USD: Continued slow erosion, from shifting headwinds.

The Dollar is on track to record a shallow depreciation for the full year of 2023: -1% on a basis and -1.3% on a broader trade-weighted index.

By our estimates, that still leaves the Dollar roughly 14-15% overvalued on a real trade-weighted basis, down about 5-6pp from its peak level of overvaluation in the autumn of 2022.

In other words, we will still enter 2024 with a relatively strong Dollar. Given the top-down global macro back drop encompassing significant disinflation alongside firm growth, and non-recessionary Fed cuts alongside buoyant equity risk sentiment, we expect this Dollar strength to continue to erode, but still relatively gradually.

That is because, across the major economies, while disinflation and rate cuts are likely to take place everywhere, US growth still feels like the ‘surest’ thing and the asset market return in the US will continue to set a high bar.

From here, our year-ahead FX forecasts envisage another 2%-3% Dollar depreciation over the next 12 months, so more erosion of the Dollar’s strong valuation, but we are still likely to be living in a strong Dollar world for at least another year.

That said, whereas the headline Dollar returns may look similar, underneath the index it is likely to feel fairly different.

In 2023, moves versus the Dollar were quite geographically segregated: large appreciations versus the Dollar in the Americas (MXN, BRL), and large depreciations versus the Dollar in Asia (JPY, CNY), with European crosses mostly treading water for much of 2023.

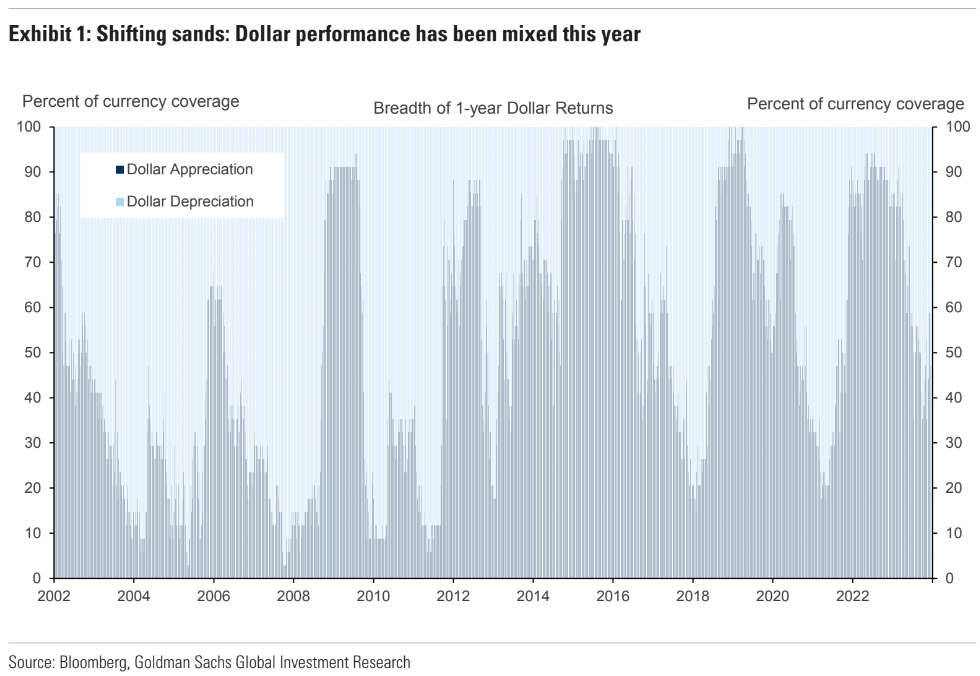

On net, the Dollar has fallen against about half of the currencies we cover over the last year (Exhibit 1).

In the year ahead, we expect Dollar depreciation to be more broad-based, with the most ‘room to run’ on the pro-cyclical flanks that are helped by a softer landing (including KRW, ZAR, AUD, NZD and GBP), but still held back by the central majors (EUR, CNY, JPY).

Lackluster activity in the Euro-area, continued structural challenges in China and a spread-out NIRP exit in Japan are all likely to mean that key ‘challenger’ currencies—EUR, CNY and JPY—are still unlikely to attract substantial capital flows away from the US.

And at the same time, even as we expect further progress, it will be harder to replicate the double-digit appreciation we have seen in the likes of MXN, COP, BRL and PLN from both a valuation perspective and the shifting policy mix.

Taken together, both top-down and bottom-up perspectives argue for lower-vol moves.

We think this is consistent with our relatively benign outlook for the global economy: ‘benign’ is rarely a good thing for FX volatility.

Instead, higher vol moves in FX next year would likely require a deviation from that baseline path.

But we still see this as a relatively ‘live’ possibility that is worth protecting against, particularly since in our baseline view the relaxation of risks stemming from the Fed is more of a policy choice than a necessity.