Did you know a three-letter region is home to one of the world’s oldest and most stable currencies?

- It has existed for centuries

- It’s never changed its status

- It has never debased itself

Sounds like a monetary system we could all take a page out of, right?

The rai stone, created from limestone and shaped like a hollow disc can be found on the Micronesian islands of Yap.

Created centuries ago, these discs represented currency on the island.

Approximately 6,000 of these discs are known to exist scattered around the Micronesian islands.

Contrary to Roman or British currency which saw their currencies be “clipped” during hard times as citizens shaved off portions of their coins for the true metal value, in Yap, the discs rested peacefully.

Not only that, because the discs were heavy, transfer of the discs between holders was completed orally.

Where the stone sat was irrelevant, including one instance where a disc was lost at sea yet became part of the “money supply”.

The clipping of coins for their value led to the debasement of monetary systems. While we don’t “clip” our coins today as there is almost no metal value in them or in the banknotes we carry, nations have been debasing their currencies at a torrential pace. Central Banks and governments debase through monetary actions, known as expansive monetary policy.

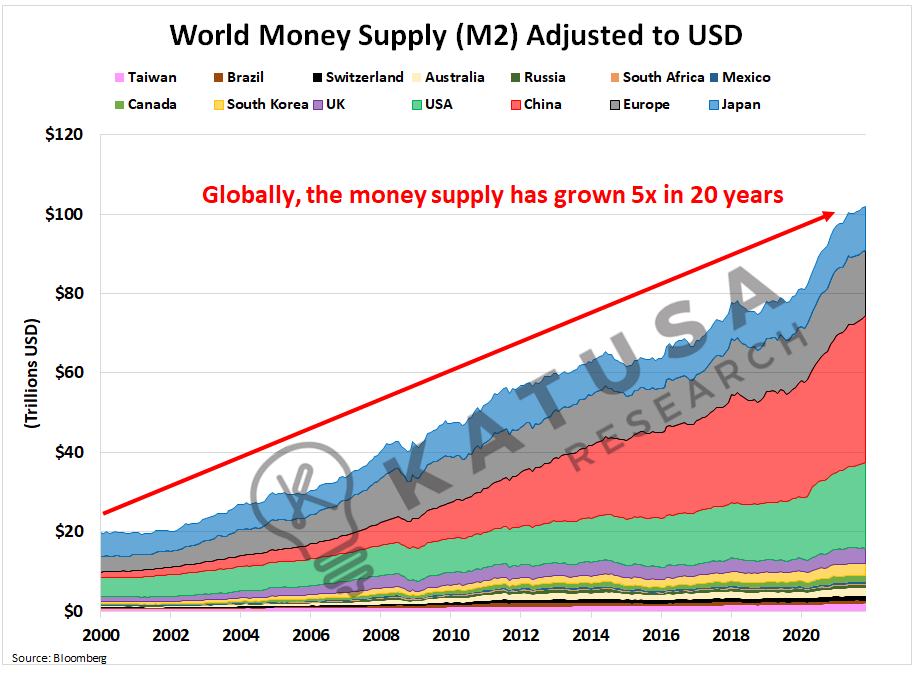

Shocking World Money Supply Growth

Did you know that over the last 20 years…

If you took all the currency created in the world and converted it to US Dollars… the money supply would have increased by 5-fold?

That’s equivalent to nearly two full years’ worth of emissions from all energy production around the world.

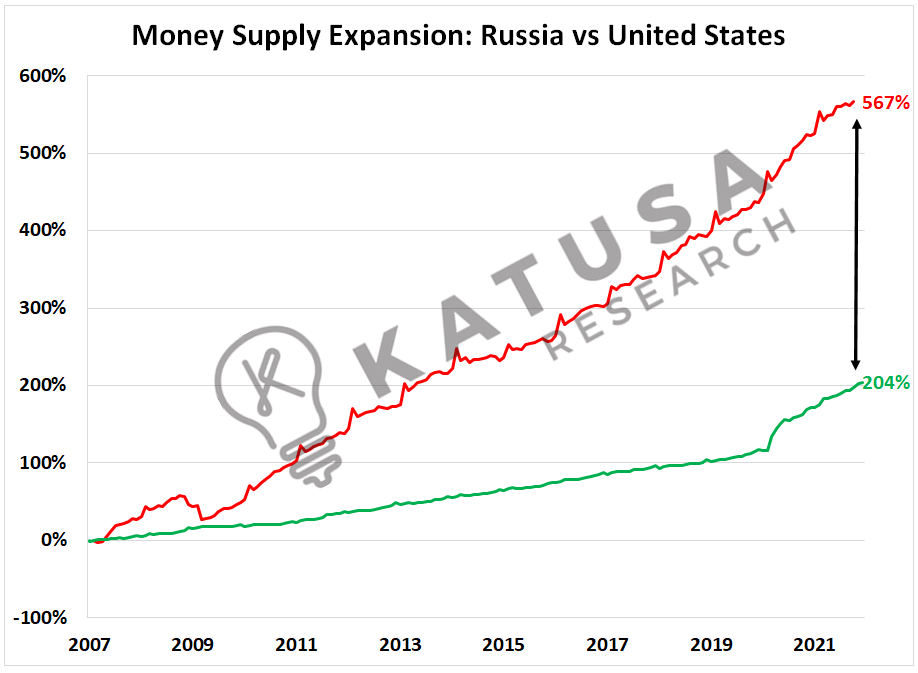

Looking at this chart only tells half the story.

To truly grasp the impact of expansionary monetary policy, let’s look at the currency expansion as its local currency…

And then see the relative effect of that monetary expansion against other currencies.

Breakdown: The Turkish Lira

Let’s look at the Turkish Lira, which I highlighted in my Amazon Best Seller Rise of America.

In the next chart, you’ll see the enormous expansion of money compared to the United States.

What many investors fail to realize is that currency performance is measured relative to another currency.

- Key drivers in the performance of currencies are monetary policy and expected economic stability.

This chart shows the money supply expansion in Turkey compared to the United States.

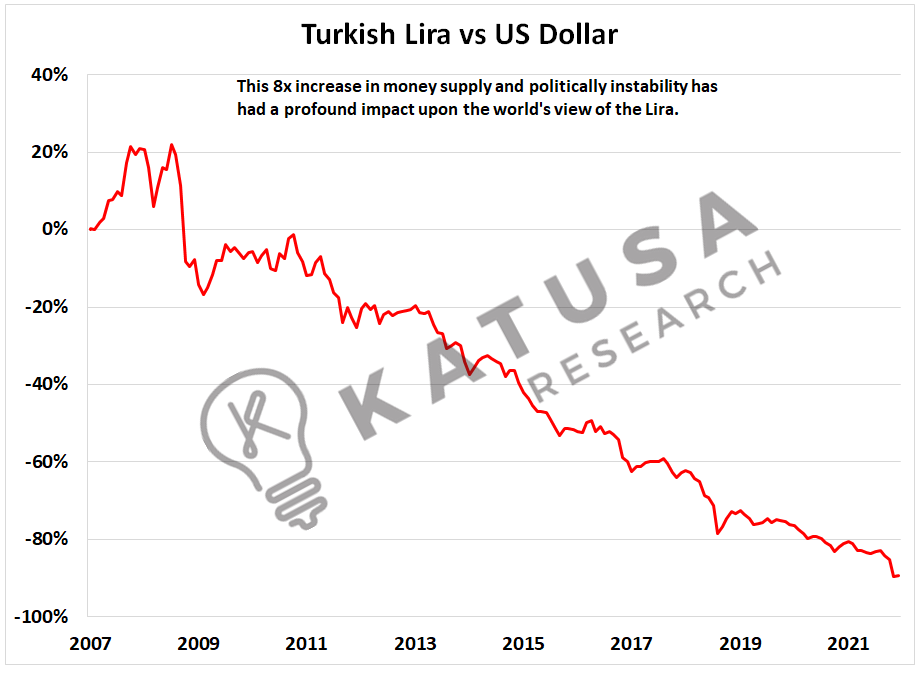

And this is the impact of all this money being created.

- This 8x increase in money supply and political instability has had a huge impact on the world’s view of the Turkish Lira.

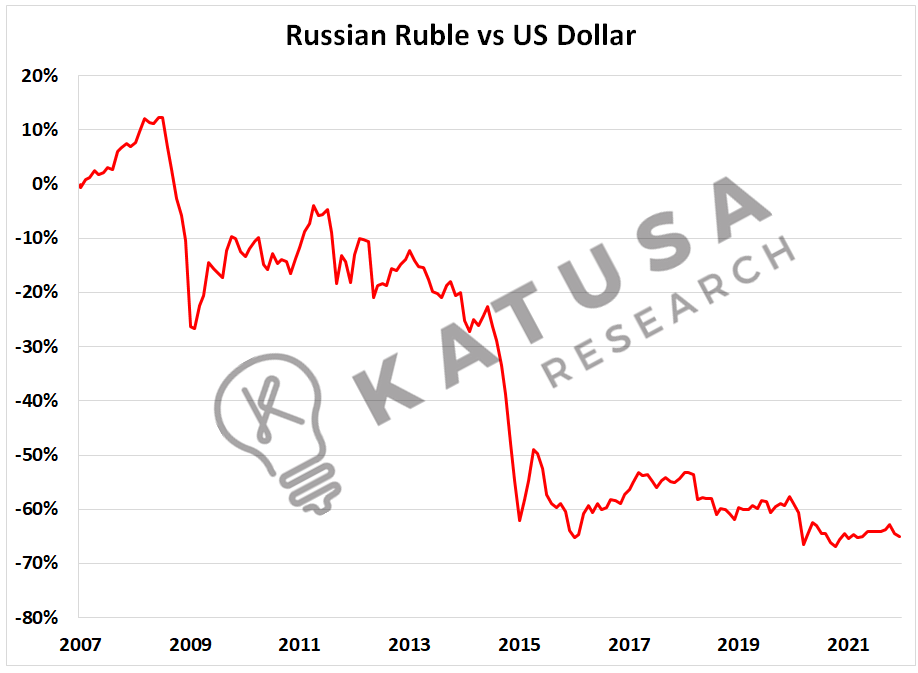

The Russian Rubles are Running…

In a similar fashion, you can see this situation unfolding in Russia.

A highly expansive monetary policy is relative to the United States…

Again, we see a similar chart pattern arise in the Ruble – US Dollar currency pair.

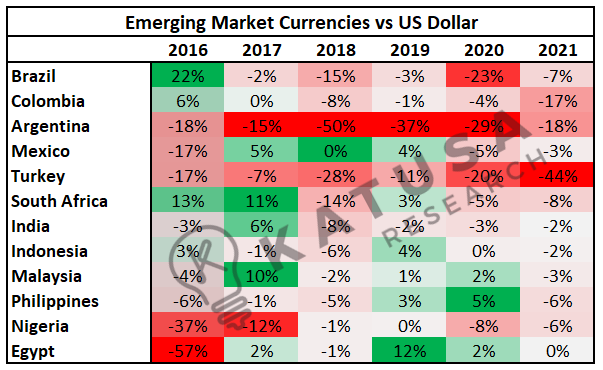

Exotic Currencies and Riches

Many investors are drawn to the emerging and frontier markets because they are exotic, in the early stages of development, and ripe for potential investment.

While that is true, there are huge risks associated with those emerging nations.

Many investors will consider company-specific risk and maybe a few will consider the government risk.

But most forget the currency risk.

The table below shows the performance for a basket of emerging market currencies versus the US Dollar.

As you can see…

- Unless you were dialed in on the currency move, or highly sophisticated and hedged the risk, your investment profits were massively at risk.

Unquestionably our new era of Quantum Economics, ZIRP and NIRP (Zero & Negative Interest Rate Policy) coupled with gigantic stimulus packages have set us down a treacherous debasement path.

This is a situation I see continuing well into the future.

Katusa’s 2022 Currency Watchlist

Here’s a list of currencies you must keep an eye on as an investor.

If your stocks hold cash, assets and projects (especially in the first 4 bullets), there are big currency risks:

- Turkish Lira

- Chilean & Peruvian Pesos

- Brazilian Real

- Euros and Pounds

- Canadian, Australian, US dollars

With debasement being a theme seen around the world investors and speculators are often in search of the next “rai stone”.

From Stone Disks to Bits

If you ask an economist what criteria something must be to qualify as money, they will respond with 3 checklist items.

- Store of value

- Medium Exchange

- Unit of account

Whether you like it or not, we exist in the world of digital everything. Payments, artwork, and some would argue, currency.

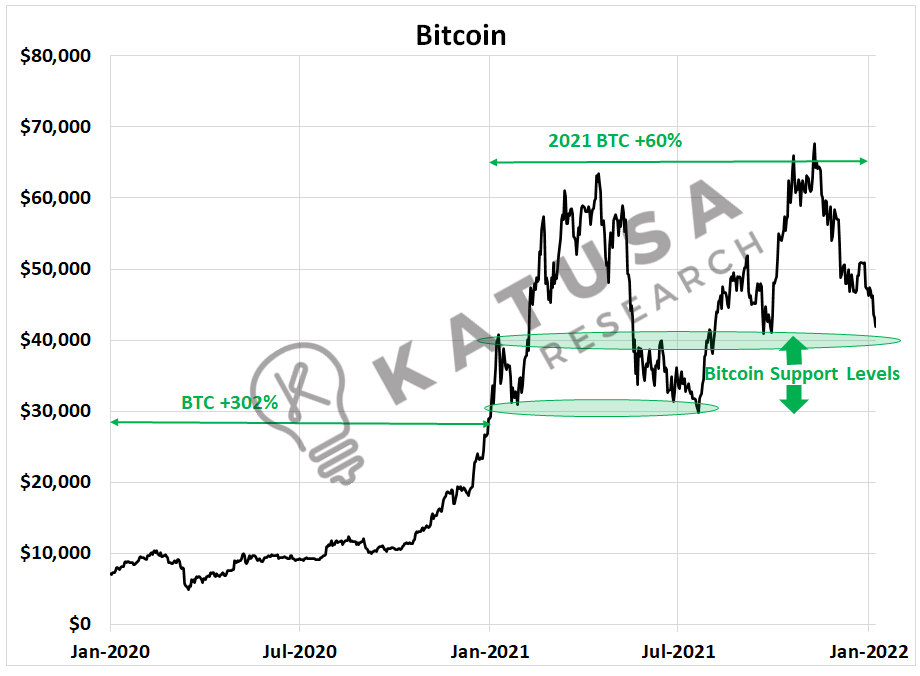

Over the last five years, Bitcoin has become a dominant force in the global markets.

And is now considered by many to be a major asset class, just like stocks, bonds, and commodities.

Bitcoin has become a true competitor for investor capital much to the chagrin of many precious metal and gold standard bugs.

Bitcoin’s Next Move

It has been a rocky start for BTC holders with bitcoin falling nearly 10% so far this year, making it the worst performer out of major asset classes.

But we all know that can change in a flash in the crypto world.

Especially when $1 Billion USDT is transferred to Binance in the span of a few hours.

Below are several key technical levels for Bitcoin.

As we flip the calendar to 2022, I expect fiat and digital currencies to remain a highly volatile asset class.

Many gurus and dollar haters continue to beat their chests that the end of the US dollar is here. It’s the same song they’ve been singing for years now.

Time and time again they have been proven wrong.

Marin Katusa is the founder and CEO of Katusa Research, an independent investment research firm.

_____

Equities News Contributor: Marin Katusa

Source: Equities News