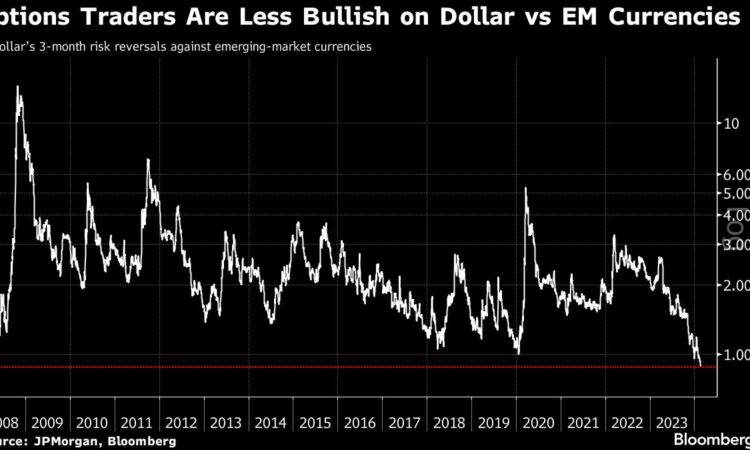

(Bloomberg) — Options traders are the least bullish on the dollar against emerging-market currencies since 2007 as impending US interest-rate cuts boost the appeal of higher-yielding assets.

Most Read from Bloomberg

The greenback’s three-month 25-delta risk-reversal rate against EM currencies fell to 0.90% points this week from a year-to-date high of 1.19% points in mid-January, according to an index compiled by JPMorgan Chase & Co. Risk reversals are a hedging strategy that protects a long or short position by using put and call options.

The decline was accompanied by a drop in similar-tenor implied volatility, signaling reduced demand for dollar call options.

Sentiment toward the dollar is showing signs of deterioration as investors seek clues as to when a slowdown in US inflation will prompt the Federal Reserve to start easing policy. A cut would reduce the greenback’s allure as a high-yielding haven asset.

“The Fed is done tightening and the next course of action is a cut,” said Christopher Wong, a foreign-exchange strategist at Oversea-Chinese Banking Corp. in Singapore. “A potentially less restrictive environment, yield differentials to improve, exports recovery in the emerging market” and hopes for China stimulus give room for the dollar to ease against EM currencies, he said.

The dollar has been rangebound since late January against the currencies of developing economies, according to a Fed index. This has led to a drop in currency-implied volatility and the greenback’s risk-reversals rate has fallen along with it, said Ryo Suzuki, executive managing director at SBI Liquidity Market Co. in Tokyo.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.