High-net-worth investors are pulling out of the stock market. Here’s where they’re funneling their cash instead

Moneywise and Yahoo Finance LLC may earn commission or revenue through links in the content below.

The U.S. stock market has been performing well this year, despite tariff uncertainty, but recently hit a sluggish patch — one predicted by high-net-worth investors, who are increasingly betting on other investment types.

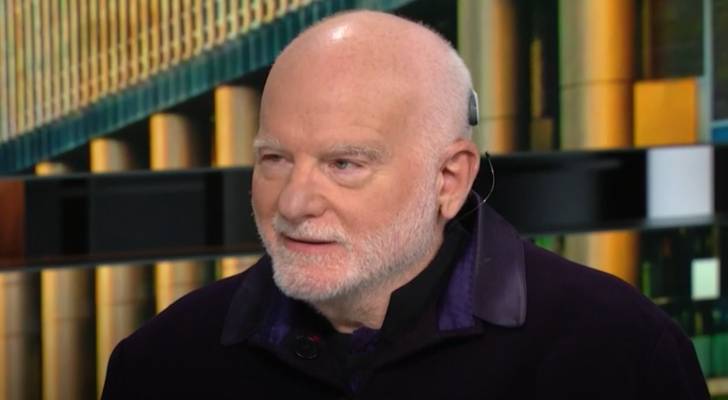

Michael Sonnenfeldt, founder of Tiger 21, an exclusive network of ultra-high-net-worth investors, says the ultra-rich aren’t chasing the stock market hype.

“Actually, they just pulled back a couple points in the last quarter from the stock market and from real estate,” Sonnenfeldt told CNBC in September, noting that the average Tiger 21 member controls more than $100 million (1).

So where is their money going?

Private equity remains a “strong” holding, he said, but members are increasingly allocating to areas that were once ignored. “For the first time, cash is coming up a little, fixed income is coming up a little and gold and bitcoin.”

The shift points to a more defensive posture, as Wall Street remains jittery. CNN Business reports that the strong year has given investors “outsized expectations” about stock performance. Coupled with the possibility of an AI bubble and December’s Federal Reserve interest rate cut, investors are on edge (2).

For the Tiger 21 group and other investors like them, stronger allocation to cash and fixed income signals a renewed appetite for liquidity and steady yields after years of near-zero interest rates, while growing exposure to gold — and even itcoin — reflects a search for alternative stores of value.

Sonnenfeldt says his members are approaching their portfolios with a little more caution these days. Naturally, when they’ve created as much wealth as they have, he adds, preservation is their highest priority.

That makes gold a natural destination. The precious metal has served as a store of value for thousands of years. It isn’t tied to any single country, currency or economy, and it can’t be printed like fiat money. Investors often flock to it during periods of economic stress or geopolitical uncertainty — pushing prices higher.

Gold is up over 60% so far this year, and hit highs of about $4,350 in mid-October (3). After a slight dip in November, the spot price of gold recovered in December. This performance could be indicative of the trust many investors have put in the commodity, as opposed to the stock market.