- Markets got a wake-up call as China-based DeepSeek’s AI chatbot took center stage.

- Investors fear stocks like Nvidia won’t be able to justify their expensive valuations.

- Here’s why some strategists think this news will be a net positive for US markets.

Investors just got a jarring reminder that artificial intelligence is still the backbone of this market, for better or worse.

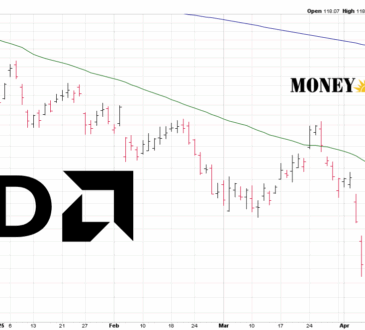

The technology-focused Nasdaq Composite is up more than 80% in the last two years, largely thanks to optimism about AI and the productivity gains it promises. Companies have invested hundreds of billions of dollars into the semiconductors that power AI to keep pace with their peers, and in response, investors poured money into stocks like Nvidia and AMD.

But there’s now concern that the AI rat race has been more like a wild goose chase.

Technology stocks got shelled on Monday as markets realized that China-based AI startup DeepSeek has a chatbot that appears to rival OpenAI’s ChatGPT, even though it was reportedly developed in two months and for only $6 million. Nvidia shed a record $589 billion in market value, and the Nasdaq had one of its worst days in recent memory.

For a market that was already expensive, the DeepSeek scare was enough to spark a sell-off.

“Traders know that the market and AI stocks are generally at pretty frothy valuations,” Dave Sekera, the chief US market strategist at Morningstar, said in written commentary on Monday. “I think what we’re seeing: People are selling first and will ask questions later.”

Why AI stocks may be in trouble

Questions about the sustainability of the AI-driven rally have become the main conversation in markets. US stocks calmed down on Tuesday; the Nasdaq rebounded 2% while the S&P 500 bounced back by 0.9% after a milder 1.5% loss.

Bears are worried that companies’ mammoth investments in AI went overboard. If they’re right, tech giants have overpaid drastically for AI chips, and demand for Nvidia’s chips could crater.

“DeepSeek has shown that innovation doesn’t need a trillion-dollar price tag,” Lukman Otunuga, a senior market analyst at online broker FXTM, said in written commentary. “If US tech leaders fail to convince investors of their edge, AI stocks could face further pressure this week.”

David Bahnsen, the chief investment officer at The Bahnsen Group, has been wary of large growth stocks for years. He has warned that the market is overly dependent on richly valued Magnificent Seven stocks, though the Nasdaq has charged higher anyway.

This DeepSeek disruption could be the needle that pops the tech bubble, in Bahnsen’s view.

“The idea that this level of spending on AI may not be necessary or prudent to begin with — well, that could prove to be a fundamental game-changer on top,” Bahnsen said in commentary.

Ironically, Bahnsen believes the US’s attempt to cut China off from cutting-edge AI chips motivated them to create their own workaround. Instead of having China as a top customer, he thinks they will be a leading competitor in the AI space by being cheaper and more efficient.

If Chinese companies like DeepSeek are as formidable as they appear to be, Bahnsen thinks US-based AI companies will receive a big valuation markdown. Markets aren’t properly pricing in competition, in his view, and Big Tech earnings may not be able to support the lofty premium.

“The valuations of many of these AI and tech companies offer no margin of error,” Bahnsen said. “Excessive valuation always becomes a problem, eventually, but fundamental news becomes a heightened problem when it is combined with excessive valuation.”

Emily Bowersock Hill, the founding partner and CEO at Bowersock Capital Partners, called this AI correction “long overdue” in recent commentary. She believes US stocks “have been deep into the greed phase of the fear/greed cycle” for months, so a sudden reset is healthy.

“While we still believe in the AI-driven productivity story, investing in this sector going forward may not be as easy as it was over the past two years,” Bowersock Hill said. “We expect investors to be more discerning and selective when it comes to AI investing.”

Tech analysts are giving stocks like Nvidia a closer look, but few have changed their tunes so far.

Nvidia’s stock-price reset brings it closer to Morningstar’s fair-value estimate, which tries to account for AI’s game-changing upside and the risk of internet-bubble-level downside.

While DeepSeek could pose a serious threat to Nvidia, cloud companies likely won’t cut back on AI spending anytime soon. In fact, Microsoft CEO Satya Nadella suspects that AI spending will take off as the technology becomes more efficient.

“We believe AI GPU demand still exceeds supply, so while slimmer models may enable greater development for the same number of chips, we still think tech firms will continue to buy all the GPUs they can as part of this AI ‘gold rush,'” Morningstar strategist Brian Colello remarked.

Investors should be thankful for cheaper, better AI

Although the market is heavily reliant on large AI stocks that could be upended by more efficient Chinese competitors like DeepSeek, even cautious strategists don’t see a full-blown meltdown.

“While 2025 will likely be more volatile than 2023 and 2024, with projected returns in the single digits, it would take a significant shock to derail the current bull market,” Bowersock Hill said. She added: “We see some indications of bubble formation, however, we are not there yet.”

In fact, while the DeepSeek news initially caused panic-selling, some market strategists believe it could be a major market catalyst long term, if AI gets significantly cheaper and more efficient.

“A lower-cost model could help speed AI adoption, which in turn increases the potential demand for services in the intelligence and applications layer (those using AI), as well as potentially enhancing productivity gains for the wider economy,” Solita Marcelli, the chief investment officer Americas for UBS Global Wealth Management, recently remarked.

Demand for AI could explode if the technology becomes cheaper and consumes less energy, UBS said. That would be a major win for most companies, and it could even be a net positive for Nvidia if the chipmaker makes up for lower semiconductor prices with even stronger sales. It’s harder to see a silver lining for electric utility firms, whose shares have been crushed this week.

If the next generation of AI lives up to the hype, UBS believes productivity, economic growth, corporate earnings, and stock prices can all rise. The firm sees the S&P 500 climbing another 9% to 6,600 in its base case and thinks it can reach 7,000 by year’s end, if all goes right.

Others agree that AI isn’t going away, as Truist strategists recently noted that computing power and demand has never gone down. However, while the bank’s top minds still like tech stocks, they believe those who are heavily invested in them may want to diversify their portfolios.

“We are mostly seeing money rotating within the market as opposed to large outflows today,” Keith Lerner, the chief market strategist at Truist, wrote in a January 27 note. “If there is a silver lining, the rotation underway could lead to somewhat more of a balanced near-term market.”