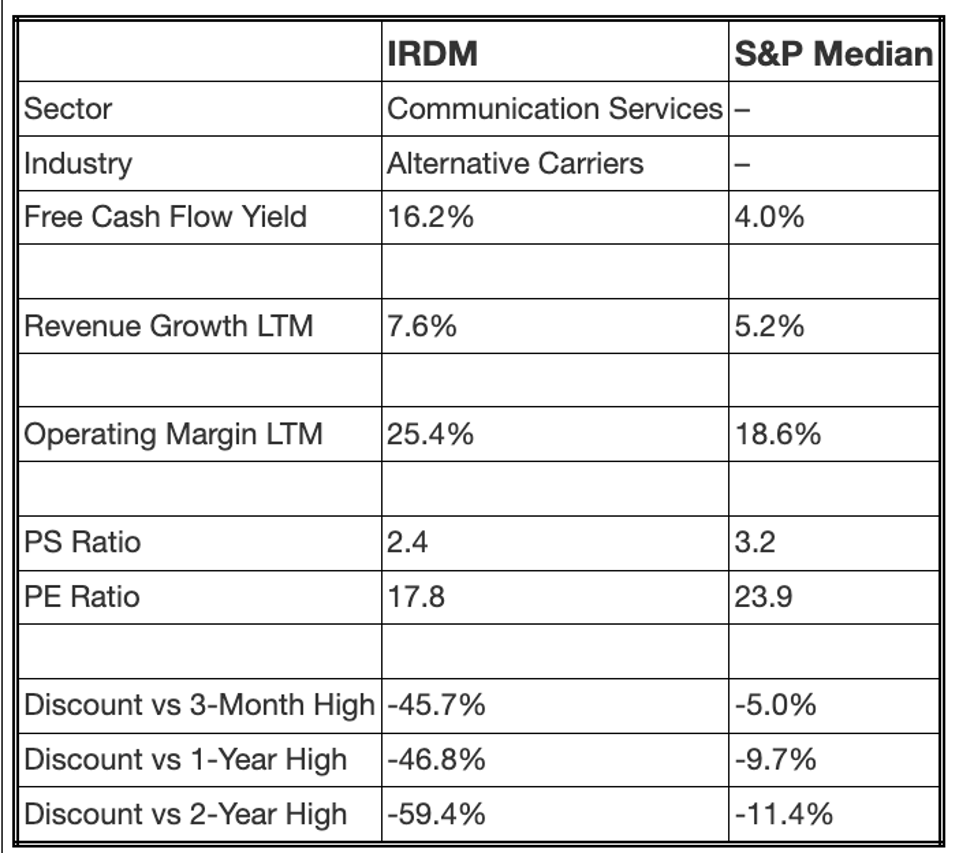

Here’s why we believe Iridium Communications (IRDM) stock deserves your attention: It is growing, generating cash, and is available at a substantial valuation discount. Let’s review the numbers.

- Cash Yield: Iridium Communications boasts an impressive cash flow yield of 16.2%.

- Growing: The revenue growth over the last 12 months is 7.6%, indicating that the cash reserves are expected to increase.

- Valuation Discount: Currently, IRDM stock is trading 46% below its 3-month high, 47% below its 1-year high, and 59% below its 2-year high.

Free Cash Flow Yield is defined as free cash flow per share divided by stock price. Why is it important? If a company generates a high amount of cash per share, it can be utilized for further revenue growth or distributed to shareholders through dividends or buybacks. For a brief background, Iridium Communications delivers mobile voice, data, push-to-talk, broadband, and IoT communication services to businesses, governments, NGOs, and consumers via a wholesale distribution network.

Investing in a single stock can be risky; however, there is significant value in the more diversified strategy we adopt with the Trefis High-Quality Portfolio. Furthermore, consider how your portfolio’s long-term performance could improve by allocating 10% to commodities, 10% to gold, and 2% to crypto alongside equities.

Comparison with S&P500 Median

Trefis

But do these statistics provide a complete perspective? Read Buy or Sell IRDM Stock to determine if Iridium Communications still possesses a competitive advantage that remains sustainable.

The Message? The Market Can Recognize and Reward

The following statistics are derived from the “high FCF yield with growth and discount” selection strategy since 12/31/2016. The statistics are calculated based on monthly selections, with the assumption that once a stock is selected, it cannot be re-selected for the subsequent 180 days.

- Average forward returns over 6 months and 12 months of 25.7% and 57.9% respectively

- Win rate (percentage of picks that return positive) of over 70% for both 6-month and 12-month durations

However, Be Aware of the Risks

That being said, IRDM is not shielded from significant declines. It experienced a drop of approximately 31% during the Global Financial Crisis and nearly a 30% decrease during the 2018 correction. The COVID pandemic had an even greater impact, resulting in a 44% decline, followed by an inflation shock that caused it to drop nearly 47%. Even with solid fundamentals, considerable pullbacks occur when the markets become turbulent.

However, the risks are not confined to large market crashes. Stocks can decline even when the markets are performing well – consider events such as earnings reports, business updates, and changes in outlook. Read IRDM Dip Buyer Analyses to see how the stock has rebounded from sharp declines in the past.

Consistently selecting winners is a challenging endeavor – especially with the potential volatility associated with a single stock. Alternatively, the Trefis High Quality (HQ) Portfolio, which consists of 30 stocks, has demonstrated a track record of significantly outperforming the S&P 500 over the past 4 years. Why is this the case? Collectively, HQ Portfolio stocks have provided superior returns with lower risk compared to the benchmark index; offering a smoother ride, as illustrated by HQ Portfolio performance metrics.