Trading can be a handful when you don’t receive the right guidance and analysis, especially with constant market fluctuations. Whether you are a novice or advanced trader, remember to stay up to date with the latest news.

Check out XM technical analysis on a daily basis and discover if you should open buy or sell positions on different instruments. In what follows, is a glimpse of for today:

USDCAD halts advance. Is it setting the stage for a new bearish round?

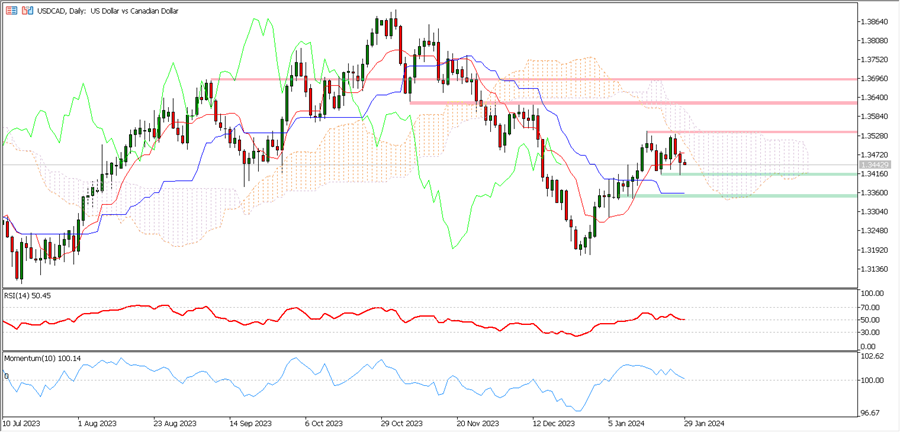

USDCAD has been on the backfoot over the last few sessions, after failing to overstep the January 17th high, and appears stuck in a narrow range below the Ichimoku cloud.

The Canadian currency is supported by rising prices amid escalating geopolitical tensions in the Middle East. The pair may be vulnerable to further declines in the coming days, especially if military operations intensify in response to yesterday’s attack on an American base in northeast Jordan

Technically, the oscillators are suggesting further price declines in the near-future. Both the RSI and momentum indicator appear ready to dive to the negative waters.

Currently, a dip in price below the 1.3415 level will reflect a sell signal, as it will trigger a fast decline towards the 1.3340 – 1.3320 support area, which encompasses the Kijun-Sen line. A strong penetration here will bolster bearish pressures towards the 1.3240 area.

On the flipside, Overstepping the 1.3530 – 1.3540 zone will confirm the resumption of the January bullish wave and reflect a new buy signal. In this scenario, buyers would initially target the December high of 1.3620. A jump over this hurdle will shift attention towards the 1.3690 resistance area.

In short, USDCAD shifted to the sidelines after the remarkable January rally stalled. A drop below 1.3415 or a step over 1.3540 will direct the market accordingly.

It is noteworthy mentioning that the economic agenda this week is packed with plenty of U.S. events which may dictate the dollar’s future path, most notably the on Wednesday and the on Friday.

Mohamed El-Sherbiny – Analyst and Instructor – XM Live Education

Are you interested in the foreign exchange market? Trade forex with XM and withdraw your profits within minutes.