A new research paper out of Russia proposes the future of the international monetary and financial system. The country is the current chair of BRICS which is meeting next week. One of its proposals is a CBDC and DLT system to support local currency payments. While the paper makes some interesting points, the mixture of fact and propaganda undermines the document’s gravitas. The document was authored by the Ministry of Finance, the Bank of Russia and Yakov and Partners.

In January BRICS expanded its membership from the original five members — Brazil, Russia, India, China, and South Africa — with the addition of Iran, Saudi Arabia, the UAE, Ethiopia, and Egypt.

In terms of cross border payments, the Russian proposal is to develop a cross border payment infrastructure that is at least as cost efficient and fast as current systems. More importantly, it wants a “System based on mutual dependency, rather than centralized decision-making by a single entity.” It added that it must ring-fence participants from sanctions.

A DLT cross border payment system

One of four proposals for cross border payments is a potential DLT solution, as it believes a traditional clearing model will be expensive and slow. It proposes “a new multinational platform based on modern technologies, which would include a financial messaging component and allow to conduct settlement via tokens backed by national currencies, CBDCs, at the discretion of each participating country – this approach would allow a greater degree of decentralization.”

It outlines the advantage of DLT as eliminating credit risk if CBDCs are used. Speed will improve by removing intermediaries and only performing compliance checks once, rather than several times along the payment chain. Plus, automation removes the need for reconciliation.

It claims savings could be $15 billion, even though JP Morgan previously stated a multi-CBDC cross border payment platform could save as much as $100 billion, although the latter figure includes advanced economies.

Delving into the DLT design, initially the paper asserted the platform could use public blockchain, private or federated. However, it eventually dismisses retail CBDC as a path, opting for a wholesale platform. It envisages separate national systems that are interoperable with a single integrated multi-currency infrastructure using a shared set of rules.

The paper focused on the DLT option because of “its novelty, associated risks, and, potentially, game-changing economics.”

However, it also outlined three other strategies:

- a network of global commercial banks that can conduct cross-border transactions in local currencies

- direct links between individual countries’ central banks

- centers for trading in commodities: grain oil, natural gas and gold.

It emphasized a move away from U.S.-dollar settlement towards local currencies.

The previously used term, the ‘BRICS Bridge’, was not mentioned. Nor was there any reference to the similar mBridge project which has reached minimum viable product stage, involving three BRICS members. However, the paper managed to discuss Project Dunbar, which finished in 2021.

Facts versus wishful thinking

As Russia pushes back against the dollar’s dominance, the paper makes some assertions that warrant scrutiny. For example, it argues that with modern technology and high frequency trading, there is no longer information asymmetry. Hence, it makes the leap that there is no need for reserve currencies.

“Utilizing centralized settlement mechanisms and reserve currencies for the purpose of conducting cross-border payments is also a legacy ‘overhang’ that is no longer optimal in the 21st century,” the authors state, continuing that the “universal search for a ‘world currency’ (in our era, represented by the reserve currencies) was a direct consequence of global information asymmetry.”

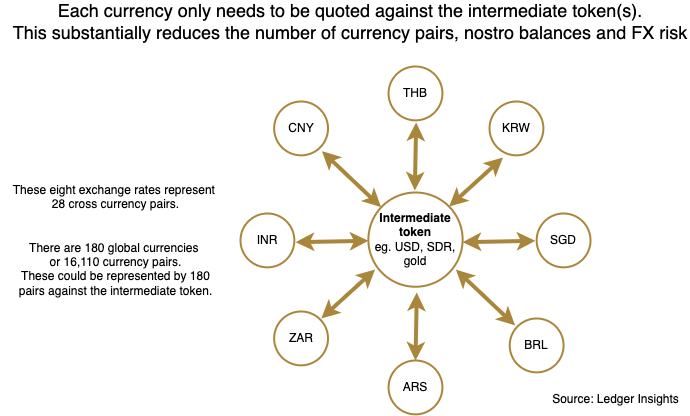

Greater transparency certainly makes markets more efficient. But so does liquidity. There are 180 currencies in the world. To make markets for each and every currency against every other currency gives 16,110 currency pairs. If you have one reserve currency, and each currency is quoted against that reserve, then there are just 180 currency pairs providing deep, liquid markets versus 16,110 mainly thinly traded pairs. The smaller the economy, the more important it is to focus on one or two currency pairs for better rates.

That intermediary currency could be the IMF’s special drawing rights (SDR) or something else. But an intermediary currency is desirable. Below is a graphic from our tokenized deposit report illustrating this point. The Russian paper also complains that the SDR overly represents advanced economies.

Swift gets the blame

Payment messaging system Swift is one tool that’s been used against Russia for invading Ukraine. Other countries fear similar treatment in the future, hence they are open to discussing alternative payment systems. However, the authors appear to blame Swift for things it has no control over.

In terms of delays in payments, the paper rightly pointed out a key issue is that banks have different operating hours resulting in delays.

Despite this caveat, the paper states, “Even though in 2023 SWIFT claimed that 89% of cross- border payments are completed within an hour, the BRICS cross-border payment survey showed that key pain points of the current system for the constituents are time delays, high costs (Brazilian respondents cited FX spreads of 2.5% on cross-border payments, in Africa this figure is 8.5% and may even reach 20%), and a lack of pricing transparency.”

This paragraph conflates two separate points: Swift’s payment completion data and the BRICS survey. Swift is purely a messaging system. It neither sets nor influences FX rates. So while there are certainly issues with massive FX spreads that trickle down to consumers, they are not caused by Swift. Like all markets, wide FX spreads are often a reflection of risks and currency volatility.

Meanwhile, there’s been some debate in the Western press about BRICS being some kind of alternative to NATO, despite the focus being on trade. This has likely arisen because NATO-member Turkey is applying to join BRICS. The Russian Foreign Ministry responded, “BRICS has never been, is not and is not going to become a military alliance. Moreover, BRICS is not even an international organization or an integration structure, but an interstate association of equal participants.”