- US economic growth continues to impress relative to Europe and Japan

- Stronger US economic data sees markets pare Fed rate cut bets

- Higher US interest rates fuel US dollar strength

- Quiet calendar next week may see these trends continue

- EUR/USD now very oversold, adding to near-term squeeze risk

- USD/JPY enters major resistance zone

US economic exceptionalism continues to drive US bond yields higher, helping to fuel strength against the and . With very little information out next week to question US economic resilience, traders should be alert to the risk of Federal Reserve officials attempting to shift market expectations on the outlook for US interest rates.

US Economic Exceptionalism on Display (Again)

The US economy continues to impress, rolling along at levels well above everywhere else in the developed world. According to the Atlanta Federal Reserve GDPNow forecast model that attempts to predict US economic growth based on economic indicators, the US is on track to grow 3.4% annualized in the September quarter, accelerating from the 3% pace in the three months to June.

That’s well above levels that would typically keep unemployment and inflation stable, pointing to downside risks to the former and upside risks for the latter if the forecast model is accurate.

Source: Atlanta Fed

Outside US, Growth in Developed Nations Is Hard to Find

As US economic growth impresses, activity in other parts of the developed world is struggling. You can that in Citi’s economic surprise index with US economic data shown in the top pane with Eurozone and Japanese data in the middle and bottom panes respectively.

A reading above 0 indicates more data than not is topping economist forecasts with a score below meaning the opposite. It’s like chalk and cheese between the three with US data beats becoming more prevalent while data misses continue in Europe and Japan.

Source: Refinitiv

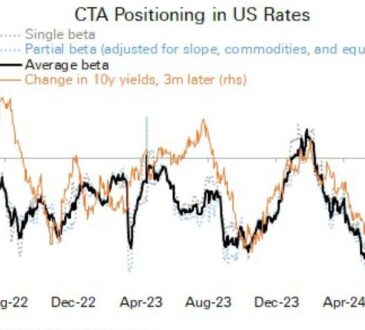

Fed Rate Cut Bets Pared, Pushing US Yields Higher

US economic exceptionalism is flowing through to expectations on how far and fast the Federal Reserve will cut interest rates. Traders have slashed expectations on the number of cuts by the end of 2025 from nine to less than six over the past month.

That in turn is flowing through to longer-term interest rates with yields on pushing noticeably higher over the same period.

Source: TradingView

With sluggish economic activity in Europe and Japan, the uplift in US interest rates has seen relative yield differentials widen in favor of the US in recent weeks, especially for longer-term bonds.

With US rates offering higher returns than other parts of the developed world, that’s helped push capital towards US dollar-denominated asserts, including against the euro and Japanese yen.

Source: TradingView

Higher US Yields Feeding Dollar Strength

You can see the influence higher US rates is having on moves in the , EUR/USD and USD/JPY given the strength of the relationship with short and longer-dated bond yields over the past month.

Source: TradingView

With no major economic data released in the US, Euro area or Japan next week, there’s very little information that can alter these trends outside of speeches from central bank officials.

Given the improving growth picture in the US, the risk is FOMC officials may attempt to shift market expectations towards no rate cut in November, an outcome that would help to boost US yields and dollar further.

EUR/USD Very Oversold Near-Term

Source: TradingView

EUR/USD has been a major casualty of US dollar strength in October, sinking from above 1.1200 to below 1.0850 after a breaking out of the rising wedge it had been sitting in for much of September. Since, it’s taken out the 50 and 200-day moving averages along with numerous horizontal and downtrend supports. It simply looks sick.

However, with RSI (14) sitting at 27.25, EUR/USD looks increasingly oversold near-term. Nothing goes in straight lines forever, and while my medium-term bias is to sell rallies, I could be persuaded to take a cheeky long if given the price signal or chart pattern to do so. If we were to receive an obvious bottoming pattern, the risk of a squeeze appears elevated. We haven’t yet, but I’m on alert for one.

On the downside, support is found at 1.0800 and again at long-running uptrend support around 1.0755. Above, resistance is likely to be encountered at the 200-day moving average, with downtrend resistance around 1.0895 and at 1.0955.

USD/JPY Punctures Major Resistance Zone

Source: TradingView

The relentless march higher in US bond yields has seen USD/JPY push into a strong resistance zone between 149.75 and 151.95. With horizontal resistance at 150.90 and 200-day moving average in between, it may be a tough slog to push meaningfully higher next week.

Still, with momentum indicators such as MACD and RSI (14) generating bullish signals, the inclination is to buy dips unless provided a clear reversal signal or pattern.

Support may be found at 149.75, below 149 and again at 147.20. If the top of the resistance zone at 151.95 were to be broken cleanly, it could lead to a quick push towards 155.375 with very little visible resistance located in between.

Unless we see USD/JPY upside not accompanied by higher US bond yields, the inclination would be to fade any warnings from Japanese government officials about the threat of intervention to support the yen.