On Aug. 22, Alphabet (GOOG +0.02%) (GOOGL +0.02%) passed Amazon to become the fourth most valuable company in the world.

Alphabet’s market cap now sits at a whopping $2.5 trillion — meaning it only has to gain 20% to join Nvidia, Microsoft, and Apple in the $3 trillion club.

Here’s why Alphabet stands out as the most likely company to reach $3 trillion next, and why the growth stock is worth buying now.

Image source: Getty Images.

The most profitable Titan

The “Ten Titans” are the 10 largest-growth focused companies by market cap, consisting of Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta Platforms, Broadcom, Tesla, Oracle, and Netflix.

These 10 companies comprise a staggering 38% of the S&P 500 — illustrating their influence on the broader market.

Many of the Ten Titans have delivered monster returns for their shareholders, with stock prices far outpacing earnings growth and leading to valuation expansion. But Alphabet is different.

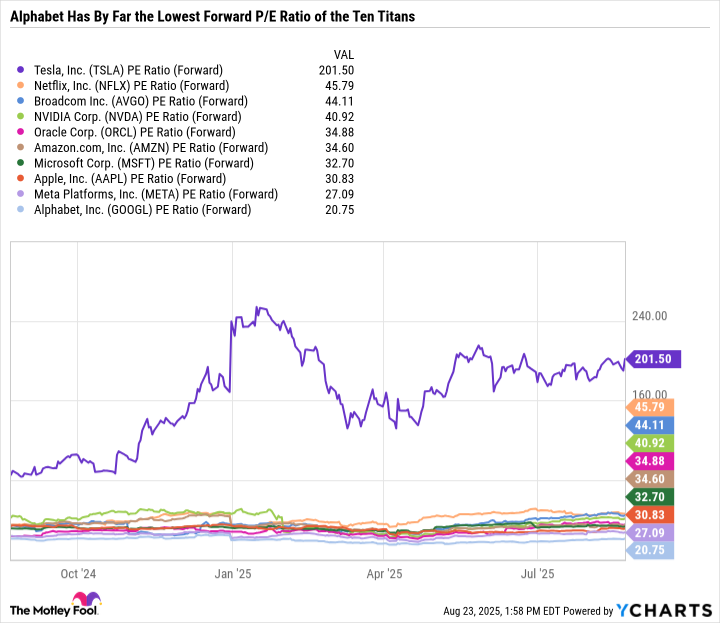

Alphabet is by far the cheapest of the Titans based on forward price-to-earnings (P/E) ratio. This metric takes the price of a stock and divides it by analyst consensus estimates for the next 12 months of earnings.

Alphabet’s forward P/E is far lower than second-place Meta Platforms.

TSLA PE Ratio (Forward) data by YCharts

It’s also worth noting how much cheaper Alphabet is than other major cloud players, like Amazon, Microsoft, and Oracle. In fact, if Alphabet had Microsoft’s forward P/E ratio, it would have a market cap of $3.93 trillion.

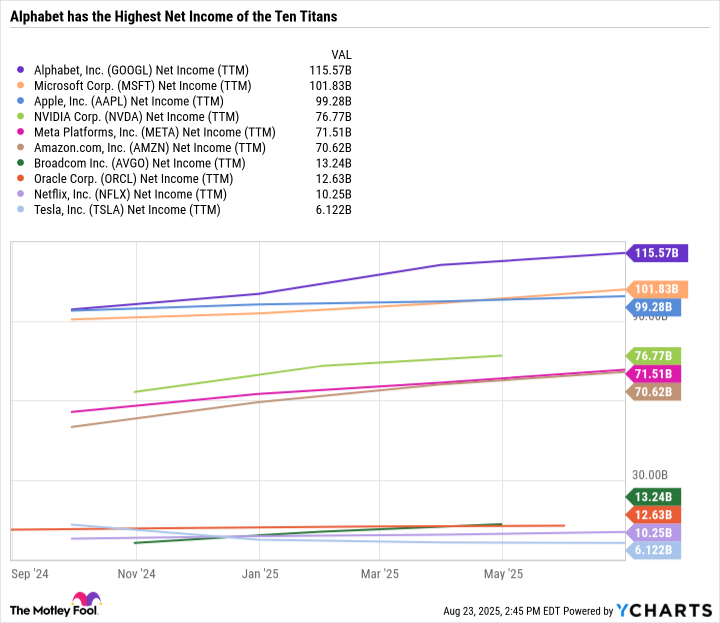

And if the Ten Titans were priced based solely on earnings, Alphabet would be the most valuable, as it has the highest net income among the group.

GOOGL Net Income (TTM) data by YCharts

Why Alphabet is inexpensive

The main reason Alphabet has a relatively low valuation is due to concerns about Google Search. Alphabet is a highly diversified business, with a variety of services including YouTube, Google Network, Google One, devices like Pixel and Nest, Google Cloud, and more. Google Search is so massive that it made up 56% of Alphabet’s revenue in its latest quarter. This is staggering considering YouTube is one of the most valuable platforms in media, and Google Cloud has the third-largest cloud computing market share behind Amazon Web Services and Microsoft Azure.

The reality of Alphabet’s business model is that it still heavily depends on Google Search and ad sales. So buying the stock is essentially a bet that Alphabet will be able to defend its revenue stream even as it faces increased competition from other informational resources, namely artificial intelligence (AI)-powered interactive search tools like Microsoft Copilot, ChatGPT, and more.

Google Gemini, developed by Google DeepMind, is a large language model (LLM) that gives Alphabet a seat at the AI information table. Google Search’s AI mode offers users AI capabilities without leaving Google Search in favor of a different information tool.

Microsoft spent decades trying to capture market share from Google Search through apps like Bing, but was largely unsuccessful. Now, AI-powered systems present a way to erode search engine market share over time and level the playing field. The bear case for Google is that search engines are like linear television networks, and conventional AI tools are like streaming, with streaming in the midst of a multi-decade process of taking market share from cable. Even with encouraging results from Gemini, Alphabet’s investment thesis falls apart without Google Search.

Alphabet is embracing, rather than resisting, AI-powered search

Alphabet is highly aware of its need to monetize Google Search AI capabilities and Gemini as a way to protect its prized revenue stream. On its second-quarter 2025 earnings call, Alphabet noted that AI Overviews — which are powered by Gemini 2 — are driving increased Google Search traffic.

If Alphabet can continue integrating AI as a product upgrade to Google Search, rather than tearing Google Search down and building Gemini from scratch, it could be a game-changer for the company’s long-term earnings growth. Combining the benefits of webpage-based linked search with the speed and interaction of AI would be an upgrade to the existing Google Search, which some users may prefer to a stand-alone chatbot.

A rare value among the Ten Titans

Alphabet stock recovered significantly — up just over 20% in the last three months. But despite the pop, Alphabet is still inexpensive and is being valued as if Google Search is heavily at risk of being disrupted. Even though Alphabet’s latest quarter showed Google Search is still growing revenue by double digits.

Alphabet’s road to $3 trillion by the end of 2027 is very straightforward. Annual earnings growth of 10% per year and maintaining the same valuation puts it over the hump. Whereas the premium-priced Ten Titans have to blow expectations out of the water to justify their existing valuations.

Add it all up, and Alphabet remains arguably the best Titan for value-oriented investors to buy now.