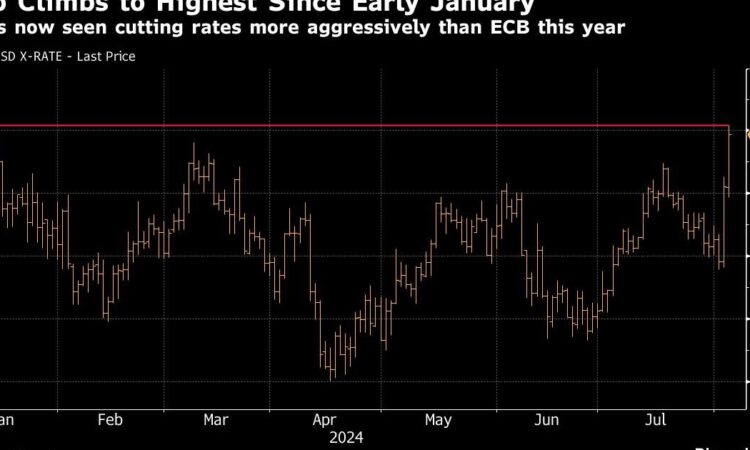

Euro Jumps to $1.10 on Bets Fed May Go Beyond ECB on Rate Cuts – BNN Bloomberg

(Bloomberg) — The euro climbed to the strongest level in seven months as signs the US economy is much weaker than previously thought bolstered bets on Federal Reserve interest-rate cuts, reducing the attractiveness of the dollar.

The common currency gained as much as 0.9% on Monday to $1.1008, the highest since early January. The rally brings the euro’s losses for the year to just 0.6%, the second best performance in the Group-of-10.

While the European Central Bank has already started easing policy with a quarter-point rate cut in June, traders are betting it may end up lowering borrowing costs less aggressively than the Fed this year. Swaps imply about 125 basis points of rate reductions in the US this year, compared to an additional 80 basis points from their euro-area counterparts.

The sharp repricing in global rates markets follows softer US jobs and activity data that ignited fears that the world’s largest economy is faltering. It’s an added tailwind for the euro, which has largely bucked the dollar’s strength this year, despite a string of domestic risks, including the volatile political backdrop in France and sub-par economic growth in Germany.

“The resilience of the euro has been one of the standout FX stories of the year in view,” said Jane Foley, head of FX strategy at Rabobank.

At one point on Monday, the swap market assigned a 60% chance of an emergency rate reduction by the Fed over the coming week — well before its next scheduled meeting on Sept. 18. While those odds eased off, the wager speaks to how nervous investors are becoming.

“This reflects the aggressive repricing of Fed easing that stood in contrast with the relatively stable ECB rate expectations,” said Valentin Marinov, head of G10 FX strategy at Credit Agricole. “I think that the US rates moves are starting to look very exaggerated and believe therefore that a lot of Fed-related negatives are in the price of the USD.”

The outlook in Europe meanwhile is far less clear. ECB officials have to juggle the growth picture in Spain and Italy, which is proving more resilient than the euro area’s biggest member state Germany. A recent acceleration in German inflation may also keep them cautious.

“As a lot of this global ‘panic’ today is driven by worries on the Fed’s path, EUR is going to reap some benefit from it,” said Helen Given, a foreign-exchange trader at Monex Inc. “Over the last few weeks and months, we’ve seen the euro zone attempt to claw itself out of a small recession to some success, while the economic picture in the US has continued to slow.”

–With assistance from Anya Andrianova.

(Updates context throughout.)

©2024 Bloomberg L.P.