Japan is emerging as a powerful contender in the global semiconductor supply chain industry, where change is accelerating faster than ever. It attracts local and foreign companies by offering subsidies of up to 50% of semiconductor manufacturing company investment costs. If Japan, which has declared plans to revive its semiconductor industry, continues this pace, Korea might be overtaken by Japan in the next 10 years.

According to a comprehensive analysis of major domestic semiconductor companies and experts on Monday, Micron’s Hiroshima D-RAM plant in Japan received 39% of the investment funds from the Japanese government, boosting cost competitiveness by 5-7%, securing an additional 5-7 won profit for selling an item costing 100 won. In the intensive competition to secure high-tech semiconductor facilities where trillions of won are invested per production line, companies that receive such investment will gain additional competitiveness in addition to technology competitiveness and mass production know-how. Micron, the third largest player in the D-RAM market, may leverage its production base in Japan to threaten Samsung Electronics and SK hynix’s position.

Global No. 1 foundry player TSMC financed 41% of its investment in Kumamoto Plant 1 with subsidies from Japan, boosting cost competitiveness by 10%. Japan plans to increase the subsidy rate to 50% to concretize TSMC’s plan to build two additional foundry plants in Japan. “Added cost competitiveness can become a game changer, just as you can knock down your competitor in boxing with repeated jabs,” said Professor Kim Jeong-ho of the Department of Electrical and Electronic Engineering at KAIST.

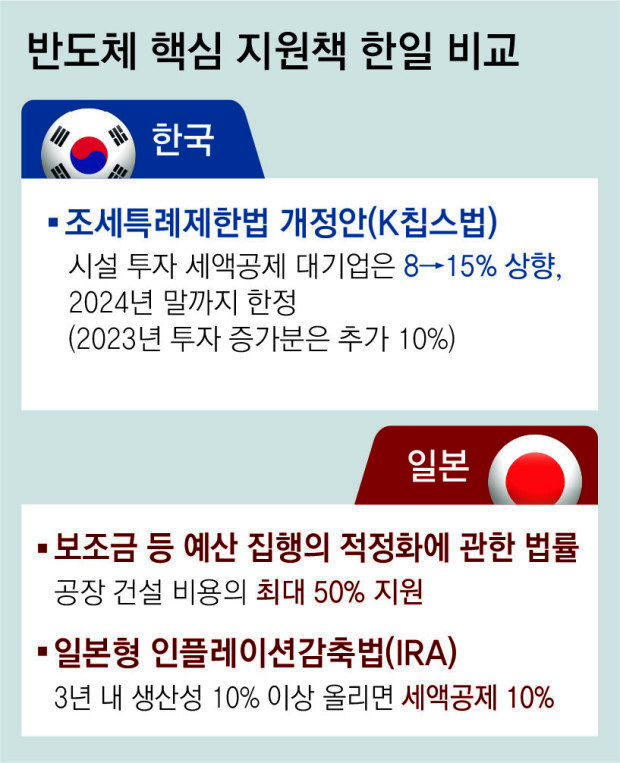

The Japanese government has designated semiconductors as ‘materials of specific importance,’ paving the way for cash payments worth trillions of won per case. Accordingly, various forms of support other than cash are being poured into Japanese companies such as Rapidus and Kioxia. These policies reflect Japan’s ‘two-track strategy’ of attracting overseas companies and fostering the growth of domestic companies.

In contrast, there is no cash support policy for semiconductor facility investments in Korea. Following the passing of the amendment to the Restriction of Special Taxation Act (K Chips Act) at the National Assembly in March, the tax credit rate for facility investment for Korean multinational companies increased from 8% to 15%, but it will be reset in December next year as it is a sunset law. A simple comparison of Japan’s tax subsidies and Korea’s tax credit policy shows that there is no reason for Micron or TSMC to invest in Korea. Korea’s taxes, including the corporate tax rate and minimum tax, are particularly high, making it less attractive for investment than other countries.

will@donga.com