(Bloomberg) — Australian unemployment climbed to a two-year high at the opening of the year, highlighting the nation’s cooling labor market and sending the currency lower as traders brought forward bets on an interest-rate cut.

Most Read from Bloomberg

The economy added just 500 roles in January, confounding expectations for a 25,000 gain and well shy of numbers needed to hold down the jobless rate, government data showed Thursday. Unemployment advanced to 4.1% from 3.9% while the participation rate was steady.

The weak figures prompted swaps traders to price the Reserve Bank embarking on a rate-cutting path as early as August. That sent the currency to the day’s low of 64.78 US cents while yields on the policy-sensitive three-year government bonds fell as much as 12 basis points to 3.74%.

“This is another sign of moderation in jobs demand,” said Diana Mousina, deputy chief economist at AMP Ltd. “I still don’t think that you can justify a near-term rate cut right now because the labor market still looks tighter than before the pandemic. It’s loosened, but not enough to get worried about.”

In explaining the surprising weakness in the report, the ABS said the data reflected seasonal patterns as January was a popular month for holidays. Also, some people who were marked as unemployed last month were actually in between jobs, meaning the unemployment rate could drop back again.

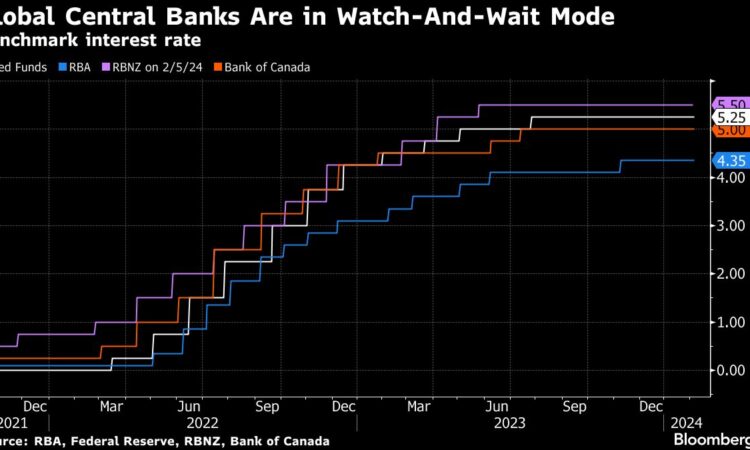

The RBA last week held its key rate at a 12-year high of 4.35% as it waits on data to signal a firm trajectory for the economy. Today’s job figures, together with monthly inflation for January out next week, will help shape the policy debate at the central bank’s March 18-19 meeting.

Mousina reckons the RBA board could drop its mild tightening bias if next week’s CPI indicator softens further. The RBA raised borrowing costs by 4.25 percentage points between May 2022 and November 2023 to rein in surging consumer prices. While inflation remains elevated, it has been steadily cooling, encouraging bets on rate cuts.

Thursday’s data showed annual jobs growth cooled to 2.6% in January from 3.7% a year earlier.

“This easing in the labor market reflects the slowdown in economic growth,” Marion Kohler, head of economic analysis department at the RBA said in a speech two days ago. “Adding to this, labor supply has increased, boosted by elevated population growth and record high participation in the labor force.”

Looking ahead, the RBA — which characterizes Australia’s labor market as still tight — expects the labor market will slow further, sending the unemployment rate to 4.4% by mid-2025.

What Bloomberg Economics Says…

For the RBA, the rising unemployment rate will be a compelling reason to reverse course and start cutting rates as soon as the second quarter.

— James McIntyre, economist

For the full note, click here

McIntyre estimates that Australia’s economy needs more than 32,000 new jobs a month to keep up with an expanding labor force.

Thursday’s labor data also showed:

-

Underemployment edged up to 6.6% and the underutilization rate rose to 10.7%

-

The economy added 11,100 full-time roles and shed 10,600 part-time

-

The employment to population ratio fell to 64.1%

-

Monthly hours worked also declined

Australia’s Treasurer Jim Chalmers was philosophical on the report in comments after its release.

“It’s consistent with an economy which is softening and we’ve made it clear now in a couple of budget updates, that we expect the economy to slow in the course of 2024,” he told reporters in Canberra.

“That’s what happens when you’ve got interest-rate rises working their way through the system, when you’ve got the systemic inflation and when you’ve got global economic uncertainty which is characterized by concerns over China and obviously two major conflicts as well.”

–With assistance from Garfield Reynolds, Ben Westcott and Tomoko Sato.

(Adds comments from economists.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.