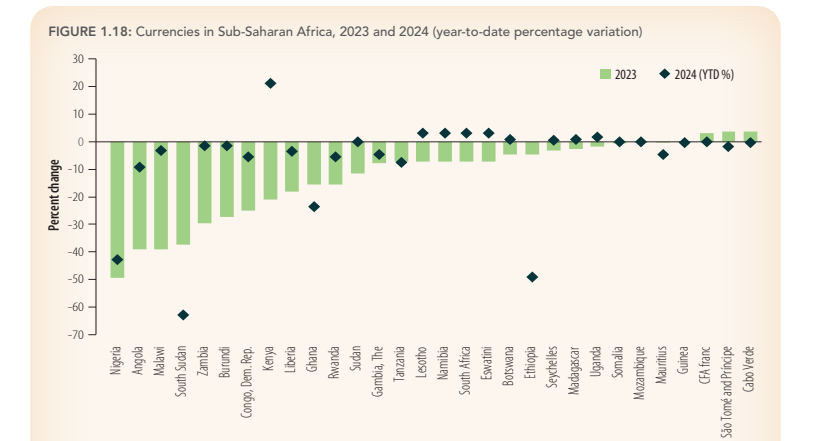

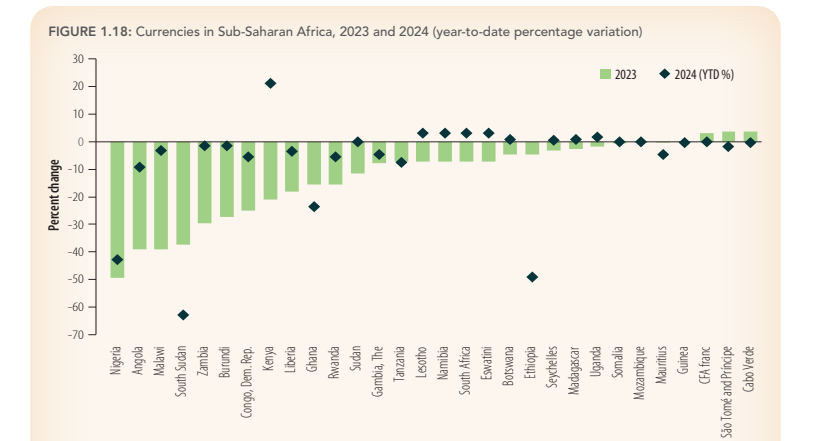

Cedi, naira among 4 worst performing currencies in Sub Saharan Africa in 2024 – World Bank

The Ghana cedi and three other currencies are the worst-performing currencies in Sub-Saharan Africa (SSA) in 2024, the World Bank’s October 2024 Africa Pulse Report has revealed.

According to the report, the cedi has lost about 24% value to the US dollar, placing it as the 4th weakest in SSA.

South Sudan’s pound (over 60%), Ethiopia’s birr (51%) and Nigeria’s naira (over 40%) are the worst-performing currencies in Sub-Saharan Africa in 2024.

Interestingly, the Kenya shilling is the best-performing currency in Africa this year with a year-to-date gain of about 21% as of August 2024.

“Ethiopia, Ghana, and Nigeria are among the worst performing in Africa this year, and their currencies continue weakening while demand for foreign exchange remains pressing”, the report said.

It added “By end-August 2024, the Ethiopian birr, Nigerian naira, and South Sudanese pound were among the worst performers in the region. The Nigerian naira continued losing value, with a year-to-date depreciation of about 43% as of the end of August. Surges in demand for US dollars in the parallel market, driven by financial institutions, money managers, and non-financial end-users, combined with limited dollar inflows and slow foreign exchange disbursements to currency exchange bureaus by the central bank explain the weakening of the naira”.

In contrast, the report said some currencies that weakened in 2023 have stabilised or strengthened this year.

“The Kenyan shilling is the best-performing currency in Sub-Saharan Africa this year: it appreciated by 21 per cent year-to-date by end-August 2024. The South African rand and currencies pegged to it have strengthened by 3.1% so far this year, after losing value in the past year”.

Although most currencies are stabilising, the October 2024 Africa Pulse Report pointed out that the exchange rate pressures and shortages of foreign exchange remain a concern for African policymakers.

“From a sample of 30 countries and two currency unions (the Economic and Monetary Community of Central Africa and WAEMU), more than one-third of the countries in the region are set to have less than three months of imports in international reserves by end-2024”.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link