A monetary surprise in the first half of the year, the Russian Ruble (RUB) has established itself as one of the world’s best-performing currencies. A performance that may seem paradoxical for an economy under Western sanctions, deeply entangled in Vladimir Putin’s war in Ukraine and penalized by falling Oil exports.

Behind this solid performance of the Ruble lies a more nuanced economic reality, one that may even give cause for concern in the medium term.

A spectacular leap for the Russian Rouble

The Russian Ruble has soared in the first half of 2025, outperforming most of the world’s currencies. In particular, it strengthened markedly against the G10 currencies. Currently, one US Dollar equals around 78 Russian Rubles, way below the 113 Rubles seen at the beginning of the year.

It appreciated by 31.1% against a flagging US Dollar, while the US Dollar Index (DXY) just posted its worst first-half performance in decades.

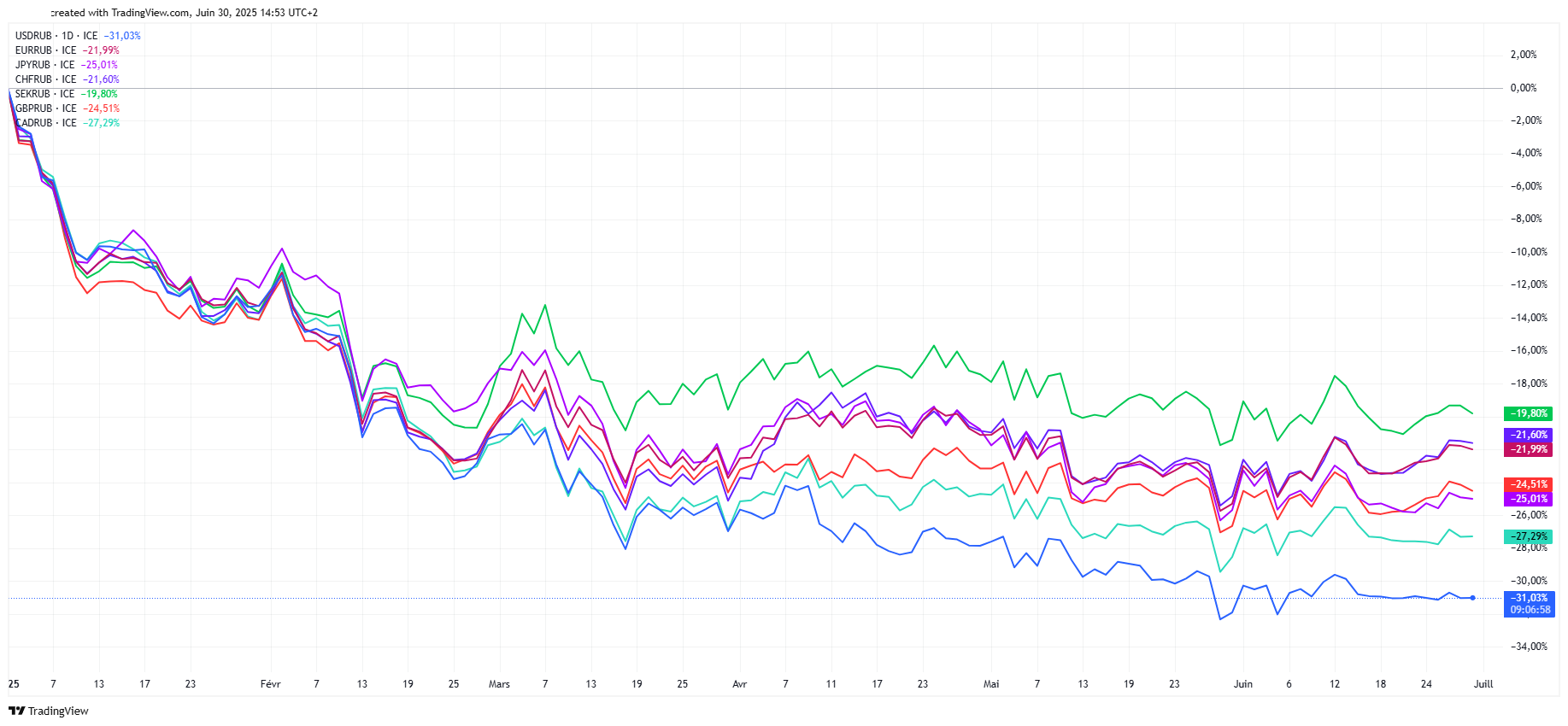

But this upward trend can also be observed against all the major G10 currencies. Against the Canadian Dollar (CAD), the Russian Ruble has appreciated by 27.4%, while it has gained 25.1% against the Japanese Yen (JPY). It also outperformed the Pound Sterling (GBP) by 24.6%, the Euro (EUR) by 22.1%, the Swiss Franc (CHF) by 21.7% and the Swedish Krona (SEK) by 19.9%.

G10 currencies’ performance against RUB. Source: TradingView.

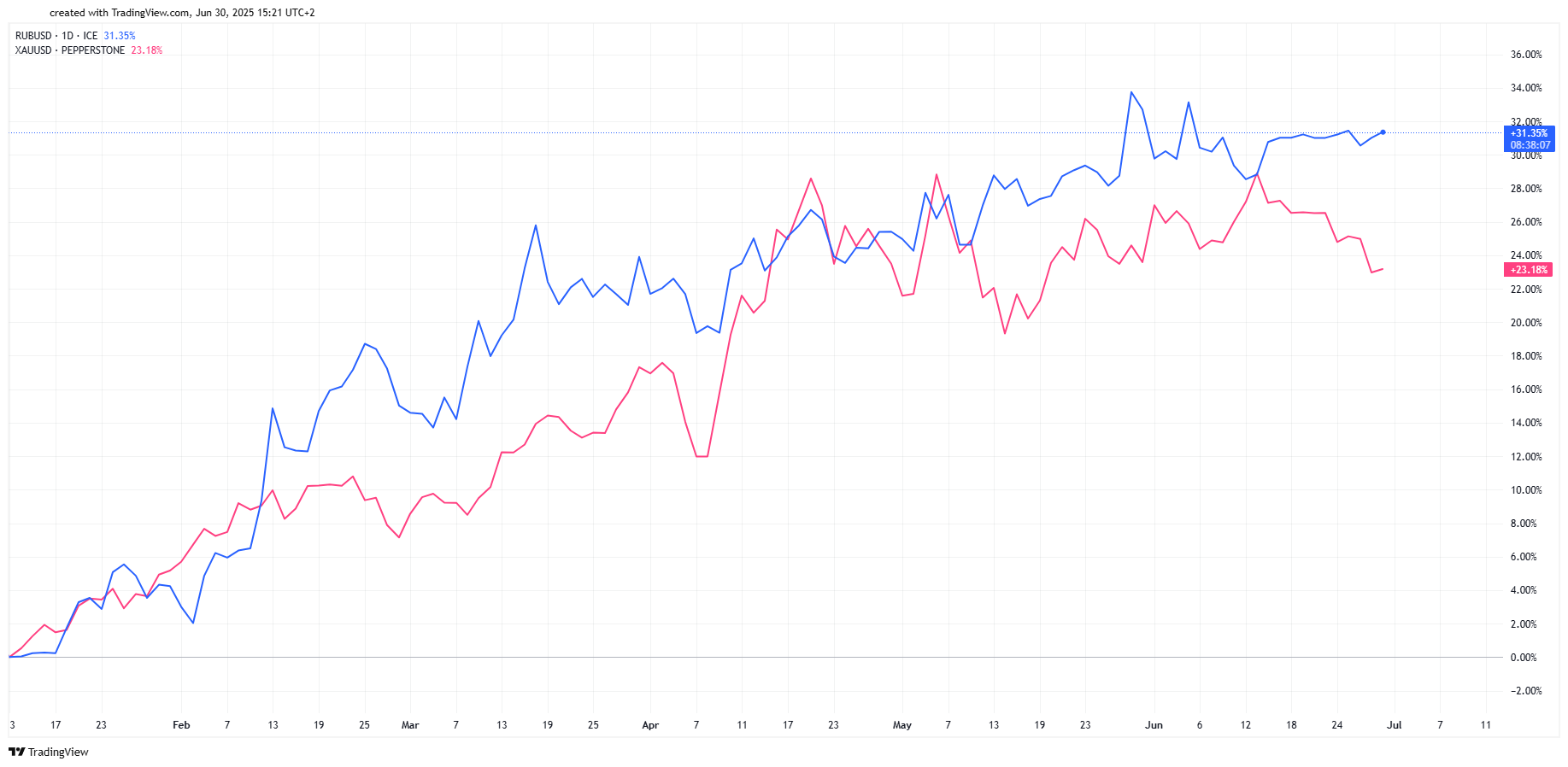

This performance is all the more remarkable in that it even outstrips that of Gold itself, which rose by 23% over the same period against the US Dollar.

RUBUSD vs XAUUSD (Gold) performance. Source: TradingView.

This renewed vigour comes after several years of depreciation, and against an unfavourable economic backdrop: President Putin’s protracted war in Ukraine, Western sanctions, declining Oil exports and financial isolation. This apparent paradox is arousing both interest and skepticism among economists and investors.

The central question is: does the Russian Ruble’s surge reflect a real dynamic of economic recovery, or is it an artificially constructed solidity?

A surge fuelled by economic policy

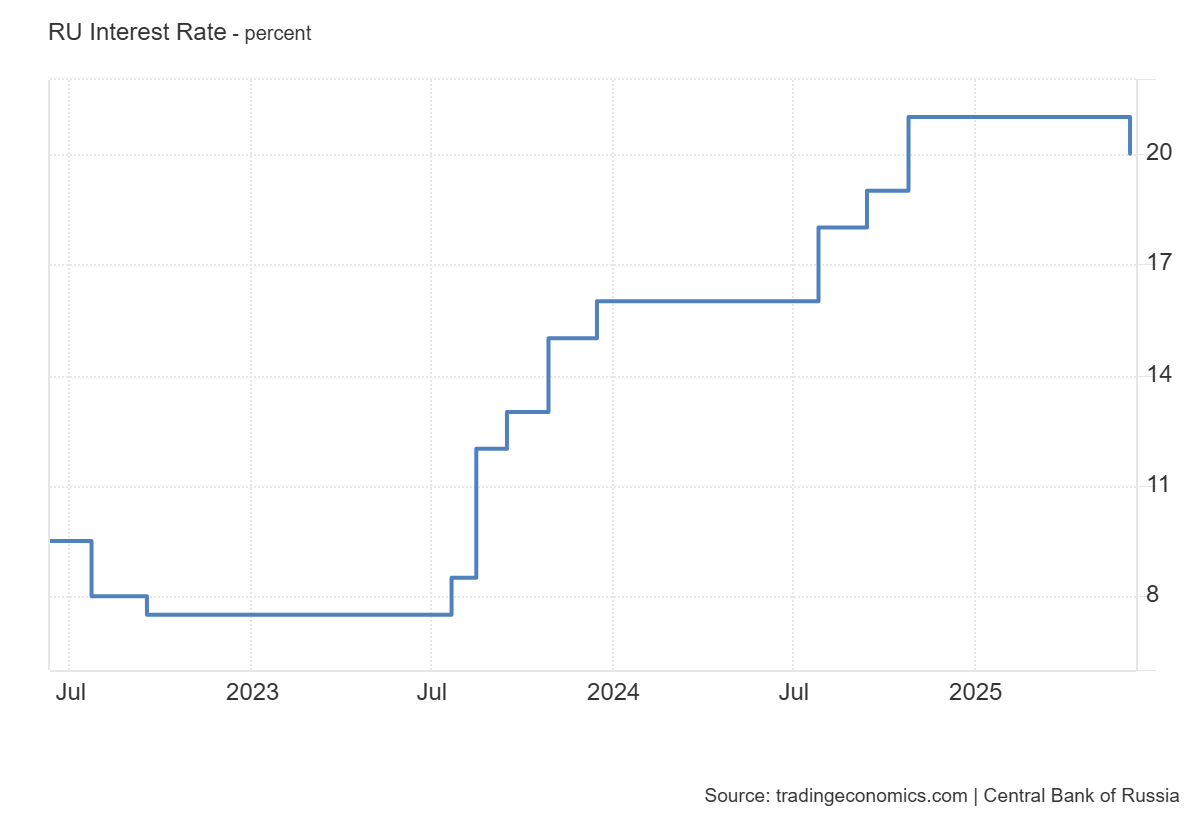

The Russian Ruble’s strength is largely artificial, driven by a series of restrictive economic and monetary policy measures. The Central Bank of Russia maintains an extremely high key interest rate, at 20%, in order to contain galloping inflation (above 10%) and stabilize the currency.

These rates discourage domestic credit, curb consumption and limit imports, all of which reduce demand for foreign currency.

At the same time, strict capital controls prevent massive outflows of funds, while major exporters, particularly in the energy sector, are forced to repatriate their foreign currency earnings and convert them into Russian Rubles on the domestic market.

This process mechanically fuels demand for Russian Rubles, contributing to their rise in value.

According to Commerzbank, this performance does not reflect any market reality. Since trading in currencies has been sanctioned on the Russian financial market, USD/RUB or EUR/RUB rates are no longer truly “floating”.

“The Russian Ruble evolves according to a technical, artificial exchange rate, which reacts only marginally to fundamentals,” explains Tatha Ghose, currency analyst at Commerzbank.

The Trump factor and a weak US dollar

In addition to these internal dynamics, there are favorable external factors. Donald Trump’s return to the White House, accompanied by an aggressive trade policy, has significantly weakened the US Dollar, reducing its appeal as a safe-haven asset.

Markets are also anticipating a possible easing of Western sanctions if peace talks between Moscow and Kyiv progress, an assumption reinforced by a recent telephone call between Donald Trump and Vladimir Putin.

The prospect of a ceasefire in the Ukraine war has been enough to boost the confidence of some speculative investors, who see Russian high-yield assets as a lucrative carry trade opportunity – borrowing in low-rate currencies to invest in Russian Rubles.

Commerzbank warns, however, that the Russian market is over-optimistic, anticipating a swift peace agreement and a lifting of sanctions. A scenario that is far from certain.

Perverse effects for the Russian economy

But while the strong Russian Ruble may look good on the charts, it is seriously complicating the finances of the Russian state. The federal budget relies heavily on dollar-denominated Oil and Gas revenues.

With an overvalued Russian Rouble, every US Dollar exported is converted into fewer Russian Roubles, reducing revenues.

As a result, the Kremlin is having to dip into the National Wealth Fund to plug a growing public deficit, estimated at over 2,000 billion Russian Rubles in the first quarter, or around 1% of GDP, according to Ministry of Finance data.

Tax increases are already being considered, and non-priority spending could be cut if the trend continues.

What’s more, a strong currency penalizes Russian exporters, whose margins are eroding. Not only the Oil sector, but also the Aluminum and metallurgy giants are seeing their revenues melt away, while their Russian Ruble-denominated costs are rising.

A probably temporary performance

Despite its spectacular gains, the Russian Ruble is considered overvalued by many analysts, who anticipate a gradual weakening by the end of 2025, with an expected USD/RUB exchange rate of between 95 and 100.

Should a peace agreement be signed with Ukraine, capital controls could be lifted, triggering a sudden outflow of funds and a rapid depreciation of the currency.

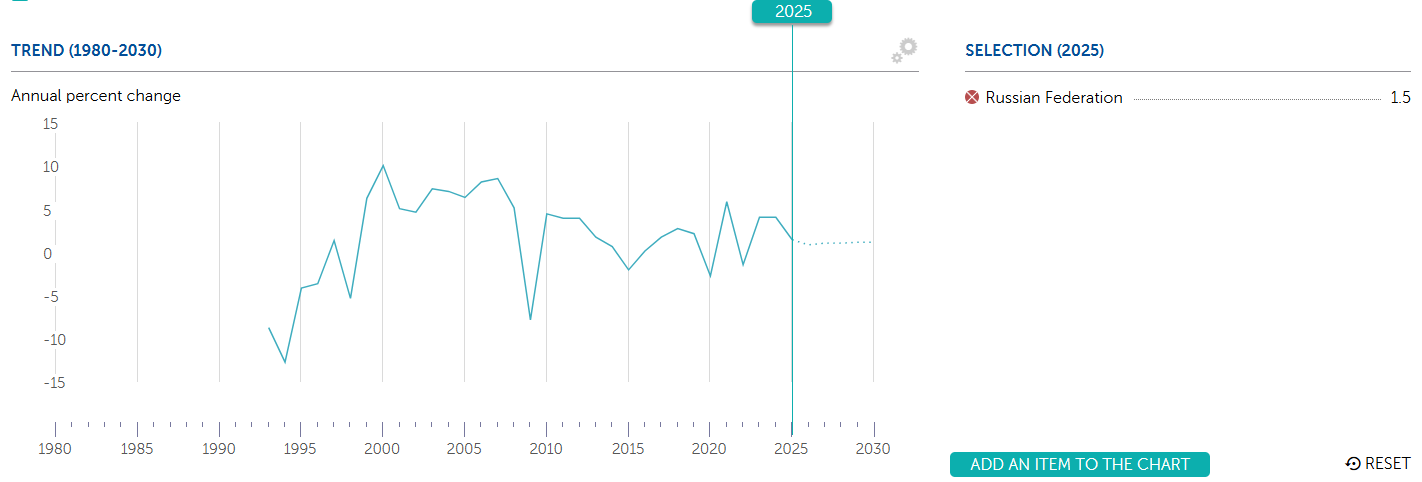

The Central Bank of Russia could then be forced to cut interest rates to revive an economy that is already losing momentum outside the military sector. Russian GDP, artificially inflated by defense spending, is showing signs of running out of steam.

The growth rate slowed to 1.4% in the first quarter, forecasted at 1.5% for the full year and 0.9% in 2026, according to IMF projections. In addition, non-military-related business bankruptcies are rising.

“Investment bank Goldman Sachs is forecasting a 100-Russian Ruble exchange rate as early as this summer. Analysts surveyed in April by Russia’s Central Bank predicted an average dollar exchange rate of 95.2 Russian Rubles in 2025. Russia’s Economic Development Ministry expects the Russian Ruble to fall to 98.7 against the dollar by the end of the year”, notes Meduza, an online newspaper and news aggregator covering Russia and the Eurasian region.

Commerzbak forecasts USD/RUB at 95.0 by the end of the year, and 125.0 by the end of 2026.

The strong Russian Rouble: Illusion of stability in a militarized economy

The Russian Ruble’s strength offers temporary respite, curbing inflation, making imports more affordable and enabling the Central Bank of Russia to boast a certain stability.

But this stability rests on fragile foundations: authoritarian control, growing indebtedness, dependence on energy exports, demographics at half-mast and economic isolation.

In the long term, the Russian economic model is moving further and further away from the standards of an open market economy.

Ultimately, the Russian Ruble’s trajectory in the months ahead may depend less on market fundamentals than on political decisions over the Ukraine war made in the Kremlin, and by President Putin himself.