(Bloomberg) — The proximity of Federal Reserve interest-rate cuts is tormenting the US dollar this month, sending the world’s reserve currency slumping and igniting rallies in major peers across the globe.

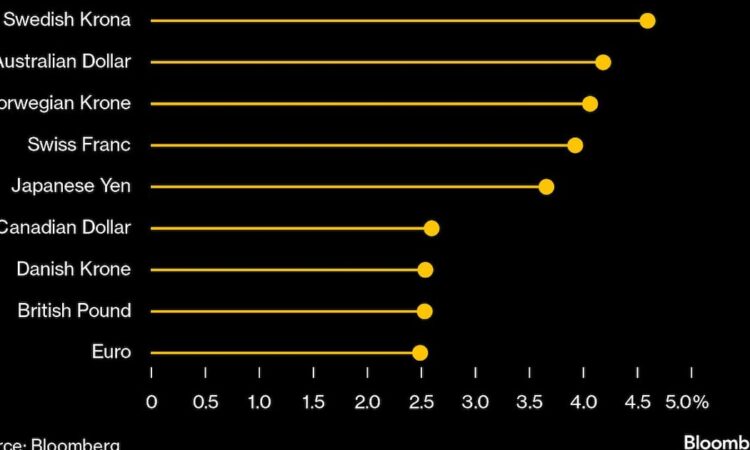

The Bloomberg Dollar Spot Index has slumped almost 2% in August so far, heading for its worst monthly loss this year. That’s fueled rallies in nearly all major exchange rates tracked by Bloomberg — including gains of at least about 4% in the higher-risk New Zealand dollar and Swedish krona, along with the safe-haven Swiss franc.

Such large moves came in a volatile month for the $7.5-trillion-a-day currency market as traders saw evidence in support of lower US borrowing costs. The greenback lost value after market turmoil and an exodus from the so-called carry trade in early August, then dropped further when Fed Chair Jerome Powell said it was time to start cutting rates.

“The dollar has really been trading on Fed easing expectations,” said Skylar Montgomery Koning, a foreign-exchange strategist at Barclays in New York. “That has pretty much been the singular driver.”

While the greenback gauge ticked higher on Thursday after data showed the US economy grew at a slightly stronger pace in the second quarter than initially reported, it has fallen in every week so far this month.

Confidence that policymakers will soon start easing has emboldened traders to make riskier investments, said Valentin Marinov, head of G-10 FX strategy at Credit Agricole SA in London. That’s fueled demand for high-yielding currencies such as the New Zealand dollar.

“The build-up of Fed rate cut expectations helped ease the US and global financial conditions and thus propped up risk sentiment,” he said.

What Bloomberg strategists say…

“So the dollar may attempt to recoup some of its recent losses considering how much it has sold off, but a resounding comeback looks remote if market pricing on the Fed is largely right.”

— Ven Ram, cross-asset strategist. Read more on MLIV.

A rebound in global equities, lower US yields and cheap levels have spurred rallies in the kiwi, krona and Canadian dollar despite the prospect of domestic easing that would typically apply downward pressure.

New Zealand’s central bank began its easing cycle earlier than previously signaled, as policymakers reckon their economy has fallen into its third recession in less than two years, while the Bank of Canada is just days away from what’s expected to be a third-consecutive rate cut. At the same time, Sweden’s Riksbank cut rates by just 25 basis points last week, having discussed a potential half-point reduction.

Now, attention narrows further on the path for US interest rates. Traders are pricing in at least a quarter-point cut in September, and a total of about 1 percentage point worth of easing by the end of 2024.

Market expectations are too aggressive given the US economy is still faring relatively well compared to the rest of the world, according to Nathan Thooft, a senior portfolio manager at Manulife Investment Management in Boston. He expects the dollar’s losses to be limited going forward.

“We don’t have a high level of confidence to make big currency bets,” he said. “I can see the rationale behind why people are buying into something like the Swiss franc, as an example, but we’re not actively playing those trades.”

©2024 Bloomberg L.P.