Lee Beng Hong, CEO of SGX FX and head of wholesale markets & platforms at Singapore Exchange (SGX Group), said the company would like to grow electronic trading of currency options as average daily volume (ADV) of both over-the-counter and exchange-traded derivatives reached a record.

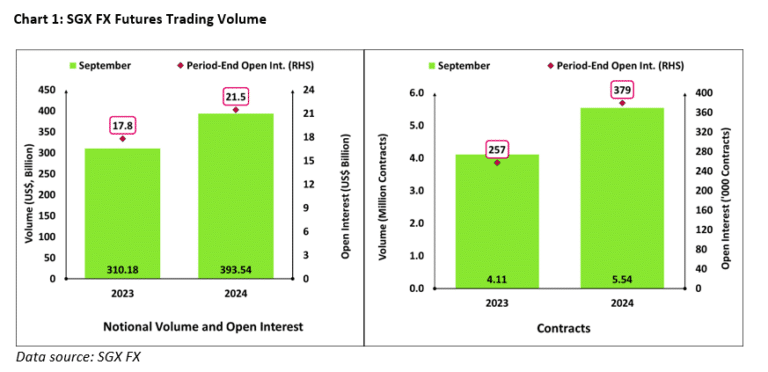

SGX reported that OTC FX ADV surpassed its target by increasing 47% to reach $111bn in the last financial year, between 1 July 2023 and 30 June 2024. In the same period, FX futures ADV grew 36% to about 204,000 contracts. In September this year, combined OTC and futures ADV reached a notional $168bn.

Lee told Markets Media: “One pillar that SGX FX wants to grow is electronic trading of options. Unlike the rest of the FX market, the options market is still traded largely bilaterally or on voice. There is a big opportunity to bring the same efficiency we provide into the options market to uplift the overall efficiency of the entire market.”

The fixed income, currencies and commodities (FICC) segment has had a compound annual growth rate of more than 20% in the previous three financial years, according to SGX’s 2024 full-year results.

Lee said SGX expects strong momentum in FX futures due to greater adoption and market conditions, but also because of regulations such as the uncleared margin rules, which make it more capital intensive to use uncleared products.

“There is no product that is more capital efficient than one that is centrally cleared on an exchange,” he added.

A differentiator for SGX is that it solves for access to both liquid and illiquid FX products, and continues to invest in new solutions, technology and automation, according to Lee. He continued that SGX has launched a unique tool, Trading Plan (T-Plan), which allows OTC FX clients to automate executions based on the market environment and their predefined parameters. SGX has also created tools to make it more efficient for clients to automate and optimize FX hedging across multiple portfolios, multiple cash flows and multiple currencies.

“SGX FX’s sole purpose is to provide the best-in-class solution for clients, to improve efficiency through automation and to improve the quality of their execution,” said Lee. “Our job is to build their dream.”

Asian currencies

Lee is personally bullish around Asian currencies as he believes interest rate differentials are going to drive capital flows. In September, SGX reported that USD/CNH FX futures traded volume increased 23% year-on-year to 3.5 million contracts, lifting total futures volume in FX by 35% to 5.5 million contracts.

That followed a record ADV of KRW/USD FX futures, which rose to a new high of 17,483 lots in August, a 66.5% month-on-month jump which SGX said was due to the effect of the yen carry trade unwind spilling over to other funding currencies.

Trading volume in international Chinese renminbi futures – the SGX contract remains the world’s most widely traded international futures for the currency – has reached $15bn a day, up from $4bn about five years ago. Indian rupee futures volume has increased to $2bn a day, according to Lee.

“Our FX futures are becoming chunky and I would say that it is almost irresponsible if a trader only looks at OTC when they have a venue that is as big as SGX in CNH or Indian rupee futures,” he mused. “Korea is in the process of opening up access to offshore participants and we are the biggest international market for Korean won futures.”

SGX’s focus is to continue to invest in China, India and the rest of Asia beyond FX and into rates. Lee highlighted the success of the new three-month Tokyo overnight average rate (TONA) futures contract, which was launched on 29 July this year, building upon SGX’s existing long-term Japanese interest rate futures. In September, the exchange reported that TONA futures reached 44,928 contracts.

Data and analytics

Another pillar of growth for SGX FX is data and analytics, and using machine learning and artificial intelligence to provide insights to clients.

“SGX FX facilitates around $140bn a day in OTC FX trades and clients want to get specific insights for their interactions,” added Lee.

SGX FX has a data team that has been working on allowing clients to extract information on their interactions, the market and the way they trade. For example, when a trader gets into the office, they can get a report that tells them that they are not dealing as much with a particular client or liquidity provider and the reason why. Another possible use case is to highlight potential execution strategies for a trade.

“The trend is more electronification, more demand for insights and more demand for automation,” said Lee. “Once you give clients the right data, you can build that whole flywheel of adoption.”