Indian markets, rupee have recovered for now. The future trajectory depends on a mix of factors

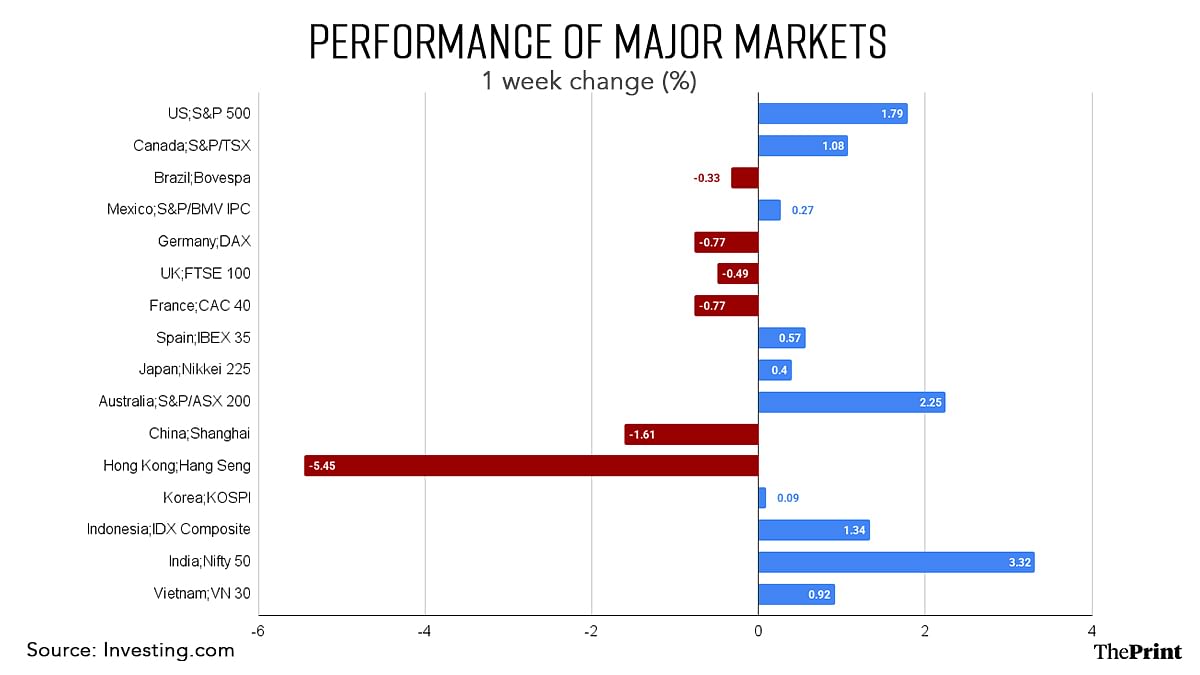

Indian stock markets have staged an impressive recovery in March, rebounding from a protracted period of negative returns that began in October. India has been one of the best performing markets in the last few weeks.

The recovery in stock markets is driven by a change in stance of foreign portfolio investors. In the last two weeks of March, FPIs have been net buyers due to aggressive buying of Indian debt. The spate of selling in the equity market has slowed down considerably, compared to the previous months.

Supported by a surge in inflows, the rupee has strengthened and managed to reverse its year-to-date losses.

The Federal Reserve’s projection of two rate cuts this year and weakening of the dollar, owing to slowdown concerns in the US, buoyed Indian markets. Design of reciprocal tariffs, corporate earnings in the January-March quarter and the performance of the Chinese markets will determine the future course of the Indian market and currency.

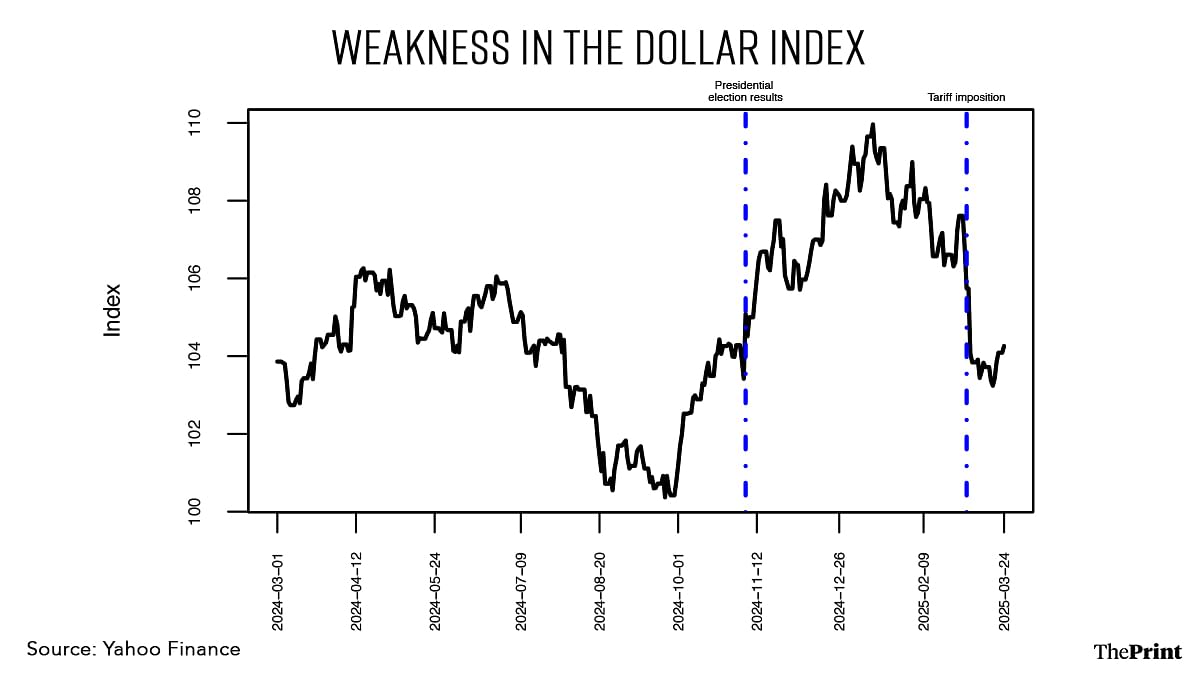

Fed projections & dollar weakness

The Federal Open Market Committee (FOMC) kept the policy interest rate unchanged at its March meeting, but continued to signal the possibility of two rate cuts this year. Rate cuts by the US makes emerging markets, including India, more attractive to foreign investors by easing the dollar and treasury yields.

The macro projections by the US Fed also signal stagflationary concerns for the US economy. The growth estimates for 2025 were cut from 2.1 percent to 1.8 percent, unemployment estimate upped by 10 basis points to 4.4 percent, while core Personal Consumption Expenditure inflation estimate was raised 30 basis points to 2.8 percent.

Even before the FOMC decision, the dollar had been displaying signs of weakness on concerns emerging from the possible impact of trade tariffs on growth-inflation dynamics.

From its recent peak on 13 January, 2025 at 109.96, the dollar has weakened to 104.26 on 24 March, 2025—an almost 5.5 percent drop. The 10-year US bond yield has also inched lower from 4.6 percent at the time of Trump’s inauguration to 4.34 percent as on 24 March.

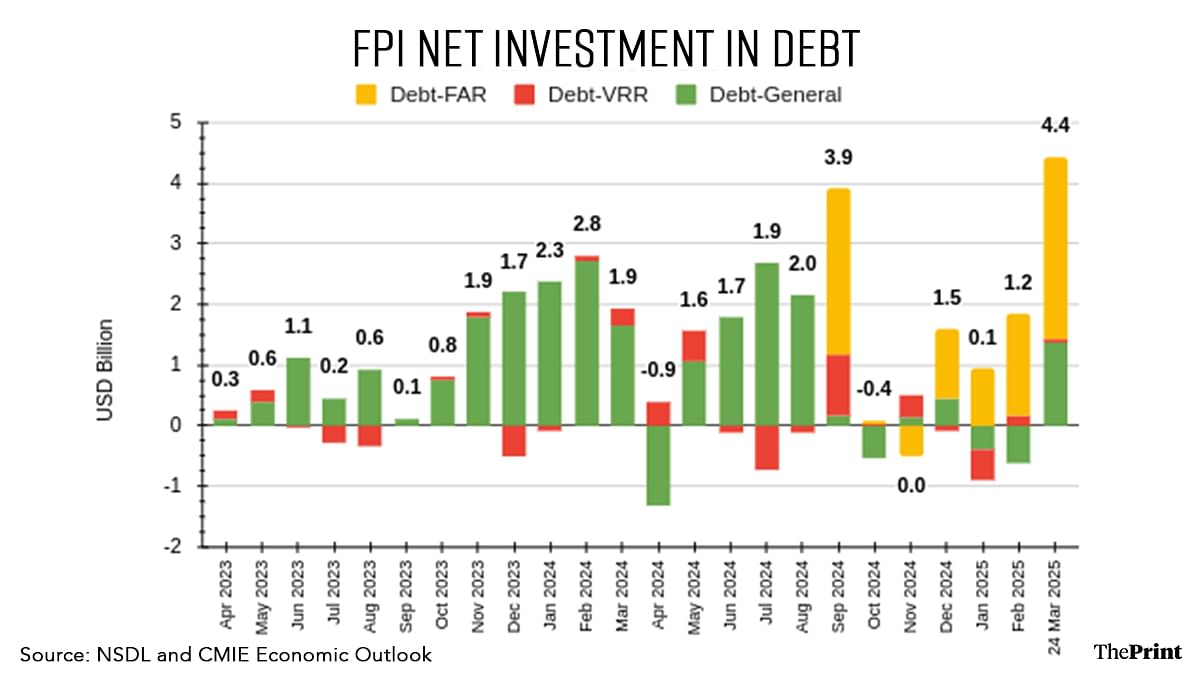

FPIs & Indian debt

Falling bond yields in the US have enhanced the appeal of Indian debt for FPIs. The inclusion of Indian bonds designated under the Fully Accessible Route (FAR) in the Bloomberg EM index also propelled FPI inflows.

Investors seemed to have factored in a rate cut in the April policy meet, and are expecting another cut in the June meeting. All these factors have led to greater inflows in Indian debt securities.

While the aggregate holding of FPIs in FAR securities has risen to Rs 2.99 trillion (as on 24 March), there are doubts on whether the recent spurt in inflows in Indian bonds is sustainable. The differential between the Indian and the US 10-year bond yield has declined, and is not likely to encourage a sustained capital inflow in Indian bonds.

On the equity front, while the pace of selling has slowed, the information technology sector continues to bear the brunt of selling by FPIs. Concerns over slowdown and paused spending by software clients, such as banks, has led to sell-off by FPIs.

Rupee appreciation

The dollar decline and foreign capital inflows have led to appreciation of the rupee. Seasonal factors, like repatriation of corporate profits, normally seen at financial year-end, also supported the rupee. The rupee has appreciated by two percent since 13 March.

RBI’s likely dollar purchases may have capped the gain in the rupee. This is seen through a recovery in foreign exchange reserves that had plummeted to a nine-month low of about USD 624 billion in late January. Foreign exchange reserves have recovered to USD 654 billion as on 14 March.

But is the recent rally in the market and currency sustainable?

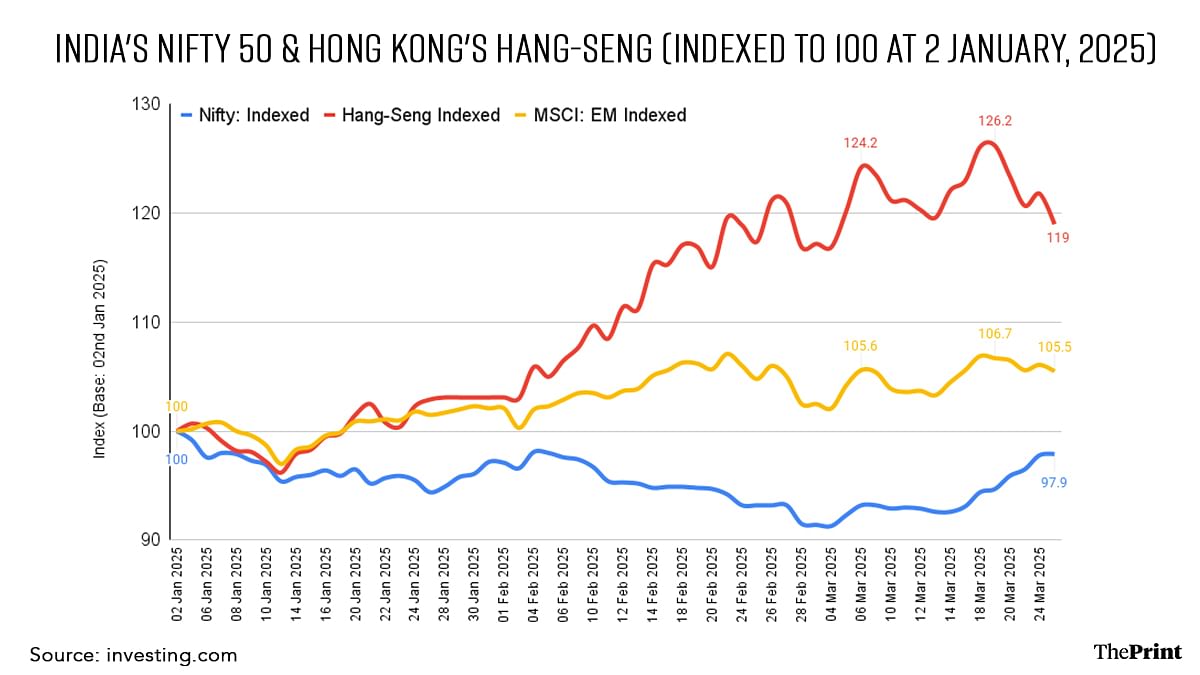

Investor focus shifting to China

This is not simply a case of reallocation of funds from the US to emerging markets. Parallelly, developments in China are reshaping the strategic preferences of foreign investors.

While much of the rally in Chinese markets is seen in technology shares amid a major AI breakthrough by Chinese start-up DeepSeek, the prospect of wide-ranging stimulus measures lifting domestic consumption in China is also supporting Chinese markets.

China has unveiled a series of measures, including aggressive monetary stimulus, a debt package to ease local governing financing strains and surprise wage increases to boost consumption. The Hong Kong’s Hang Seng index, where several major Chinese companies are listed, has seen a substantial gain since the start of February.

Foreign investors are also diverting their capital from India to China due to China’s relatively low valuation. Improvement in economic data due to coordinated policy approaches by China could weigh on Indian markets.

Uncertainty persists

The uncertainty on tariffs is far from over and could impinge upon the risk on sentiment that has recently gained traction.

India walks a tightrope on this issue. Its offer to lower tariffs on US imports to shield its exports from reciprocal tariffs will determine the investor sentiment and market performance. Piecemeal and hasty reductions in tariffs could act as shocks for certain sectors and fuel uncertainty.

Crude oil price fluctuations could keep the rupee vulnerable. Corporate performance in the March quarter will also impact the trajectory of the market, going forward.

Radhika Pandey is associate professor and Madhur Mehta is a research fellow at NIPFP.

Views are personal.

Also Read: The difference a few months can make. From a strong economic outlook, US now staring at a slowdown