Nvidia (NASDAQ:NVDA) has turned beat-and-raise earnings into a routine, but will the streak continue when the AI chip giant reports its fiscal fourth-quarter (January quarter) results on Wednesday (Feb 26)? More importantly, if it does, will that be enough to shake the stock out of its recent lull and put it back in rally mode?

Discover the Best Stocks and Maximize Your Portfolio:

Given how things have unfolded over the past few months, Stifel’s top analyst Ruben Roy notes that sentiment appears different this time around.

“In contrast to prior quarters, the estimate revision trajectory suggests lower expectations heading into F4Q,” said Roy, who ranks in the top 3% of Wall Street stock experts. “We think this is also evident in valuation with NVDA shares 26x 2026 EPS versus a 33x 3-year average.”

Compared to feedback received in previous quarters, Roy’s recent checks have been “decidedly mixed.” While discussions around Blackwell’s demand remain largely positive, uncertainties about the company’s timeline for meeting demand have led to a “wide range of outcomes.”

While expectations might have shifted toward a more robust Blackwell ramp in the second half of the year, it is still uncertain whether this will translate into a substantial B200/GB200 ramp or a faster shift to the B300/GB300 cycle. “Longer-term,” the 5-star analyst went on to explain, “we do not think this will matter but, for now, given continued post DeepSeek market jitters, we are unlikely, in our view, to see a strong positive catalyst to shares out of earnings.”

Not exactly what investors would like to hear, then. As for the raw numbers, Roy’s F4Q25 revenue forecast of $37.5 billion is about the same as the midpoint of the guide and is slightly lower than the consensus estimate of $38.1 billion. Roy is calling for adj. EPS of $0.83 and adj. gross margin of 73.5%, not far off the consensus estimates of $0.85 and 73.4%, respectively.

While Roy does not think a blowout quarter is in the offing, that does not mean he takes a bearish stance in anyway when considering Nvidia’s prospects.

“Despite the likelihood of less meaningful post earnings positive estimate revisions relative to recent quarters, we believe that the underlying trends in AI infrastructure spend continue to bode well for NVDA,” the analyst said.

With Nvidia trading at roughly 27x Roy’s FY2027 (CY2026) EPS estimate of $5.12 – below its five-year average multiple of 33x and far from its 64x peak in late 2021 – the analyst sees the stock as “reasonably valued.”

Meanwhile, with GTC just weeks away (March 17th to 21st), it could serve as a potential catalyst for the stock, as Nvidia is expected to share updates on its technology roadmap, provide deeper insights into emerging AI use cases, and discuss customer adoption trends.

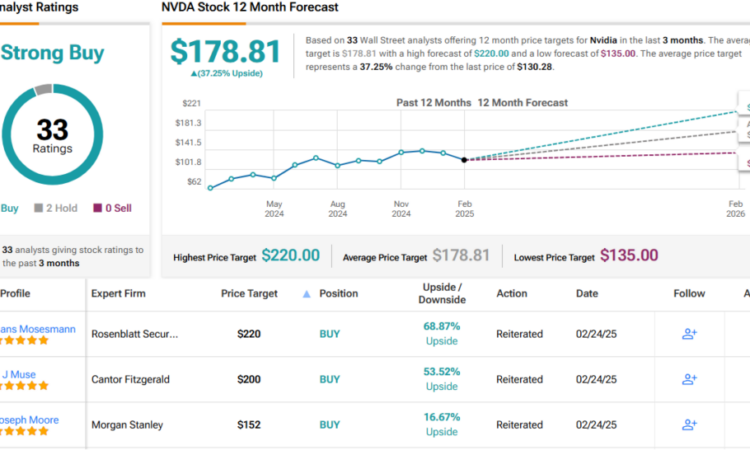

To this end, Roy rates NVDA shares as a Buy, along with a $180 price target, suggesting the stock will gain 38% in the months ahead. (To watch Roy’s track record, click here)

Most of Roy’s colleagues are thinking along the same lines. Based on a mix of 31 Buys vs. just 2 Holds, the analyst consensus rates NVDA a Strong Buy. At $178.81, the average target implies shares will climb 37% higher over the next year. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link