Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

“Time has come” for cuts

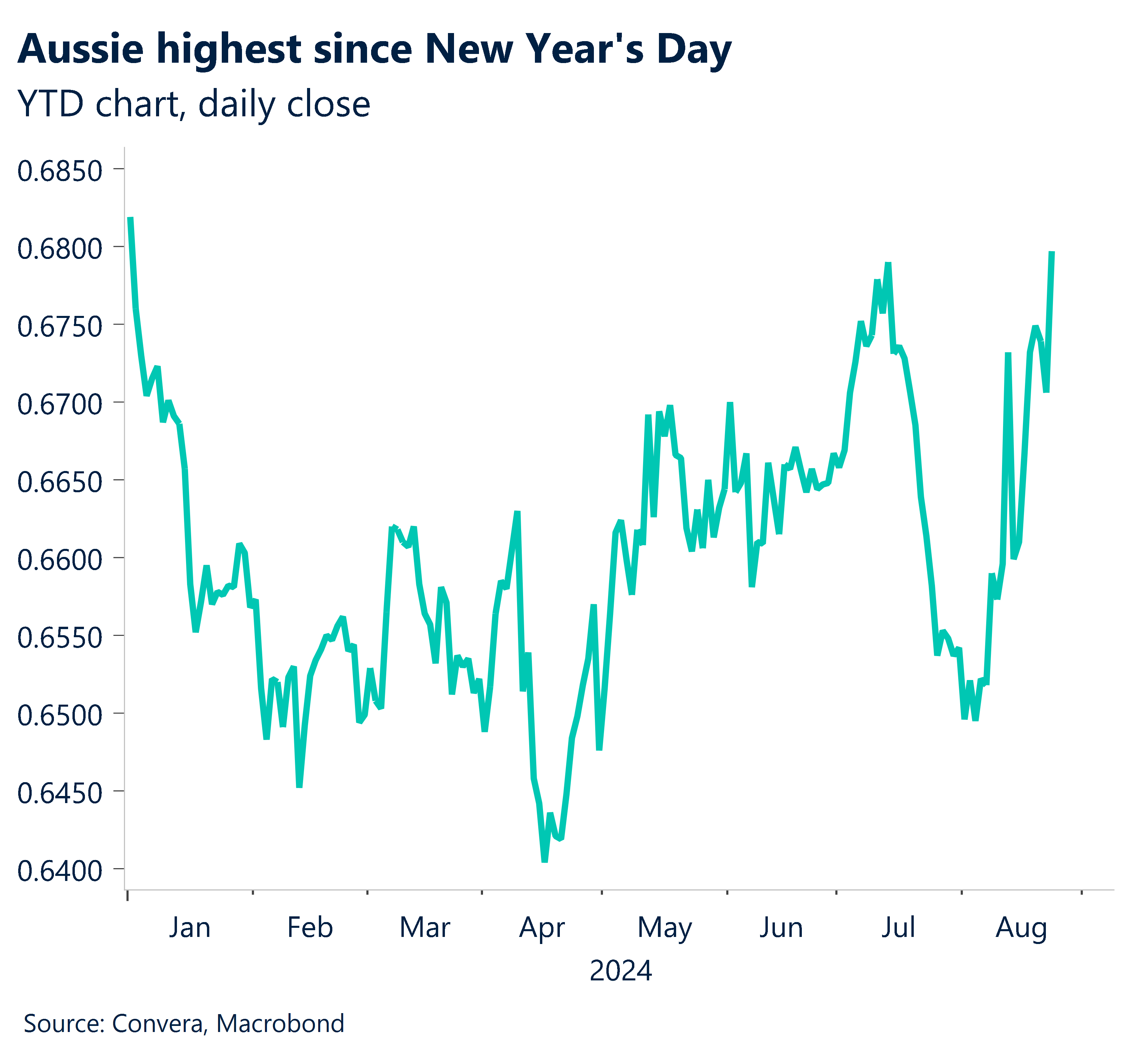

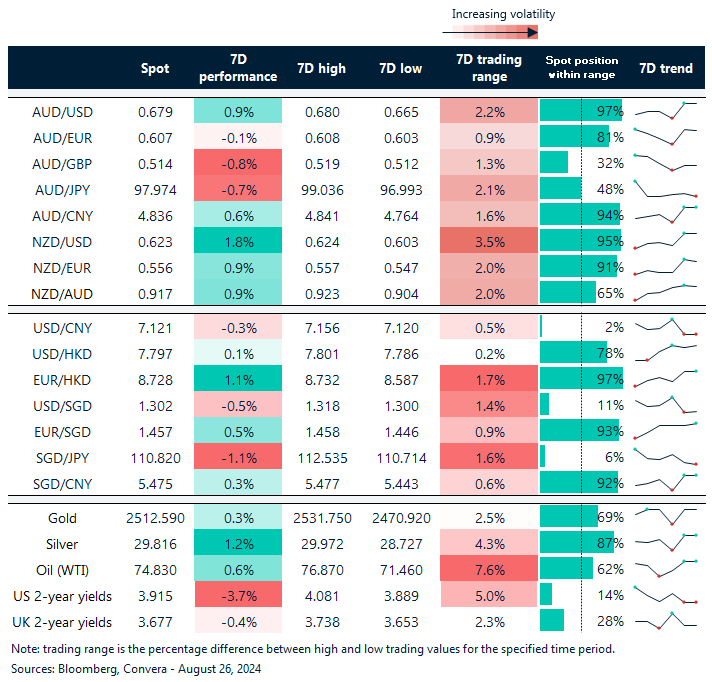

The Australian and New Zealand dollars surged to the highest levels since January as Federal Reserve chair Jerome Powell used his highly-anticipated Jackson Hole speech to signal a likely rate cut in September.

Powell said: “The time has come for policy to adjust….the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

The USD index tumbled after the speech with the greenback falling to the lowest level in over a year.

The AUD/USD jumped 1.4% as it closed at the highest level since 1 January.

The NZD/USD gained 1.6% to close at the highest level since 15 January.

USD/SGD lowest since 2014

The greenback plunged across Asia, with the USD/JPY back below 145.00, the USD/CNH closing at the lowest level since June 2023 and the USD/SGD free-falling to levels last seen in 2014.

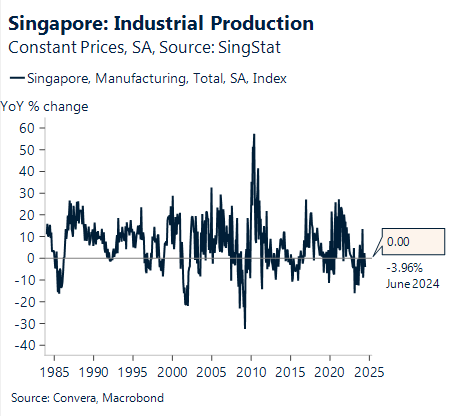

Looking to upcoming Singapore data, in keeping with a robust export performance in the same month, we anticipate that industrial production (IP) growth would pick up to 2.2% y-o-y in July from -3.9% in June, led by growing electronics and pharmaceuticals output.

This suggests that IP growth increased significantly sequentially from -3.8% to 10.0% m-o-m sa.

The central bank expressed strong confidence in H2 growth and the closing of the negative output gap by year-end at the most recent MAS meeting.

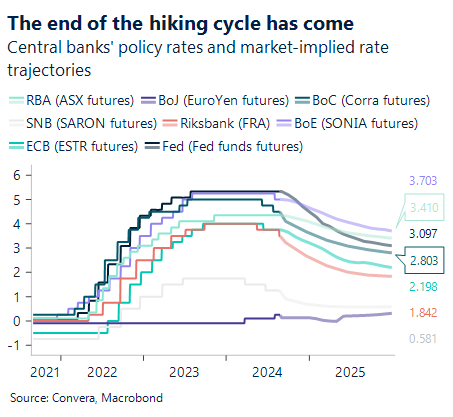

Given that we anticipate MAS to shift to easing in October, the SGD’s recent strong run could be vulnerable to an eventual reversal, causing a potential USD/SGD rebound.

All eyes on US data

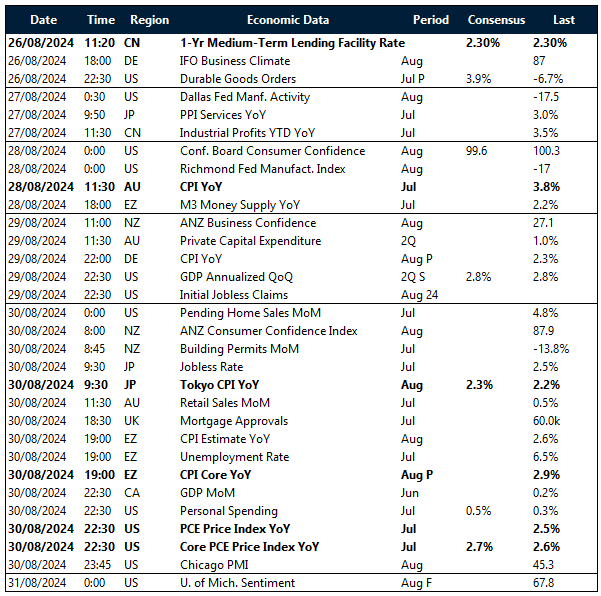

FX markets will be driven by key economic data releases this week, with notable events from the United States, Germany, Japan, and Europe.

Last week, Powell seemed to give a green light for September easing. The United States will release several important economic indicators, including durable goods orders, consumer confidence, and GDP data. Most importantly, personal consumption and expenditure, the Fed’s preferred measure of inflation, is due on Friday. These releases could provide insights into the health of the US economy and potentially impact the US dollar.

In Europe, Germany will publish its final GDP figures for Q2 and the closely watched IFO business survey. The European Central Bank will also release M3 money supply data, which could influence EUR trading.

Japan has several significant releases, including industrial production and Tokyo CPI data, which may affect JPY movements.

Australian monthly CPI, due Wednesday, will be the big event for AUD watchers.

USD tumbles after Jackson Hole

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 26 – 31 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]