After a torrid year, the outlook for the UK’s property market is poised to improve.

A number of reports have suggested that house prices will continue to drop, which will hopefully help more would-be-buyers finally get on the housing ladder, even if this negatively impacts those who already have property, and want to see its value continue to rise.

Here’s a deeper look to figure out what is actually going on out there.

First thing’s first…

Why did the housing market struggle in 2023?

Fallout from Liz Truss’s disastrous mini-budget in September 2022 was still impacting prospective buyers and sellers as they entered the new year.

The package, which included £45bn of unfunded tax cuts, led to a fall in value of the pound and mortgage rates to skyrocket over five per cent.

It marked an end to the pandemic housing boom, which was driven by buyers seeking more space and a heavily subsidised market. This was thanks to the government temporarily cutting stamp duty.

Interest rates were also at historic lows, sitting at 0.1 per cent in December 2021.

While mortgage rates recovered slightly in the first months of the year, the UK was now caught up in the worst of the cost of living crisis and the public struggled to afford basic items.

Rising inflation, which climbed to over 10 per cent at some points in the year, also meant the Bank of England was steadily raising interest rates further, to help curb soaring costs.

14 rate hikes in a row led mortgage lenders to raise the cost of their deals, cooling demand and levelling off house prices growth.

While mortgage rates have fallen since, an average two-year fixed residential mortgage rate today is 5.56 per cent, marking a significant fall from its July peak of over six per cent.

This still remains a steep increase from December 2021, when it stood at 2.34 per cent.

Will the market improve in 2024?

A number of reports have suggested that demand to buy a home ticked upwards at the start of the year.

It is believed cooling inflation, currently at four per cent, has helped improve sentiment in the market.

In January, the average house price of a home was £291k, 1.3 per cent on a month to month basis.

This is the fourth consecutive month that house prices have risen and, as a result, the pace of annual growth is now 2.5 per cent the highest rate since January last year.

“The recent reduction of mortgage rates from lenders as competition picks up, alongside fading inflationary pressures and a still-resilient labour market has contributed to increased confidence among buyers and sellers. This has resulted in a positive start to 2024’s housing market,” Kim Kinnaird, director at Halifax Mortgages, said.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, told City A.M: “So far this year we have seen an increase in buying and selling activity but although improving, the property market remains sensitive and fragile.

“The question borrowers are weighing up is whether the recent reduction in mortgage rates is just the beginning, or should they wait longer before taking the plunge.”

“We expect transactions to pick up over the next quarter but not substantially. Greater choice and continuing caution about the economy mean buyers remain nervous and are still seeking out value,” he added.

House prices are also forecast to fall by around two per cent. While this can often be an indicator of poor economic health, house prices still remain around £40k above pre-pandemic levels.

Jason Harris-Cohen, chief of Open Property Group, added: “The property market has continued to defy expectations and we’re seeing strong growth both with respect to mortgage market activity and initial offers being made.

“This growth is being driven by a belief that interest rates have peaked at 5.25 per cent and will reduce over the year ahead and there is also confidence that the decline in house prices seen over much of 2023 is now on the turn, despite a wider landscape of macro uncertainty.

“We expect this confidence will only strengthen as the year progresses, particularly given the Bank of England’s decision to hold the base rate for a fourth consecutive time last week.”

But challenges still remain..

Over 15 years of wage stagnation coupled with a squeeze on public finances means that first time buyers may still struggle to get on the housing ladder.

According to a report by Halifax, house prices for first-time buyers remain over £132k more expensive than ten years ago, with the cost of a home coming in at around £288k last year.

Despite prices being five per cent lower than the prior year, the overall number of first-time buyers fell by 21 per cent to 293,339 in 2023.

The average property values for first-time buyers are now around 6.7 times the average UK salary (£43,257).

Tom Bill, head of residential research at Knight Frank also said an upcoming general election later in the year could also rattle the market.

He explained: “There is the political risk around the election [and] around a Prime Minister who is not able to control the timing of an election.

“We have got a couple of by-elections this month which could see the infighting in the Tory party increase again.”

Bill said he expects mortgage rates will start to tick down a bit, but doesn’t expect them to move “particularly much” in the next few months. “I think it’s pretty obvious at the moment that the house price declines that we saw last year are bottoming out,” he added.

While these statistics point towards signs of a recovery, buyers in the capital are continuing to face issues with affordability.

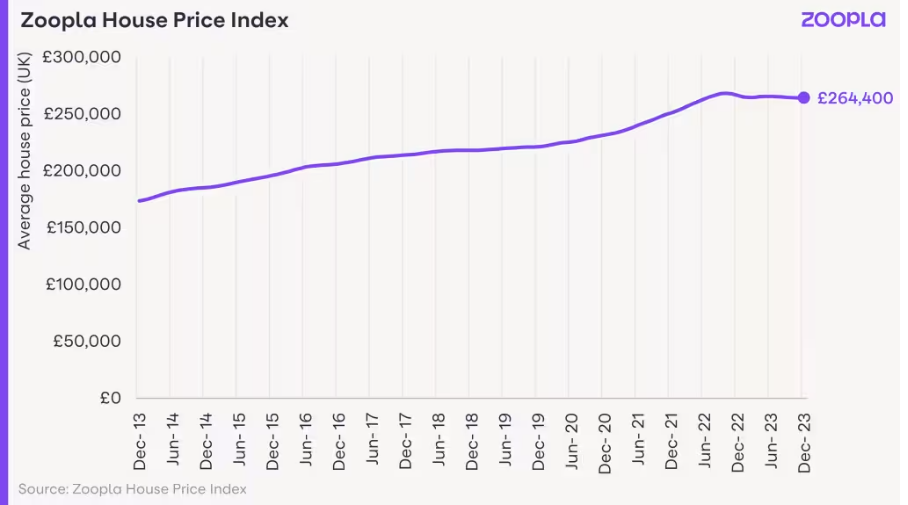

A slither of hope can be found in Zoopla’s latest house price index which showed affordability in London is the best since 2016.. The average price of a property costing £536k last month, a year-on-year decline of 1.1 per cent.

But a shortage of supply is likely to remain an issue for prospective buyers.

A report by Centre for London said the capital needs to double the number of homes built annually from 37,000 to 74,000 a year for 15 years to solve it’s challenges with housing shortages.