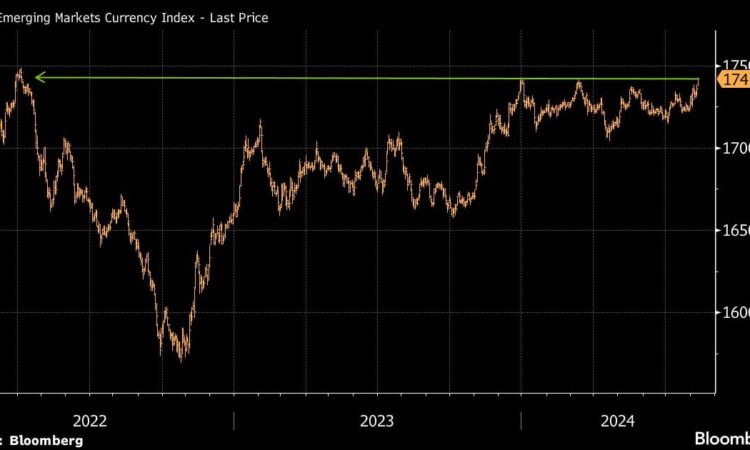

(Bloomberg) — A gauge of emerging-market currencies is gaining the most in 10 days, as the US dollar falls amid a boost in euro zone economies, with France, Spain and Germany growing faster than expected.

The MSCI EM Currency Index was up 0.2% at 9:50 a.m. London time, with the South Korean won the top performer. South Africa’s rand followed, strengthening as much as 0.7% against the dollar ahead of the government’s medium-term budget presentation due later Wednesday.

“The hard part – the structural reforms – is yet to come. And today the currency market will be watching closely for signs of such reforms and structural improvements” in South Africa, Commerzbank FX analyst Antje Praefcke wrote in a report.

Malaysia’s ringgit was on track for its worst month in more than nine years, down 6% against the dollar in October.

All in all, this is only the fourth gain for the emerging-market currency index in October. The index is heading to a decline this month after three consecutive months of gains.

In Asia, asset managers such as Allianz Global Investors, Franklin Templeton and Gama Asset Management say they’re bullish on government debt in Asia ex-China. Expectations of interest-rate cuts have buoyed demand, and they say those bonds will be safe havens in the event of market jitters around the US election.

The MSCI index for emerging-market equities fell 0.7%, heading to a decline of more than 3% in October, with Taiwan Semiconductor Manufacturing Co Ltd. and Tencent Holdings Ltd. the biggest laggards on Wednesday.

The Czech economy expanded less than expected in the third quarter as household consumption continued to recover but exports remained weak. Hungary’s economy unexpectedly entered a recession in the third quarter as domestic consumption failed to make up for a deep downturn in industrial production. Mexico posts GDP data later.

©2024 Bloomberg L.P.