Japan’s Executives Struggle to Read Volatility in Stocks, Yen – BNN Bloomberg

(Bloomberg) — Japan’s biggest companies are struggling to provide clear guidance to investors as the extreme volatility in the country’s equities and foreign exchange markets cloud their outlooks for the coming months.

Suzuki Motor Corp. was the latest in a series of companies to highlight the heightened levels of uncertainty during earnings calls with investors this week. The automaker kept its full-year revenue outlook unchanged citing volatility in the stock market and the sudden appreciation of the yen against the US dollar.

“As uncertainty remains in the markets, we kept our full-year outlook unchanged,” said Managing Executive Officer Ryo Kawamura after the company held its sales outlook at ¥5.7 trillion ($38.6 billion) despite revenue growing more than 20% in the first quarter on strong car sales.

“A weak yen benefits us, but the current strengthening in the currency will have a reverse impact,” he added at the company’s briefing on Tuesday.

On the same call, Executive Vice President Kenichi Ayukawa also expressed his “shock” at recent market moves.

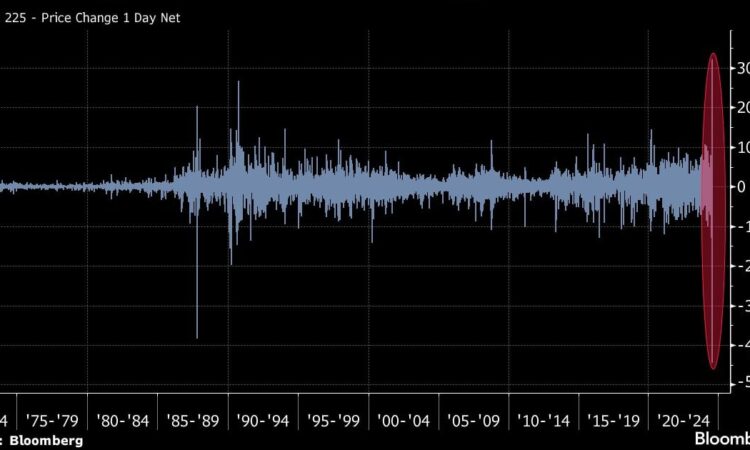

The Bank of Japan’s decision to raise its benchmark rate last week has triggered a wave of criticism after it helped set off a historic plunge in Japanese stocks and contributed to global market turmoil — likely putting any plans for further interest-rate hikes on ice. Japan’s two key share gauges surged more than 9% on Tuesday, after tumbling 12% the day before.

Executives from other Japanese companies also said they were struggling to react to the market chaos. Mitsubishi Heavy Industries Ltd. Chief Financial Officer Hisato Kozawa said Tuesday that he’s “hopeful” the market will stabilize but expects it to take some time.

The manufacturing conglomerate posted a 61% increase in quarterly profit, helped by strong sales of gas turbine engines.

Itochu Corp. Chief Financial Officer Tsuyoshi Hachimura said that investors are overestimating a decline in the US economy and that its too early to make any concrete investment decisions.

As for the yen, Hachimura said that the Japanese currency is correcting its level against the US dollar, which, he warned, may have a negative impact on consumers.

Kirin Holdings Co.’s Chief Operating Officer Takeshi Minakata also said at a briefing Tuesday that the current inconsistency in the market is disconnected from the actual economy.

Nippon Yusen Kabushiki Kaisha President Takaya Soga meanwhile had a more positive outlook, saying Monday that there is no change in Japan’s fundamentals and market players were just adjusting their positions.

He added that Japanese stocks will bounce back at some point as the country’s economy is strengthening.

©2024 Bloomberg L.P.