A barrage of legal challenges to the fees charged in US home sales has cast doubt over the future earnings of a 1.6mn-strong profession known for offering flexible and high-paying careers, particularly to women.

A federal jury in Missouri sided with a group of home sellers in Missouri, Kansas and Illinois last month, finding the largest US real estate brokerages liable for nearly $1.8bn in damages for conspiring to keep commissions high.

Home buyers and sellers in other states have filed four additional class-action complaints challenging realtors’ fees in the past two weeks. With the Department of Justice reportedly considering antitrust action, industry leaders say the industry’s decades-old commission model is over.

Outlawing the commission structure that realtors rely on could threaten the jobs of as many as 80 per cent of the country’s real estate brokers, according to one analysis by Keefe, Bruyette & Woods.

The $100bn that Americans pay real estate agents in commissions each year could shrink 30 per cent, KBW’s analysts estimated.

That could endanger a popular and high-paying career path for US women. The female-dominated industry does not require college degrees and offers flexible schedules. Most agents worked only 30 hours per week last year, according to that National Association of Realtors.

“In our surveys, it is the job the people without college degrees are most likely to say is their dream job,” said Julia Pollak, chief economist for the jobs site ZipRecruiter.

“It clearly is a very unusually lucrative opportunity for people relative to the training and certification requirements,” she added. Compared to other popular careers that do not require degrees, such as being an electrician or a plumber, “the barriers are relatively low . . . and the pay is typically quite high.”

Agents say they expect the estimated third of realtors who work part time and those with the least experience to see the biggest cuts to their incomes. Agents specialising in luxury properties and working in cities with a diverse array of property types, from condos to co-operatives, should be least affected.

“I do think some people are going to have to leave the industry,” said Mary Lou Wertz, founding partner of Maison Real Estate in Charleston, South Carolina. “I think this will shake some people out.”

Unlike in the UK and much of Europe, US home buyers typically hire realtors to represent them through the transaction. The seller pays 5 per cent to 6 per cent of the sale price to their broker, who typically splits the commission evenly with the buyer’s agent. At the median selling price for US homes of $431,000 in the third quarter, the typical commission would be about $26,000.

If the seller refuses to pay, their home will not be posted to the Multiple Listing Service, which buyers’ agents use to find homes for their clients and which powers listings sites including Zillow. Plaintiffs in the Missouri case said these restrictions made it almost impossible to sell a home without paying a realtor.

The challenges to the decades-old system of co-operative commissions comes as agents are struggling with an influx of new realtors and slowing home sales.

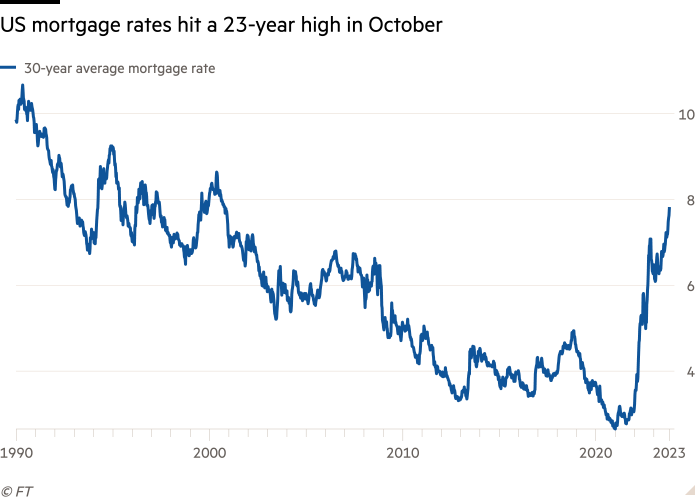

Existing home sales dropped 15 per cent year-on-year to 3.9mn in September, their lowest level since 2011. Average rates for 30-year fixed mortgages briefly hit 23-year highs in October, making homeowners hesitate to sell and pricing buyers out of the market.

Nina Hatvany, a Compass agent in San Francisco, said her team’s sales were down 40 per cent from this time last year. Now, she said, she expects headlines about the Missouri lawsuit to prompt more buyers to try to negotiate down her standard rate.

“It’s going to be a whole new ballgame,” Hatvany said.

Consumer advocates see the legal backlash as a long-awaited reckoning that could improve affordability in a tough market.

Stephen Brobeck, a senior fellow at the Consumer Federation of America, said clients often receive too little service to justify tens of thousands of dollars in fees.

“The industry has essentially been rebuffed by the American people,” he said.

Real estate is one of the few industries where intermediation costs have not fallen in the internet age, said ZipRecruiter’s Pollak. Real estate agents could now go the way of travel agents, she predicted: the few flight bookers who remain now largely specialise in co-ordinating the most complex trips.

“These days, with all of these online tools, it’s not that clear that you actually need all of this hand-holding or that it should cost that much,” she said.

Agents say they provide valuable services including advice on mortgages, appraisals and home inspections. Forcing buyers to pay for representation upfront could also disadvantage first-time buyers and those from marginalised communities in an already competitive market, they argue. Alternatively, buyers might go without agents or choose to pay them by the hour for à la carte services.

As the class-action suits work their way through the courts, realtors said brokerages are mired in confusion. Agents are asking “what does this mean and how will we show our value?” said Jen Davis, a Missouri-based Keller Williams agent who coaches other realtors.

For Laura Ellis, chief strategy officer of independent brokerage Baird & Warner, who said she was already suffering “whiplash” from the property market’s swings since 2020, there could be advantages in driving out inexperienced, part-time agents who had damaged the field’s reputation.

“There will be a lot of job loss, and I actually think that’s really good for our industry,” she said.

“Seismic change is coming to our industry,” Ellis added. “The writing is on the wall.”