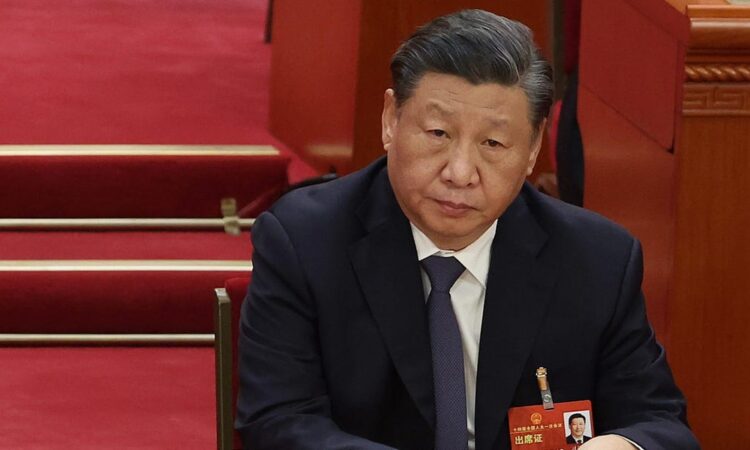

- Chinese stocks surged Tuesday, with market regulators expected to meet with Xi Jinping.

- Meanwhile, US futures traded mixed ahead of the opening bell.

- Investors await fourth-quarter earnings reports from Eli Lilly, Ford, and Snap.

China’s beaten-down stocks were the big movers on global markets Tuesday as benchmark indexes rebounded on speculation that Beijing could step up its efforts to address a recent market rout.

The CSI 300 gauge of mainland equities was up more than 3% by the closing bell, while Hong Kong’s Hang Seng surged 4% in its final hour of trading after Bloomberg reported that regulators are set to meet with president Xi Jinping.

Meanwhile, US futures traded mixed after falling Monday as investors grappled with a blowout January jobs report and Federal Reserve chair Jerome Powell signaling that the central bank only plans to cut interest rates three times this year.

The S&P 500 and Dow Jones Industrial Average futures were down 0.1% at 6 a.m. ET, while Nasdaq futures rose by the same amount. Yields on 10-year Treasury notes dropped 2 basis points.

Investors await fourth-quarter earnings reports from pharma giant Eli Lilly, carmaker Ford, and social-media company Snap, which started laying off workers Friday in the latest tech industry cull.

Regional Fed presidents including Cleveland’s Loretta Mester and Philadelphia’s Patrick Harker are also set to give speeches Tuesday, which could give investors more of a clue about the approach policymakers are taking on interest rates.