ASIAN equities bounced on Tuesday, while the Mexican peso and Canadian dollar rallied after Donald Trump said he would delay the imposition of stiff tariffs on imports from the US neighbours, soothing trade war worries for now.

The US president’s comments that he would hold last-minute talks with Chinese counterpart Xi Jinping to pause levies on goods from the world’s number-two economy provided extra optimism.

Markets from Japan to New York were sent tumbling on Monday after news at the weekend that Trump had signed off 25 per cent duties against Mexico and Canada, fanning concerns for the stuttering global economy.

However, hours before the tariffs were due to take effect, Trump said he had struck deals with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum on immigration and fentanyl, and would postpone the measures for a month.

Talks on final deals would continue with both countries, he added.

The Republican added that he would hold talks with Beijing “probably in the next 24 hours” to avoid new 10 per cent tariffs on Chinese imports.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The three countries are the United States’ three biggest trading partners and had warned they would retaliate.

News of the deals saw the Mexican peso surge more than three per cent – having tumbled to a three-year low on Monday – while the Canadian dollar rallied more than one per cent.

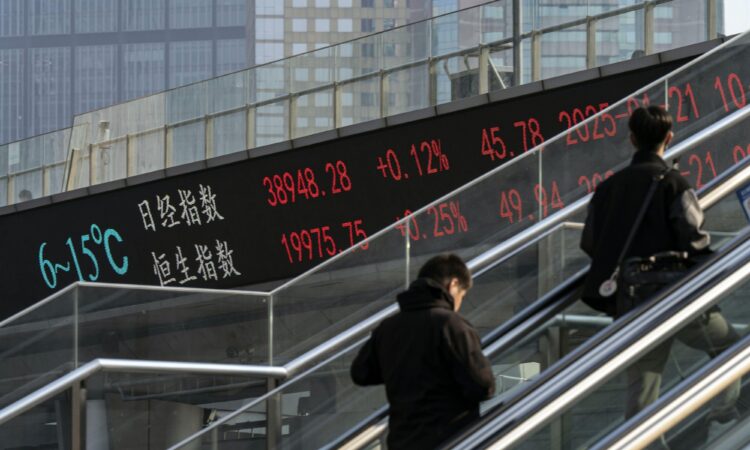

Asian stock markets also advanced, with Hong Kong up more than three per cent, while Tokyo, Seoul and Manila were all more than one per cent higher. Sydney, Singapore, Wellington and Taipei were also in the green.

However, the euro remained under pressure after Trump warned the European Union would be next in the firing line, while he did not rule out tariffs against Britain.

The “pushing back of tariffs on Mexico serves as a reminder of the cycle we have entered: tariff announcements are followed by calls and negotiations, declarations of victory, and then the cycle begins anew”, said IG market analyst Tony Sycamore.

“Ultimately the path leads to higher tariffs, slower growth, higher inflation and less certainty for risk takers and equities.”

The volatile start to February on markets follows their rollercoaster ride last week after China’s DeepSeek unveiled a cheaper artificial intelligence model rivalling those of US tech giants, sparking quesions over the vast sums invested in the sector in recent years.

“One thing we can say for sure. Markets are going to remain subject to massive headline risk in coming hours… days… and years,” Ray Attrill at National Australia Bank warned.

Gold spot prices held gains after spiking to a new record high of US$2,830.74 on Monday, having retreated from last week’s all-time peak owing to the stronger dollar and as traders sought out the metal as a safe haven from uncertainty. AFP