Property values continued to ‘defy gravity’ during 2023 with six in 10 homeowners seeing the value of their home increasing or remaining static, research from Zoopla reveals.

Despite a volatile housing market during the course of the year some three million homeowners (10%) made a value gain of 5% or more with an average gain of £7,800 or £21 a day – albeit down from £19,700 a year ago.

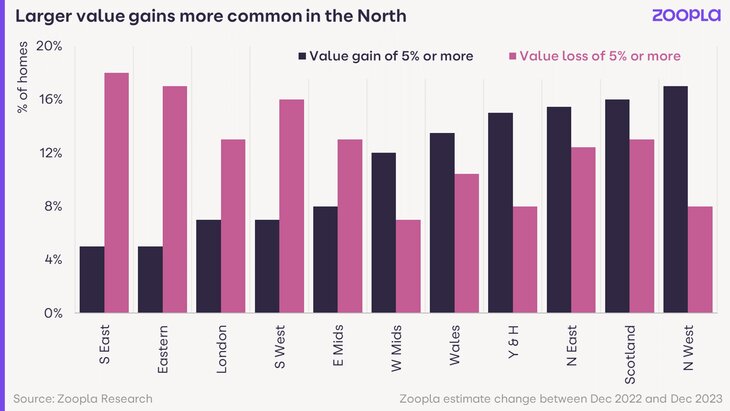

A clear North South divide emerged once again with homes in the North registering larger value increases as lower prices cushioned the impact of higher mortgage rates in more affordable parts of the country.

NORTH WEST

The North West had the highest proportion of homes registering larger value increases of 5% or more – an average of £13,200 gained – as half a million homes (17% of houses) recorded gains of over 5%.

The region was followed by Scotland where 16% ( just over 400,000) homes increased in value by 5%.

But even though the majority of homeowners experienced value increases over four in 10 (44%) of UK homes fell in value by at least 1%, with almost a third of homes falling in value by over 5% or more – a 2.5 x increase on the previous year.

SOUTH OF ENGLAND

This was felt more in the South of England with 18% of homeowners in the East of England and the South East registering home value decreases of 5% or more.

Izabella Lubowiecka (main picture), Senior Property Researcher at Zoopla, says: “While national house prices indices pointed to modest house price falls over 2023, our property by property level tracking of home values shows that most homes saw their value unchanged or slightly higher over the year.

“Value reductions were focused in southern England while modest gains were recorded in lower priced, more affordable housing markets.”