The COVID-19 pandemic forced Americans to change how they live and work, with ripple effects felt across the economy. More than one third of households report working from home more frequently now than they did before the pandemic, and workers go to the office about 3.5 days a week, a 30 percent reduction from pre-pandemic norms. The changes are squeezing the commercial real estate market, which is dominated by office buildings but also includes hospitality and healthcare facilities.

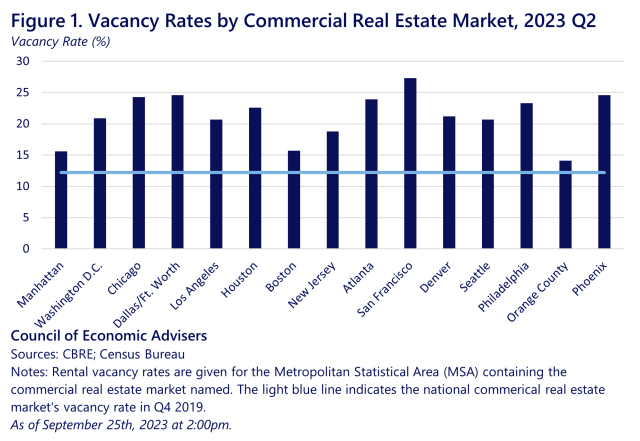

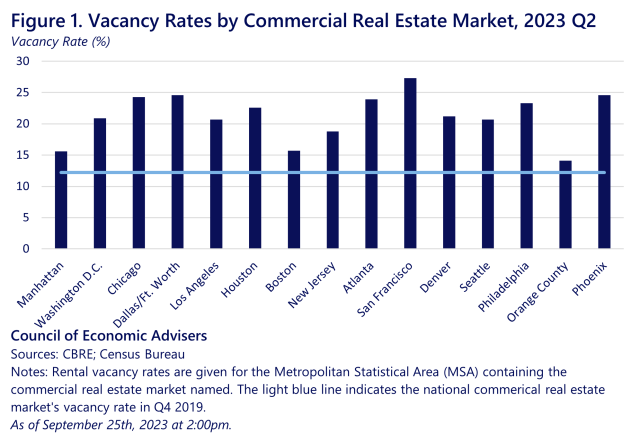

Commercial real estate investment volumes fell by 64 percent year-over-year in the second quarter of 2023. At the same time, office vacancies reached a 30-year high of 18.2 percent. As shown in Figure 1, the vacancies persist from coast-to-coast. The vacancy rates have reduced foot traffic to the “office adjacent” economy, reducing demand at local businesses, including restaurants, dry cleaners, convenience stores, retailers, and hair salons. A new initiative announced today by the Biden-Harris administration helps accelerate conversions of commercial properties to residential use, presenting an opportunity to prevent such a loop.

Policymakers in cities including DC, New York, and San Francisco are taking actions to revitalize their downtowns through commercial-to-residential conversions, including vacant offices, hotels, and other non-office commercial spaces. Proponents of the policies see them as opportunities both to revitalize vacant real estate and address the long-run supply shortage, which is plaguing the U.S. housing market and contributing to decreased housing affordability. As of the end of 2020, the market was short 3.8 million housing units; rental vacancy rates have been, in the last four years, the lowest they’ve been since the mid-1980s, most recently at 6.3 percent in Q2 of 2023; and, as of 2021, 45 percent of renters are rent-burdened, spending more than 30 percent of their disposable income on housing. Conversions also present an opportunity to combat climate change. Buildings account for 29 percent of all U.S. greenhouse gas emissions, and estimates suggest rehabilitated structures can produce 50 to 75 percent fewer carbon emissions than new construction.

A new federal guidebook shows how federal tools have already been used to make conversions possible for the development of affordable housing. This is not surprising as cities also turned to commercial-to-residential conversion incentives to repurpose vacant office space during past macroeconomic downturns. New York worked to revitalize its Lower Manhattan financial district during the post–9/11 period through zoning reforms and tax incentives; as a result, developers converted 20 million square feet of office space into residential housing, doubling the local residential population. During the same period, the dot-com bubble led Los Angeles to ease zoning restrictions for older commercial buildings, incentivizing development of 12,000 housing units over 20 years. Finally, Philadelphia linked conversions to 10-year property tax abatements, and 8.2 million square feet of office space were converted to housing, increasing the city center’s population by 54 percent.

Commercial-to-residential conversion projects must overcome significant physical complexities. Office buildings, especially new ones, are constructed on increasingly large floor plates to meet demand for open concept configurations. Residential buildings include, and often require, features like exterior-opening windows and in-unit bathrooms and kitchens, requiring changes in floor-to-floor height, window systems, heating and cooling units, sewers, and elevator access. Past conversion projects have tended toward pre-war office buildings designed on smaller plates, often with courtyards, and with individual offices.

Converting commercial real estate to housing also has unique financial obstacles. Office vacancies are not uniformly distributed across building age, size, quality, or geography, and vacancy statistics reflect unoccupied square footage, despite the buildings housing many tenants, each with their own lease terms. Commercial-to-residential conversions face the same zoning constraints that have led to longstanding housing shortages, including density restrictions, parking regulations, and strict use prescriptions.

In spite of the complexities, recent work finds that 15 percent of commercial district office buildings in the 105 largest U.S. cities are suitable for residential conversion, offering the potential to add 171,470 units, or almost one half of 2022’s yield of units in multifamily buildings. Developers say conversions can be completed more quickly than new construction at costs up to 20 percent cheaper than demolish-and-rebuild projects.

COVID-19 induced a long-run shift in office space demand and models suggest sluggish demand will continue into the next decade. Moreover, the pandemic induced a “flight to quality” in office space, shifting preferences toward high-end buildings. Ten percent of U.S. office buildings account for 80 percent of recent occupancy losses, and buildings with high vacancy rates tend to be older and in downtown submarkets. Facilities with the appropriate building, land-use, and economic characteristics can provide a new source of housing where it is badly needed, and the adaptive re-use of these properties can have the added benefits of improving the efficiency and reducing the emissions of existing buildings.

Several existing federal programs already support commercial-to-residential conversions, and the Biden-Harris Administration aims to further facilitate commercial-to-residential conversions through new actions announced today through its Housing Supply and Action Plan. The Community Development Block Grant, which provides $3 billion annually to support community housing and revitalization projects for low- and moderate-income families, and new actions make it easier to use these funds for acquisition, pre-development and construction associated with conversions. This compliments other actions like HUD’s recently announced $860,000 in grant funds to study office-to-residential conversions undertaken since the pandemic. Similarly, new DOT policies unlock $35 billion in available lending capacity for development projects at below market interest rates, which will make conversions easier to finance.

The announcement today also catalogues the broad set of federal tools that can be used for conversions. This includes the Historic Tax Credit, which has supported more than 47,000 properties and created more than 150,000 low- and moderate-income housing units since its inception. New opportunities will continue to arise.