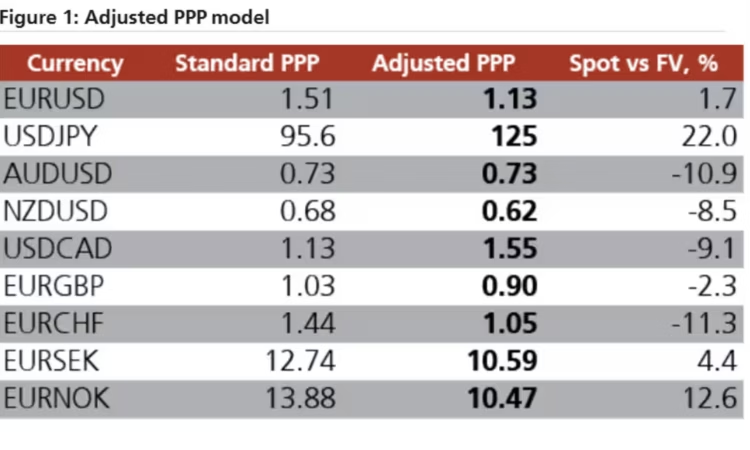

UBS maintains a purchasing power parity model for ascertaining the long-term value of different currencies and going forward, and it anticipates that the AI investment boom may lead to a resumption of U.S. productivity outperformance. For the firm’s chief fx strategist, Vassili Serebriakov, this would be supportive of the dollar’s long-term fundamentals.

Right now, he opines, the dollar, as represented by its DXY index against other leading currencies, is broadly in line with fair value. He finds that G10 average GDP/capita rose from 79.5% of the U.S. level in the fourth quarter of 2024 to 80% in the first quarter of 2025. In the second quarter the move was entirely reversed.

For historical comparisons that figure back in 2011 was as high as 91%.