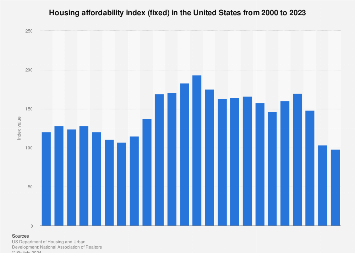

The Housing Affordability Index value in the United States plummeted in 2022, surpassing the historical record of 107.1 index points in 2006. In 2023, the housing affordability index measured 98.1 index points, making it the worst year for homebuyers since the start of the observation period.

What does the Housing Affordability Index mean?

The Housing Affordability Index uses data provided by the National Association of Realtors (NAR). It measures whether a family earning the national median income can afford the monthly mortgage payments on a median-priced existing single-family home. An index value of 100 means that a family has exactly enough income to qualify for a mortgage on a home. The higher the index value, the more affordable a house is to a family.

Key factors that drive the real estate market

Income, house prices, and mortgage rates are some of the most important factors influencing homebuyer sentiment. When incomes increase, consumer power also increases. The median household income in the United States declined in 2022, affecting affordability. Additionally, mortgage interest rates have soared, adding to the financial burden of homebuyers. The sales price of existing single-family homes in the U.S. has increased year-on-year since 2011 and reached 389,000 U.S. dollars in 2023.