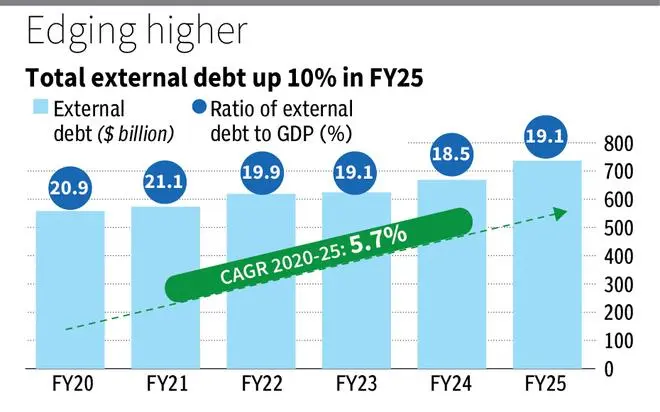

The comfortable external debt has been a strong point for the Indian economy in recent past. Total overseas borrowing has been increasing at a modest annual rate of 5.7 per cent over the last five years and stands at $736.3 billion in March 2025. While India Inc seems to be relying more on domestic sources, NBFCs have increased their external debt sharply in the last five years.

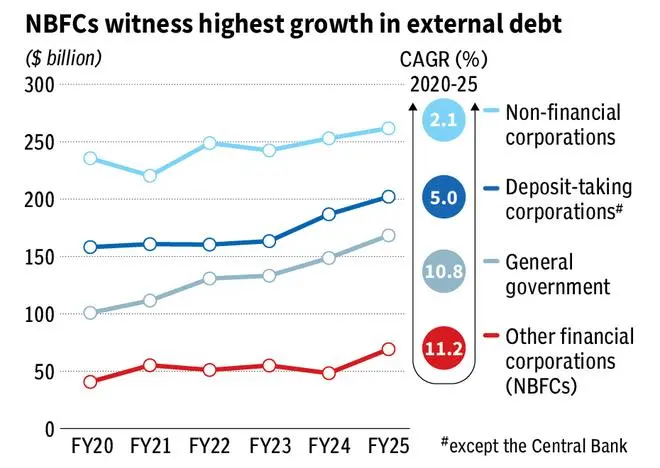

Non-financial corporations or Indian companies had the highest share in total external debt at 35.5 per cent, followed by banks at 27.5 per cent, general government 22.9 per cent and other financial corporation’s 9.4 per cent.

While non-financial corporations or Indian companies remain the largest external borrowers, accounting for $261.7 billion, their external borrowing has been growing at a slower pace, averaging 2.1 per cent between FY20 and FY25. The growth in external debt taken by companies was just 3.4 per cent in FY25. This is in line with the declining debt and capital investments of Indian companies. With Indian banks being flush with liquidity, they would also have found it easy to raise funds from domestic sources

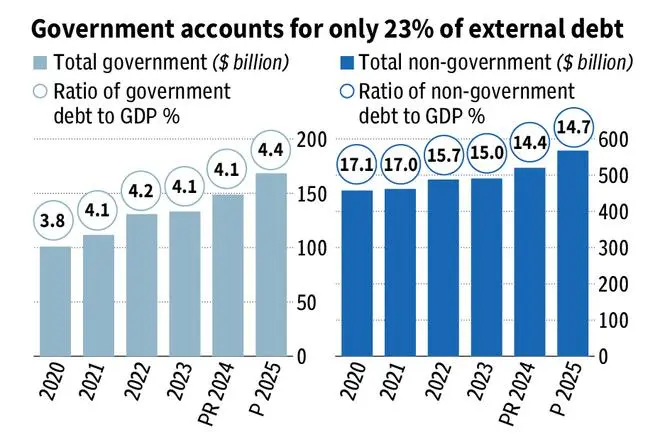

The Indian government continued to be a cautious borrower in overseas markets. Total government debt stood at $168.4 billion in FY25. But given the large fiscal deficit, its external borrowing has also been growing at a CAGR of 10.8 per cent between FY20 and FY25. The growth in external debt of the government in FY25 was 13.2 per cent.

NBFCs take the lead

Other financial corporations, largely consisting of NBFCs, Housing Finance Firms and other financial intermediaries, have a compounded annual growth rate of 11.2 per cent over the last 5 years, outpacing other sectors and emerging as the fastest growing contributor to India’s external debt profile.

The external debt of OFCs stood at $69.2 billion in 2025, recording an increase of 43 per cent over the previous year.

According to Vivek Iyer, Partner and Financial Services Risk Leader, Grant Thornton Bharat, this surge in OFCs offshore borrowing is rooted in the evolving nature of India’s domestic monetary landscape. “With RBI’s efforts to increase domestic credit growth, coupled with the surplus liquidity being sucked out of the system, the domestic cost of borrowing is not expected to go down any sooner than it already has, this acts as a push factor for OFCs to raise debt from offshore sources as the effective hedged costs of borrowing could appear more attractive.”

While this seems as the cheaper alternative, it is inherently vulnerable to external shocks on account of interest rates and currency volatility, however, Iyer ascertains that in the current global economic environment, the possibility of interest rates hardening is much unlikely and as for the currency volatilities which persist as a concern, he believes that the OFC’s effective risk management strategies are equipped enough to cushion these shocks.

India vs the rest

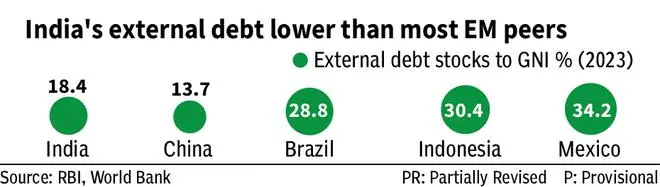

Compared to other emerging economies, India has a relatively lower external debt to GNI ratio of 18.4 per cent as opposed to Mexico (34.2 per cent), Indonesia (30.4 per cent) and Brazil (28.8 per cent) in 2023, according to World Bank.

(The writer is an intern with businessline)

Published on July 4, 2025