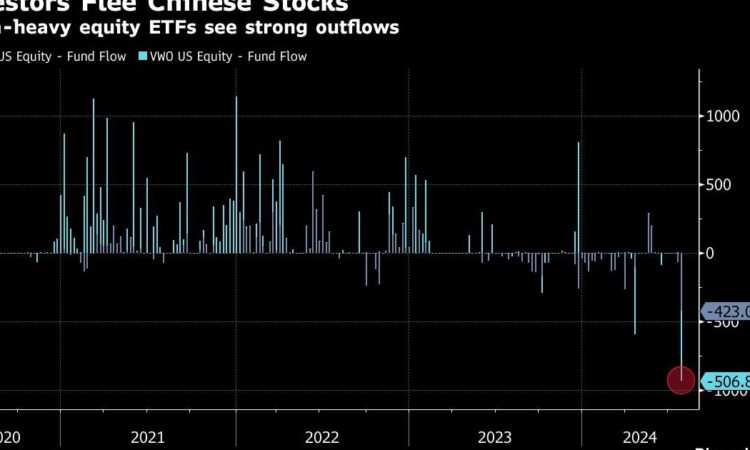

Meanwhile, stocks rose for the first session in four, led by Asian tech heavyweights, as risk sentiment improved at the start of a week packed with central bank decisions, earnings and economic data. Though still up 0.4%, the rally in developing-nation stocks has faded from earlier in the session. Last week investors yanked cash from large exchange-traded funds with heavy allocations to Chinese stocks.

Upcoming monetary policy decisions in the US, Japan, and the UK — as well as several countries in Latin America — will help provide guidance on the demand for riskier assets. Investors will also watch GDP data from the euro zone, as well as from emerging nations including Hungary and the Czech Republic.

“We expect the Fed to hold rates but it may lay the groundwork for a September cut,” strategists at ING Bank including Francesco Pesole wrote in a note Monday. “We’ll see whether month-end flows offer some respite to the battered high-yielding currencies, even though the carry trade unwinding may continue this week if we are right with our call for a 15bps Bank of Japan rate hike on Wednesday.”

Elsewhere, Venezuela’s dollar bonds fell as political tensions soared anew after President Nicolás Maduro was declared the winner of Sunday’s election. The opposition, rejecting that claim, called on the military to enforce what it said was the will of the people.

Ethiopia’s central bank allowed the nation’s currency to trade freely in a key move to secure more than $10 billion of funding and debt relief from the International Monetary Fund. The birr plunged upon the decision.

©2024 Bloomberg L.P.